Airtasker (ASX: ART): Will more air come out of the share price?

![]() Nick Sundich, March 2, 2022

Nick Sundich, March 2, 2022

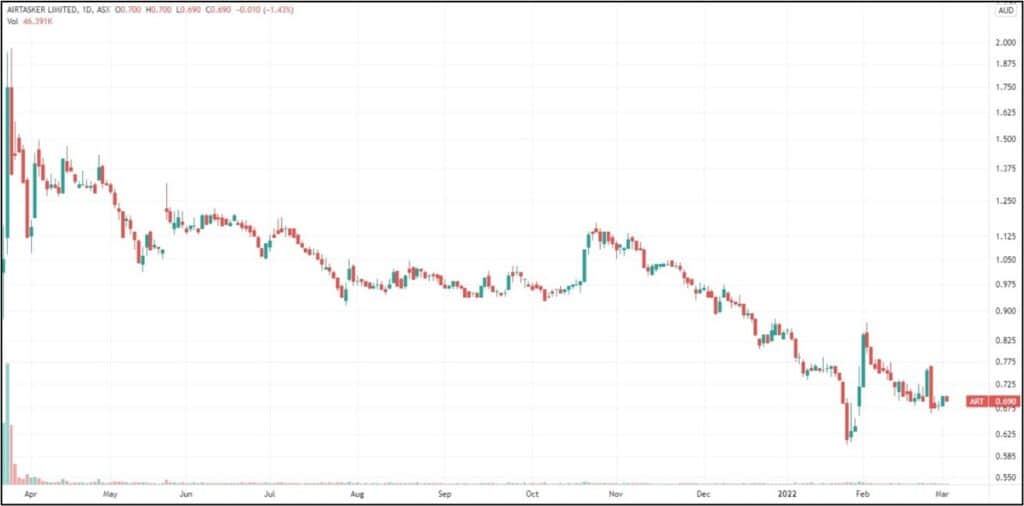

It has almost been a year since Airtasker (ASX: ART) listed on the ASX, raising $83.7m at 65 cents per share. Shares went on a frenzy during its first few weeks, hitting an all-time high of $1.97, but have gradually declined since then and are barely above their listing price. On top of that the company’s recent half-yearly results have failed to spark enthusiasm.

What is Airtasker?

Airtasker is a platform where people can ‘post’ tasks – almost anything imaginable – and other people (taskers) can apply to complete them. Payment is completed through the platform and the prices (and times) are negotiable. Airtasker generates revenue from a service and booking fee charged to taskers and customers.

Airtasker is a company in the s0-called Gig Economy, which consists of the entire ecosystem of freelancers and the people they ostensibly work for. Examples of other companies in the Gig Economy include Uber, Deliveroo and Airbnb.

Airtasker was founded in 2012 and, while it was private, was one of Australia’s most prominent technology companies. The hefty rise in its share price in the days following its IPO shows just how eagerly anticipated its listing was. Only a couple of months after the company listed, it returned to investors for another $20m, to buy US jobs posting business Zaarly. Again, investors were eager to buy shares. But things have not been as glamorous since then.

Airtasker price chart (Source: Tradingview)

Why have Airtasker shares declined?

Undoubtedly, Airtasker has been a victim of the Tech sell-off, which has hit non-profitable tech companies particularly hard. Investors are concerned their high valuations will be difficult to sustain in an environment of rising interest rates, especially given low interest rates have been responsible for increasing valuations in the last decade and particularly since COVID-19.

Rising interest rates will hit companies that are not earnings or cash flow positive yet hard, because rising interest rates and bond yields will make raising and repaying capital (both debt and equity) more expensive and harder. Airtasker was also hit by the Delta lockdowns in Sydney and Melbourne. The company estimated Delta cost it $14m in additional Gross Marketplace Volume (GMV).

1HY22 results was a mixed bag

The company released its half-yearly results last week. It reported revenue was up 10.4% to $13.9m, and GMV grew 15.5% to $83.6m. It also reported that the average task price rose 20% from $190 to $229 and its presence in the United States and the United Kingdom was growing. But its EBITDA was negative $3.2 million compared with $0.2m in the prior corresponding period. The company blamed increased investment in product development, marketing, and expansion.

Is Airtasker a buy?

On April 15 last year in Stocks Down Under, we rated the company two stars because we thought its revenue multiple was too high – at 19.9x forecast FY21 revenue. The company is currently trading on 7.6x forecast FY22 revenue and 5.6x forecast FY23 revenue. For the record, its forecast revenue for those years is $33.8m and $46.3m, while its forecast EBITDA losses are $16.5m and $15.1m. In FY24, its EBITDA loss is expected to moderate to $7.0m and its revenues are expected to grow to $61.1m – which would be more than double its FY21 revenue.

We think Airtasker’s share price is more reasonable than it was immediately following its IPO. But we still would not recommend it, at least until the company’s losses moderate the heat eases on the broader Tech sector.

Stay up-to-date on ASX-listed stocks!

Make sure you subscribe to Stocks Down Under today

No credit card needed and the trial expires automatically.

Frequently Asked Questions about Airtasker

- Does Airtasker pay a dividend?

No, ART is a growth company and is investing its capital in expanding its markets and growing its revenues.

- Where is Airtasker based?

Airtasker is based in Sydney, Australia but has activies in multiple other countries.

- Is Airtasker a buy?

Currently (March 2022) we are not advisong investors buy ART shares. We believe there is more downside from the current share price around $1.70.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…