Hub24 (ASX:HUB): There’s a good reason why it is up 50% this year

![]() Nick Sundich, October 17, 2023

Nick Sundich, October 17, 2023

Hub24 (ASX:HUB) is a growth stock that has somehow managed to perform in the difficult market environment. Glancing at today’s trading update, it is not hard to see why.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Hub24 (ASX:HUB) is a real growth stock

Hub24 offers an investment platform aimed at financial advisers and their clients a comprehensive range of investment options, including market-leading managed portfolio solutions, and enhanced transaction and reporting functionality.

You wouldn’t imagine a business with anything to do with financial advisors would have been good to invest in due to the industry exodus in the aftermath of the Royal Commission. But the business has still been able to thrive because it serves direct and superannuation investors too. And in volatile times, they are more eager than they otherwise would be for investment platforms that can help them ‘in the trenches’.

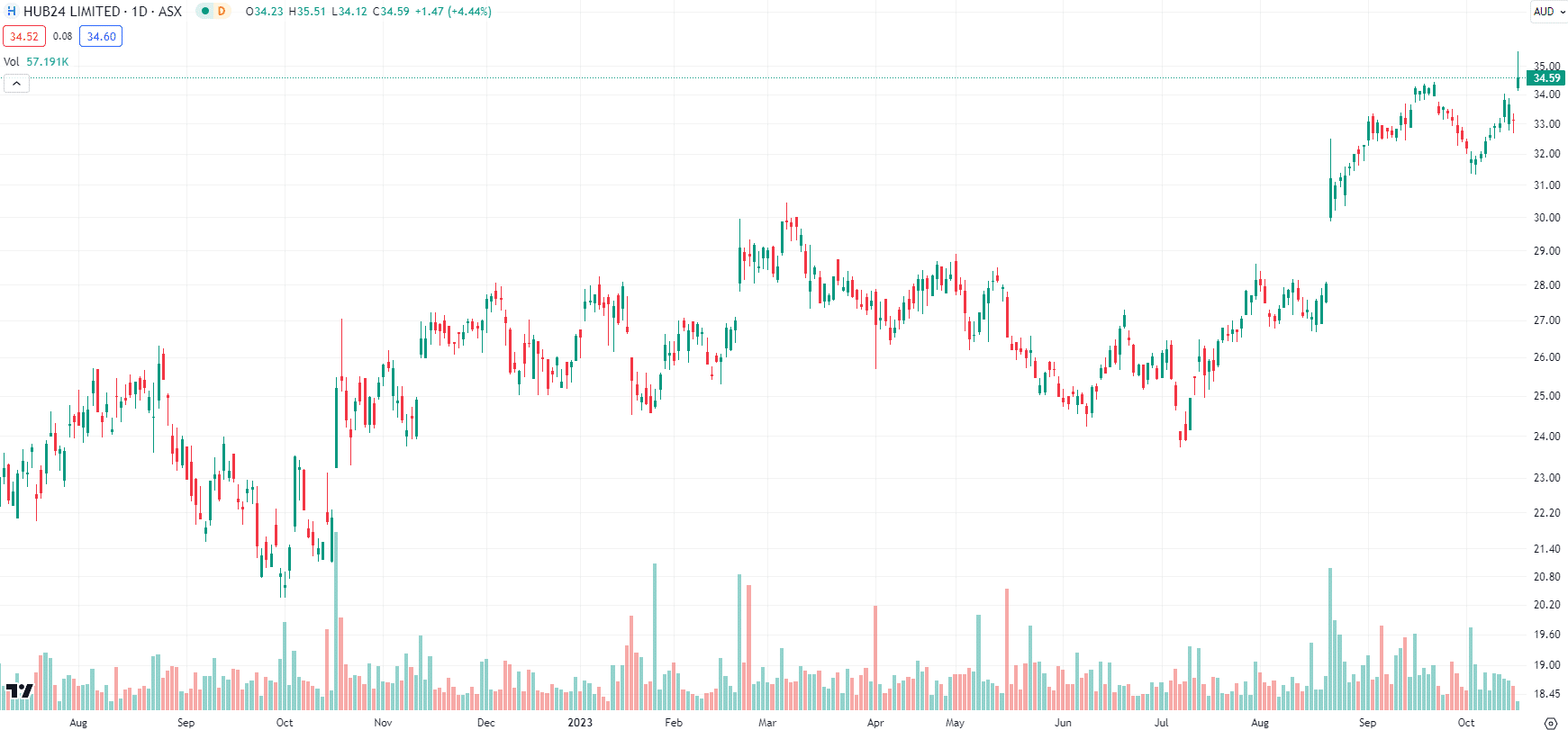

In FY23, the company delivered $279.5m in sales (up 45%) and a $38.2m profit (up 160%). The aim of the company is to have $92-$100bn in Funds Under Administration (FUA) by FY25. By the end of FY24, $80-89bn is expected. In the past 12 months, shares are up over 50% and increased a further 4% today.

Hub24 (ASX:HUB) share price chart, log scale (Source: TradingView)

A good start to FY24

Hub24 released its results for the September quarter (1Q23) this morning and the signs were that the company was going well. It recorded net inflows of $2.8bn, up 35% from the previous quarter and reached FUA of $82.7bn (up 21%) in 12 months.

The company’s Class platform (once listed in its own right before Hub24 bought it) holds 1st place among its peers in its Net Promoter Score (NPS) ranking. And the number of advisers using the platform is up over 10% from 12 months ago, at 4,026.

The bottom line is that companies don’t need to be in a sexy industry to be successful. What is most important is that it can deliver good growth, even when conditions are difficult in the industry. Investors should keep an eager eye on this company.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…