What is Commodity? Understanding Commodity Trading

Introduction to Commodities

Commodities are fundamental to our global economy. They are natural resources or agricultural products that we use every day, from the gasoline that fuels our cars to the grains that make our bread. Understanding what is commodity trading and its role can give you a better perspective on how the world works.

What is a Commodity?

A commodity is a basic physical asset that’s traded on dedicated commodity exchanges. These can be precious metals like gold or silver, energy resources like crude oil and natural gas, or agricultural products like wheat and soybeans. These items are considered the raw materials or raw materials necessary for making goods and powering services around the world.

Commodities act as the building blocks of the global economy. They’re the essential elements from which other goods are made.

Types of Commodities

Metals

Precious metals like gold, silver, and copper not only have intrinsic value as materials for manufacturing and investment but also play a crucial role in electronics, jewellery, and other industries. Their value is maintained because they are durable, relatively rare, and have various industrial uses.

Energy

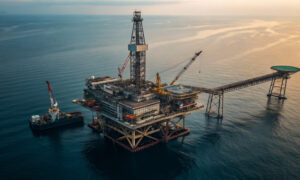

This category includes commodities like crude oil, coal, and natural gas. The energy sector is crucial because it powers virtually everything—from factories and power plants to heating your home. Crude oil, for instance, is not only a fuel source but is also used in producing plastics and pharmaceuticals, making it a staple in various industries.

Livestock and Meat

Livestock commodities include cattle and pork. These markets are influenced by factors like feed prices, health regulations, and consumer demand. For those in the industry, understanding the fluctuations in these markets can mean the difference between profit and loss.

Agricultural Products

Agricultural commodities like wheat, rice, and soybeans are essential for global food security. These markets can be highly volatile, impacted by changes in weather patterns, geopolitical tensions, and changes in trade policies. Commodity prices for these foods are closely watched by countries, companies, and consumers.

Major Commodity Exchange

When we talk about where the action happens in commodity markets, several names stand out. The New York Mercantile Exchange (NYMEX), the London Metal Exchange (LME), the Chicago Mercantile Exchange (CME) and the Australian Securities Exchange (ASX) are among the major commodities exchanges in the world. These exchanges are like marketplaces where people trade vast amounts of physical commodities and their financial derivatives. Think of them as big shops where traders buy and sell metals like gold or energy sources like oil.

Price Determination in Commodities Markets

The market price of any commodity is shaped by supply and demand. Simple idea, right? If more people want something and it’s in short supply, the price goes up. If there’s too much of something and not enough buyers, the price drops. But it’s not just about how many people want to invest in commodities or how much is available. Other big factors come into play too.

Weather, political issues, and other external events can seriously mess with commodity prices. For example, a drought can reduce the amount of crops available, shooting up prices. Or, a political conflict in an oil-producing country can make it hard to get oil, which can push prices higher. All these factors make trading commodities an exciting but risky part of the financial markets.

Understanding the commodity markets, how different commodity exchanges operate, and what affects prices can give you a good foundation whether you’re thinking of investing or just want to know more about how these essential markets work. From energy commodities to industrial metals, knowing the ins and outs of these markets can always help.

Strategies and Instruments in Commodity Trading

Commodity trading can seem complex, but it’s all about buying and selling materials or energy that industries and consumers need. Two main ways to trade commodities are through spot markets and futures markets. In the spot market, trades are made on the spot – literally, right now, you pay the price and get the commodity. The futures market is a bit different. Here, you agree today to buy or sell a commodity at a future date, and the price is also decided now. This is where futures contracts come in handy.

Futures Contracts

When people talk about futures contracts, they’re referring to agreements to buy or sell a commodity (commodity futures) at a future date at a price agreed upon today. This setup is super handy for both businesses that need to plan their costs and for traders looking to make a profit from price changes. Essentially, these contracts are promises to carry out a trade on a specific date, with the price locked in now, regardless of how the commodity price might swing in the futures markets.

Hedging and Speculation Strategies

Futures are used in two main ways: hedging and speculation. Hedging is like insurance; it helps businesses manage the risk of price changes. For example, an airline might use futures to lock in fuel prices, protecting themselves against potential price spikes in oil and natural gas. Speculation, on the other hand, is about making bets on market movements to make a profit. Traders might buy futures on the futures exchange if they think prices will go up, hoping to sell them later at a higher price.

Options and Derivatives

Options and other commodity derivatives are also popular tools in commodities trading. An option gives you the right, but not the obligation, to buy or sell a commodity at a set price before the option expires. It’s a bit more flexible than a futures contract, which is an outright agreement to trade. This flexibility makes options a great tool for managing risk without the full commitment of a futures contract.

Commodity Stocks and ETFs

Investing in commodity-related stocks or exchange-traded funds (ETFs) is another way to get involved with commodities without dealing with physical goods. When you buy stocks in companies that produce natural resources, like mining companies or oil producers, you’re indirectly investing in commodities. ETFs, meanwhile, might track a range of commodities or just one, offering a way to invest in the broader commodity market or specific sectors like agricultural products or metals.

