Here’s why Healius shares plunged another 33% this morning

![]() Nick Sundich, November 22, 2023

Nick Sundich, November 22, 2023

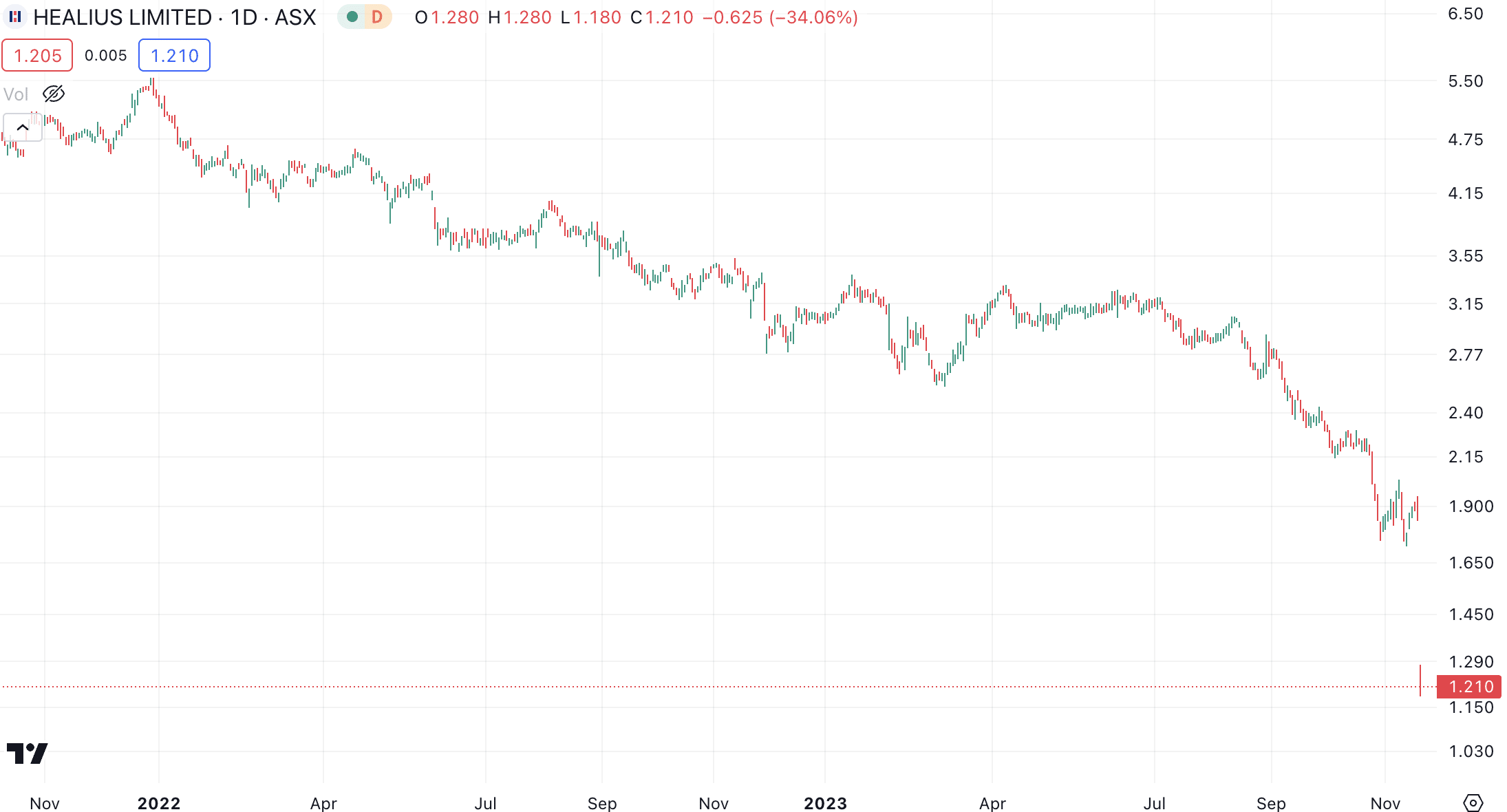

Investors who held Healius shares last Friday saw a 33% decline in their investment, while those who’ve held since Christmas 2021 have seen an 80% decline. What went wrong this morning to compound all its woes?

Why Healius shares are down

Healius is one of three pathology stocks on the ASX, with the other two being Sonic Healthcare and Australian Clinical Labs. All these companies endured a boost in revenue during the pandemic just because of COVID-19 testing numbers. The difference with Healius is that it didn’t have a strong non-COVID business to begin with, at least not to the extent Sonic had, allowing it to endure a ‘soft landing’. HLS also suffered from a high cost base and an inability not to shrink it. M&A activity hasn’t helped either, with its purchase of Agilex Biolabs underperforming and a hostile takeover bid from ACL amounting to nothing – so far.

Healius (ASX:HLS) share price chart, log scale (Source: TradingView)

A fresh capital injection, but at a cost

This morning, Healius re-entered trading after completing a $187m capital raise, done at a 35% discount to the company’s last close. This deal was necessary to keep it afloat, and while leaving it to fight another day, kept in on notice from the banks. It was only allowed to go from 3.5x leverage to 4x until June 2024 and committed to reducing banking facilities from $1bn to $750m. Healius also told investors to expect no dividends this year.

To add insult to injury, multiple brokers slashed their target prices on HLS stock. Morgans cut it by 43%, Jarden by 39% and Macquarie by 33%. And even ACL is now becoming weary, announcing the capital raise may breach takeover conditions.

When you add all these things together, it is easy to see why Healius shares are struggling.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…