5 Key milestones that PhosCo investors have to look forward to in 2026!

PhosCo investors have had a positive start to 2026 with the most recent assay results from its Gasaat project giving hope that there is a bright future.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Good results at KM

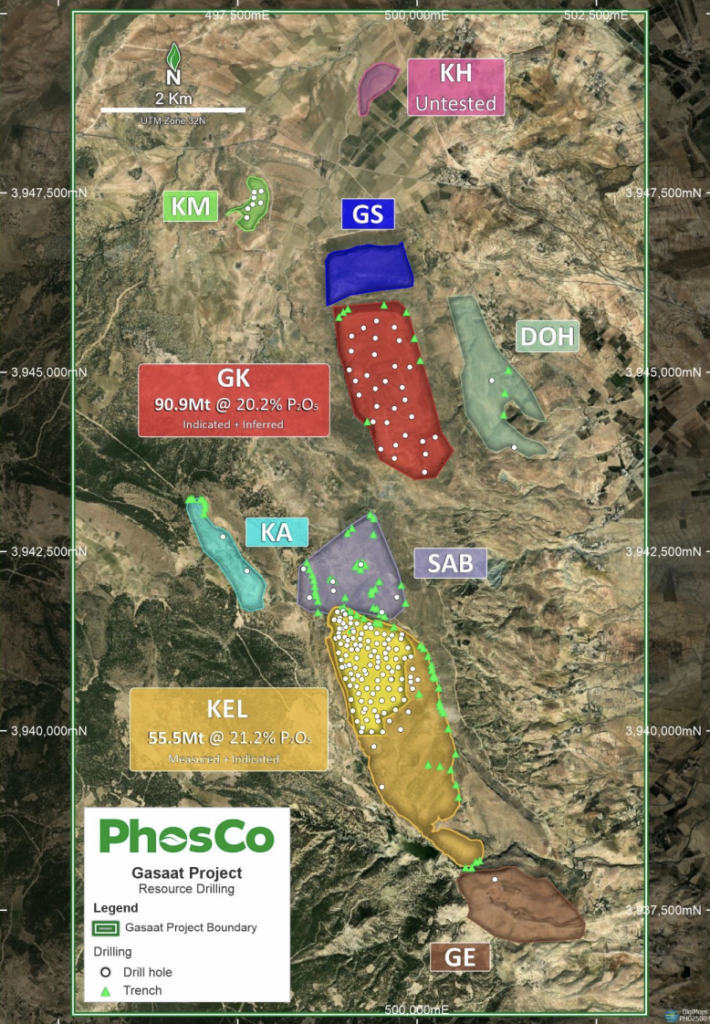

PhosCo received assay results from one particular prospect, the KM Prospect which lacks a Mineral Resource right now but one is expected immanently. The project already has 146 million tonnes at 20.6% P2O5, sufficient to run a mine for nearly 50 years, but this is only from two particular prospects (GK and KEL as per the figure below) and a further resource from KM could enhance the project’s potential even further.

Source: Company

Some investors may ask: do we need enough phosphate to last 50 years? Keep in mind that Tunisia produced 8Mt at the peak of its last bear market and the average production will be 1.5Mt in the first 10 years under the PFS. But keep in mind that phosphate is a critical resource – one of 3 essential macronutrients for plant growth. Structural factors including food demand and nutrient use efficiency will all support baseline demand.

Investors fascinated in finding out more about Phosphate should read this article of ours from last year. But today, we’re focusing on

5 Key Milestones that PhosCo investors have to look forward to in 2026!

1. A Maiden Resource at the KM

There is a broader Exploration target of 110-165Mt across the rest of Gasaat. This does not even account for other projects PhosCo has including Sekarna which is analogous geologically to Gasaat. But the KM prospect is the nesxt one that will be reported and the results reported earlier this week bode well for a good result.

There were a total of 10 drill holes totalling 662m and the company reported 3 with phosphate grades consistently >25%. The best result was 49.8m at 22.4%. Representative drill core from KM has been selected for metallurgical testing, and bulk material from the trenches has been retained for follow-up assessment.

2. Drilling results from the SAB Prospect

SAB is another prospect at Gasaat, arguably with more potential given it is adjacent to Kal. Thus far, drilling has not been as extensive, but the holes that have been drilled have showed impressive results including significant widths. The assays will be incorporated into a Maiden Mineral Resource Estimate for SAB which will be delivered eventually.

3. Maiden Mineral Resource Estimate

The maiden Mineral Resource Estimate itself is one of the most important upcoming milestones for the company. Establishing a JORC-compliant resource at SAB, building on the existing Gasaat inventory and the emerging KM discovery, will provide investors and partners with an independent, quantified assessment of the Mineral Resource that underpins the project’s long-term value and supports further technical studies.

This resource will lay the groundwork for the revised Scoping Study, which historically has underpinned the long-life nature of Gasaat with a significant JORC Resource already defined, and will now be updated to reflect the latest drilling, lower strip ratios and improved confidence in mineralisation.

4. Revised Scoping Study

The revised Scoping Study is another milestone PhosCo is targeting in the first half of 2026. It will integrate the latest drilling information and maiden resources from SAB and KM to produce a more robust economic model for Gasaat.

Updating the Scoping Study is a necessary precursor to commencing a bankable feasibility study later in 2026, and is expected to demonstrate stronger economics, especially given the shallow nature of mineralisation at SAB and KM which could be prioritised in the early years of mining.

5. Increasing demand for Phosphate

All of this is happening against a backdrop of increasing global demand for phosphate, an essential nutrient for fertiliser production that is critical to food security and agricultural supply chains.

Phosphate has recently gained heightened strategic recognition, including inclusion on critical minerals lists by governments such as in the United States, reflecting concerns about secure supply of this irreplaceable commodity.

A growing population and rising agricultural intensification continue to underpin long-term demand for phosphate fertilisers, positioning companies with significant phosphate resources like PhosCo to benefit from this structural demand trend as they advance projects toward production.

Conclusion: When will see production

It is an exciting time to be a PhosCo investor with plenty of milestones in the weeks and months ahead with further exploration work to show the potential for Gasaat. Realistically, it might be a few more years before we see an operating mine (i.e. perhaps 2029-2030) but all the groundwork is being laid right now, and several years of legal troubles were put to bed last year.

PhosCo is a research client of Pitt Street Research. Pitt Street directors own shares.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…