However, Exchange-traded commodity ETFs have their ups and downs. On the upside, they’re an easy way to invest in commodities without needing to handle the actual goods—no need to store barrels of oil or piles of copper. They can also add diversity to your investment portfolio, which might protect you against volatility in other markets like stocks. On the downside, commodity ETFs can be affected by the same factors that influence physical commodities, such as changes in supply and demand or broad economic factors. Plus, the fees associated with some ETFs can eat into your investment returns.

Each instrument has its role and suits different types of investors—from those looking to hedge against price changes in other commodity markets to those aiming to profit from shifts in commodities derivatives.

Impact on International Trade Balances

Commodities like oil, gold, and food commodities play an important role in the trade balances of nations. Countries that export more commodities than they import generally see a trade surplus. This dynamic is especially pronounced in commodity-dependent economies such as those in the Middle East with oil or Brazil with iron ore and soybeans. Changes in market prices of these commodities directly influence the economic health of these countries.

Commodities as an Inflation Hedge

Investors often turn to commodities like gold as a hedge against inflation. Historical data shows that when inflation rises, the price movements of gold generally increase as well, protecting the real value of investors’ money. Other commodities, such as oil and natural gas, can also act as hedges but are more volatile in response to geopolitical and environmental factors.

Environmental and Ethical Considerations

Sustainability Issues in Commodity Production

The production of commodities often has a significant environmental impact, leading to a push for more sustainable and ethical production methods. This includes better mining practices and more responsible sourcing of agricultural products.

Investors are increasingly considering ethical factors when investing in commodities. This includes avoiding commodities that are linked to environmental degradation and prioritizing investments in companies that maintain high ethical standards in their operations.

The Role of Technology

Advancements in technology have transformed how commodities are traded globally. The introduction of automated trading systems, blockchain for transparent traceability, and artificial intelligence for predictive analytics has made trading more efficient and accessible. These technologies help traders analyze vast amounts of data for better decision-making and can significantly reduce the risk of human error.

Future Trends in the Commodities Market

Emerging technologies like the Internet of Things (IoT) and further advances in AI are set to make real-time monitoring of supply chains more comprehensive. This will allow for more responsive price adjustments in commodities trading. Additionally, the growing adoption of machine learning models predicts trends and potential disruptions in commodity supplies, enabling more strategic trading decisions.

Experts anticipate that the prices of commodities associated with green technology and renewable energies will rise due to increased investment and government policies aimed at combating climate change. On the other hand, traditional energy commodities might see a price drop as renewable energies become more cost-effective and widely adopted.

Emerging markets are playing a crucial role in the commodities sector, both as consumers and producers. Countries like China and India are major drivers of demand for commodities due to rapid industrialization and urbanization. Moreover, as these economies grow, their move towards renewable resources is expected to significantly influence global commodity markets.

The future of commodity markets appears to be heavily influenced by technological progress, the global shift towards renewable resources, and the evolving economic dynamics of emerging markets. Understanding these trends will be vital for traders, investors, and policymakers to make informed decisions that align with long-term global economic and environmental goals.

FAQs

What are hard and soft commodities?

Hard commodities are natural resources that are mined or extracted, such as oil or gold, which often serve as input for industries. Soft commodities typically include agricultural products like coffee or sugar. Both are essential in the global market and are traded on exchanges like the New York Stock Exchange.

How do commodity ETFs work?

Commodity ETFs (Exchange-Traded Funds) provide investors exposure to commodities as an asset class without directly purchasing physical assets. These ETFs track a commodity index and can include either physical commodity holdings or commodity futures contracts. They offer a way for investors to gain exposure to commodities markets with the ease of stock trading.

What role does the Commodity Futures Trading Commission (CFTC) play in futures trading?

The Commodity Futures Trading Commission (CFTC) regulates the U.S. derivatives markets, including futures, swaps, and certain options. The CFTC aims to protect market participants from fraud, manipulation, and abusive practices related to the sale of commodities and financial futures and options, ensuring the integrity of the markets.

How can investors manage risks when buying futures contracts?

When buying futures contracts, investors can manage risks by locking in a specific price for the underlying commodity, which helps in budgeting and financial planning. Futures trading allows commodities traders and institutional investors to hedge against potential price volatility in the stock markets and secure commodity exposure at predetermined prices.

What influences the current market price of traded commodities?

The current market price of traded commodities is influenced by various factors including supply and demand dynamics, geopolitical events, economic indicators, and market speculation. For instance, oil prices can fluctuate significantly based on OPEC decisions, production changes, or geopolitical tensions. Prices of commodities tend to reflect these changes swiftly, impacting stock exchanges and global markets.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Recent Posts

Anthropic Draws a Line With the Pentagon

The AI-First Military Agenda with Anthropic The Pentagon is moving aggressively to bring cutting-edge commercial AI into defence work. A…

88 Energy (ASX:88E) Doubles on Alaska Upside, Here’s What’s Driving It

The Market Just Repriced Alaska Exploration Optionality 88 Energy surged 100% today on the back of a corporate presentation that…

Oil Jumps to US$111 as Hormuz Stays Shut, ASX Slides Hard

The Oil Chokepoint Shock Brent crude jumped 20% to US$111 per barrel, while the ASX 200 fell 3%, with companies…