Pacific Smiles shares have been muted this week despite a takeover offer and a solid trading update

Pacific Smiles shares have barely budged this week, which would lead investors unfamiliar with the stock to think it had been a quiet week. In reality, it has been a very busy week for this company with a takeover offer, a solid trading update, and a new CEO.

What a week

Barely a month after its AGM, Pacific Smiles (ASX:PSQ) gave another trading update to investors. As of the close of business on December 20, it generated $141.1m in patient fees, up 10.5% from the year before. It has guided to $293-297m in patient fees for the full year and underlying EBITDA of $26-28m. The mid-way point of these figures would be up 9% and 12% from FY23, respectively.

Only a couple of days ago, PSQ received a takeover bid from private equity firm (and now 18.75% shareholder) Genesis Capital for a $1.40 per share takeover bid. The company took this morning’s opportunity to formally respond to the offer and opted to reject it.

‘The Board considers that the Indicative Proposal is opportunistic and materially undervalues Pacific Smiles,’ it said. Nonetheless, it opted to offer Genesis some limited due diligence.

We are not surprised to see the offer rejected given there was no control premium. We would not be surprised to see the company accept an offer if there was a good premium (i.e. at least 30% to the current share price). Whether or not this will happen…only time will tell.

The company also announced it had hired a new CEO in Andrew Vidler. Vidler’s resume includes stints as Executive General Manager (Retail) at Wesfarmers Health and Executive General Manager at EBOS Group.

Pacific Smiles shares

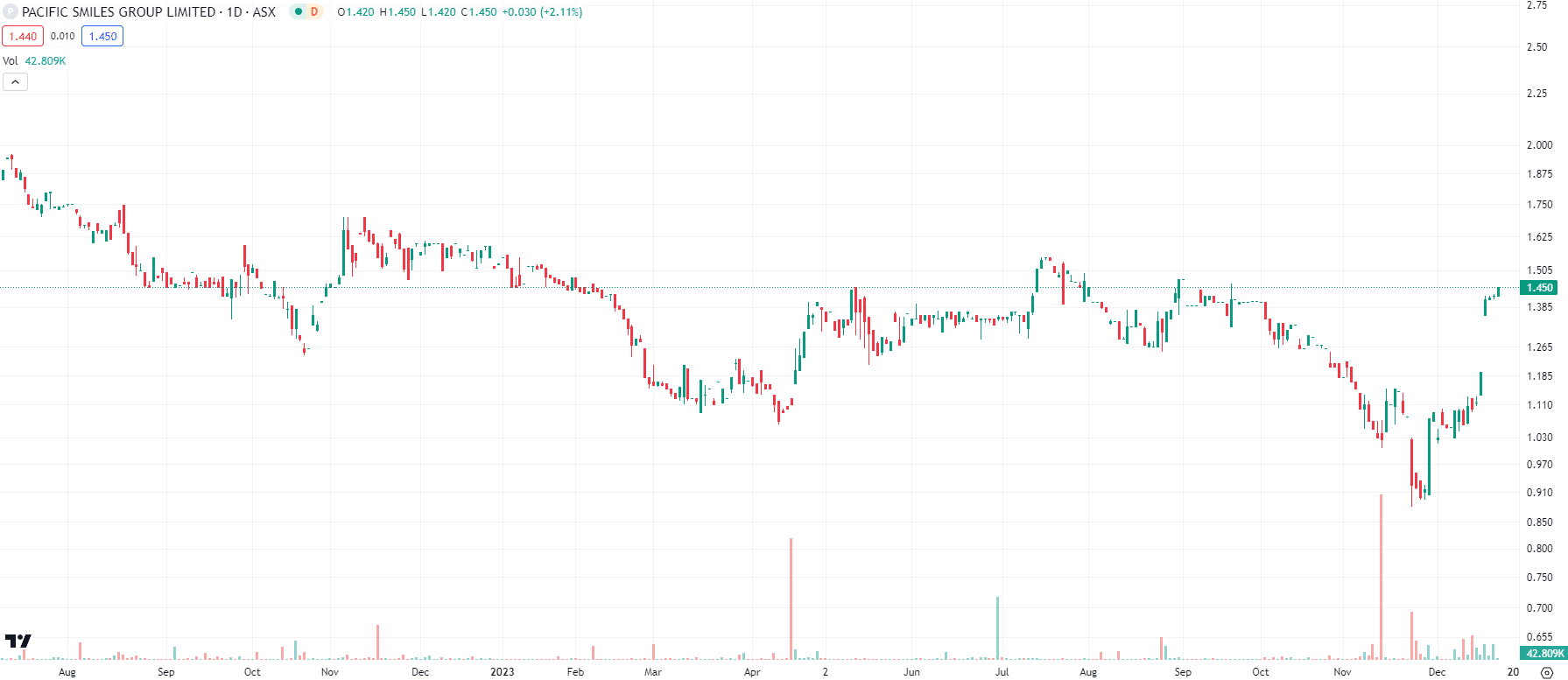

There’s no doubt that it has been a disappointing time for investors, given the performance of Pacific Smiles shares.

Pacific Smiles (ASX:PSQ) share price chart, log scale (Source: TradingView)

We see no reason investors should fear COVID putting people going off to the dentist anymore…that ship sailed nearly 2 years ago. We can understand frustration about it being the only dentistry stock left on the ASX after 1300 Smiles was acquired. Well now, there is a likelihood that the same fate could eventuate.

Ultimately, this is a solid business in a defensive industry that has many positive traits that help it stand out from its peers, including its scale and its treatment of its franchisees & employees. We think investors in this stock have a lot to look forward to in the year ahead.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

The Metals Driving Australia’s Market in 2026

Australia will still be a metals market in 2026; that part is not up for debate. What is changing is…

Patagonia Lithium (ASX:PL3) Surges 53% on Ameerex Partnership: Is This Lithium Explorer a Buy?

Patagonia Lithium Secures Key Partnerships for Growth Patagonia Lithium (ASX: PL3) surged 53% to A$0.13 on Friday, hitting its highest…

Aristocrat Leisure (ASX:ALL) Extends $750m Buyback: Time to Buy Australia’s Gaming Giant?

Aristocrat Leisure: A Compelling Investment Opportunity Aristocrat Leisure (ASX: ALL) rose 1.01% to A$57.22 on Friday after announcing a A$750…