Iluka Resources (ASX:ILU) Stage 3 is causing excitement

![]() Nick Sundich, April 5, 2022

Nick Sundich, April 5, 2022

Iluka Resources (ASX: ILU) is up nearly 70% in a year and climbed another 6% yesterday after making the Final Investment Decision (FID) on the Eneabba Rare Earths Refinery. It is a long process to get resources projects off the ground involving years of exploration, plus geological and economic studies. But this FID means the company has formally decided to go ahead and yesterday’s announcement came with government funding secured.

Risk averse investors might be forgiven for staying clear of companies that haven’t made the choice to go ahead with a project. Now that the call to go ahead had been made, now may be a good time to get onboard!

TRY STOCKS DOWN UNDER WITH A 30-DAY FREE TRIAL

What is Iluka Resources?

Since its founding in 1998, Iluka Resources has been in the mineral sands space although it now is in the rare earths space too. It has operated several mining and processing assets in several jurisdictions, including multiple Australian states, the USA and Sierra Leone. One of these projects is Eneabba in Western Australia which it claims to be the highest rare earths operation globally. It processes and sells a monazite-zircon concentrate, reclaimed from a strategic stockpile stored at a former mine void.

Stage 3 to go ahead

Yesterday, the company announced the FID on the so-called “Stage 3” of Eneabba. Stages 1 and 2 involved the building and operation of a screening plant and concentrate processor. Stage 3, however, involves the construction of a refinery that will produce praseodymium, dysprosium, neodymium and terbium. A non-recourse loan from Export Finance Australia was secured for this stage. All of those metals are critical minerals for electric vehicles, electronics, medical technologies and energy generation.

Eneabba will be Australia’s first rare earths refinery although not the first development – the former title belongs to Lynas’ (ASX: LYC) cracking and leaching plant at Kalgoorlie, although Lynas’ refinery is in Malaysia. Construction will begin in the second half of this year, first production will be in 2025 and Eneabba will have a total rare earths capacity of 17,500tpa.

