AMA shares fall another 33% after its latest quarterly

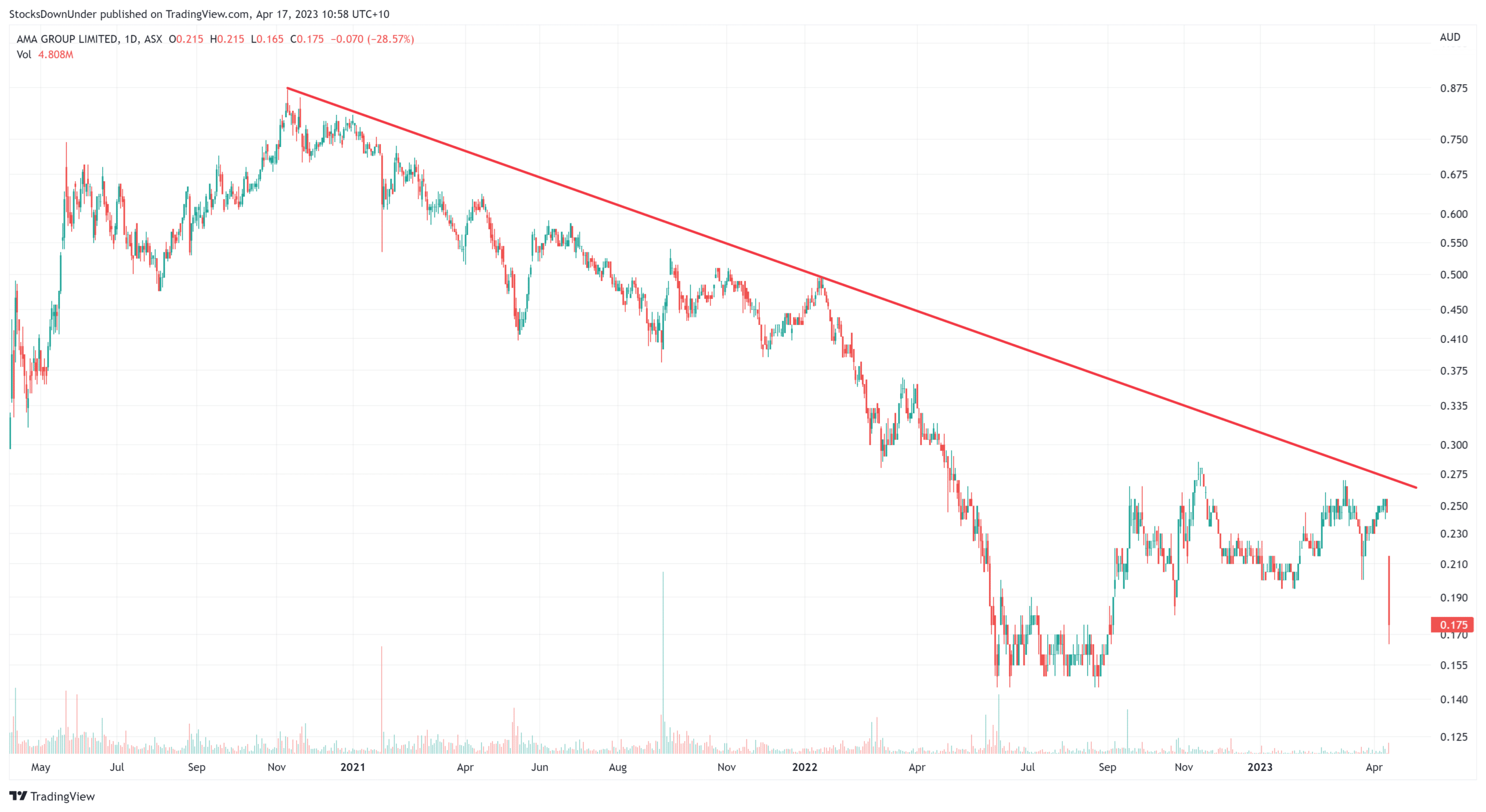

AMA (ASX:AMA) shares reached a peak of $1.43 in mid-2019, but closed Friday at 24c and opened this morning at just 17c – a drop of ~89% since the high. Where did it all go wrong and what lessons can we learn from this?

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Why it all went wrong for AMA shares

Smash repairer AMA Group has endured several issues in the last four years. Obviously, lockdowns meant less people on the roads and therefore less need for smash repairs and car parts. And when things returned to normal the company was hit by labour shortages, inflation and supply chain issues. On top of all this, it was hit by lawsuits from its disgruntled ex-chief executive and operators of a company it had acquired.

Investors have kept getting burnt by the stock because they thought the dramas were over – or at least the worst of them. But almost every quarter, they were proven wrong and paid the price.

AMA Group (ASX:AMA) share price, log scale (Source: Tradingview).

The latest setback for AMA

In its most recent quarterly, AMA slashed its FY23 EBITDA guidance to $60-$68m, down from $70-$90m. The company was still impacted by labour and supply chain issues as well as inflation. It noted that industry contracts still do not contain appropriate dynamic adjustment mechanisms that insulate parties from inflation or other pressures.

The company recorded positive cash flow from operations, but only $323,000 and it was negative by $3.7m for the 9 months in FY23 to date. It closed the quarter with $20.5m in cash, down from $33.3m at the end of the last quarter.

The lesson in all this for investors

There is money to be made from turn around stories. But it is a very risky move in the absence of any evidence that a turn around is actually happening. No company will tell its investors that it isn’t trying to solve issues impacting its performance.

But there’s never any guarantee that those efforts will bear fruit. So, try not to catch flling knives. Wait until the downtrend is broken, which wasn’t the case with AMA just yet, as illustrated in the chart.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…