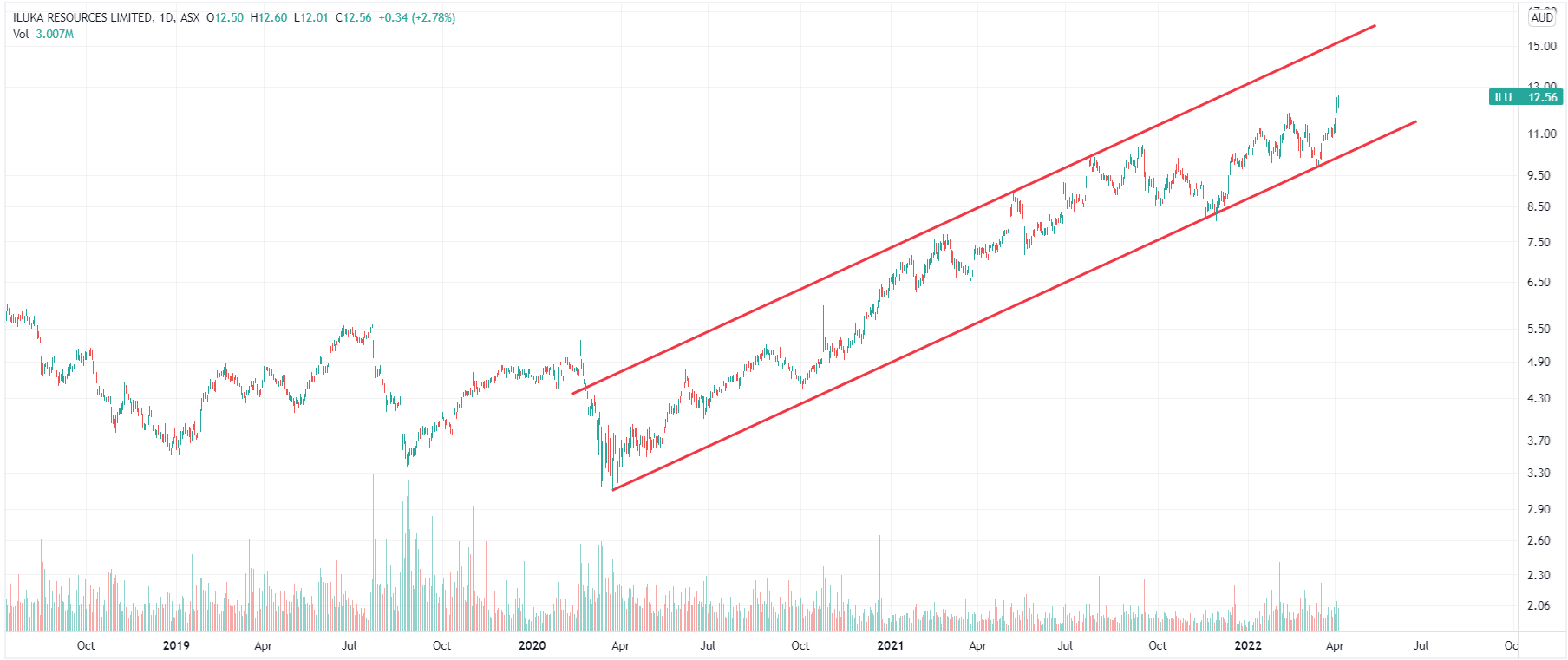

Iluka Resources (ASX:ILU) chart, log scale (Source: Tradingview)

Rare Earths to drive future cash flows

Iluka Resources’ share price has been performing well for several months now, gaining ~70% in the last year and over 200% in the last five years. Iluka has proven itself a reliable and profitable mineral sands producer, generating $1.5bn in revenue and $634m in EBITDA in CY21 – up 57% and 85% from CY20. Zircon sand prices have also helped Iluka’s cause, rising from US$1,291 per tonne in 4Q20 to US$1,590 in 4Q21.

The catalyst has been post-COVID stimulus programs, which have increased demand for zircon, which is critical in things like ceramics and tiles. Iluka’s diversification into rare earths will further help the company’s cash flow. It also helped that the company has secured funding from the government rather than the private sector. Although Iluka will have to pay back the money, it is a positive sign to have the government backing your project. The company will pay a Bank Bill Swap Bid rate plus 3%, but will have a long term facility – up to 16 years – and the loan is non-recourse.

So, is Iluka a buy at the moment?

Iluka Resources is currently trading at 6.6x EV/EBITDA for FY23 and 11.3x P/E for FY23. This compares favorably to Lynas, which trades 14.1x EV/EBITDA and 15.9x P/E currently. Considering Lynas is the largest and only major supplier of processed rare earths outside of China, you could justify a premium at the moment.

But looking forward to FY24 and beyond, the market is projecting Iluka’s EBITDA to decline. The initial decline in EBITDA for FY24 is less than 4%. But in FY25, the decline is expected to reach almost 40% on the back of the company stockpiling monazite concentrate from Stage 2 in anticipation of Stage 3 startup, rather than selling the concentrate to third party refineries.

Yesterday’s share price rise showed investors are excited about the future cash flows from Stage 3. But with first production still a few years away and an projected decline in EBITDA ahead of Stage 3, maybe investors should sit back and wait. If you’re only buying for rare earths exposure you will have some time to wait yet.

Looking at the chart, we’d recommend buying at or below $11, which would be at the lower end of the rising trading range.

Learn more about ASX-listed stocks with

Stocks Down Under!

Subscribe to Stocks Down Under today!

No credit card needed and the trial expires automatically.

Frequently Asked Questions about Iluka Resources

- Is Iluka Resources Australian?

Yes, ILU is based in Perth, WA.

- Does Iluka Resources pay a dividend?

Yes, the company paid 24 cents in the 12 months through December 2021.

- What is Iluka Resources?

Iluka Resources is a mineral sands and rare earths miner.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…