An Appendix 4C release can do miracles for stocks, just look at Nexion (ASX:NNG)

![]() Nick Sundich, October 31, 2023

Nick Sundich, October 31, 2023

Tuesday was the deadline for ASX companies to lodge their Appendix 4C (or quarterly report) with the stock market for the September quarter. This is by virtue of today being the last business day of the first month after the completion of the quarter.

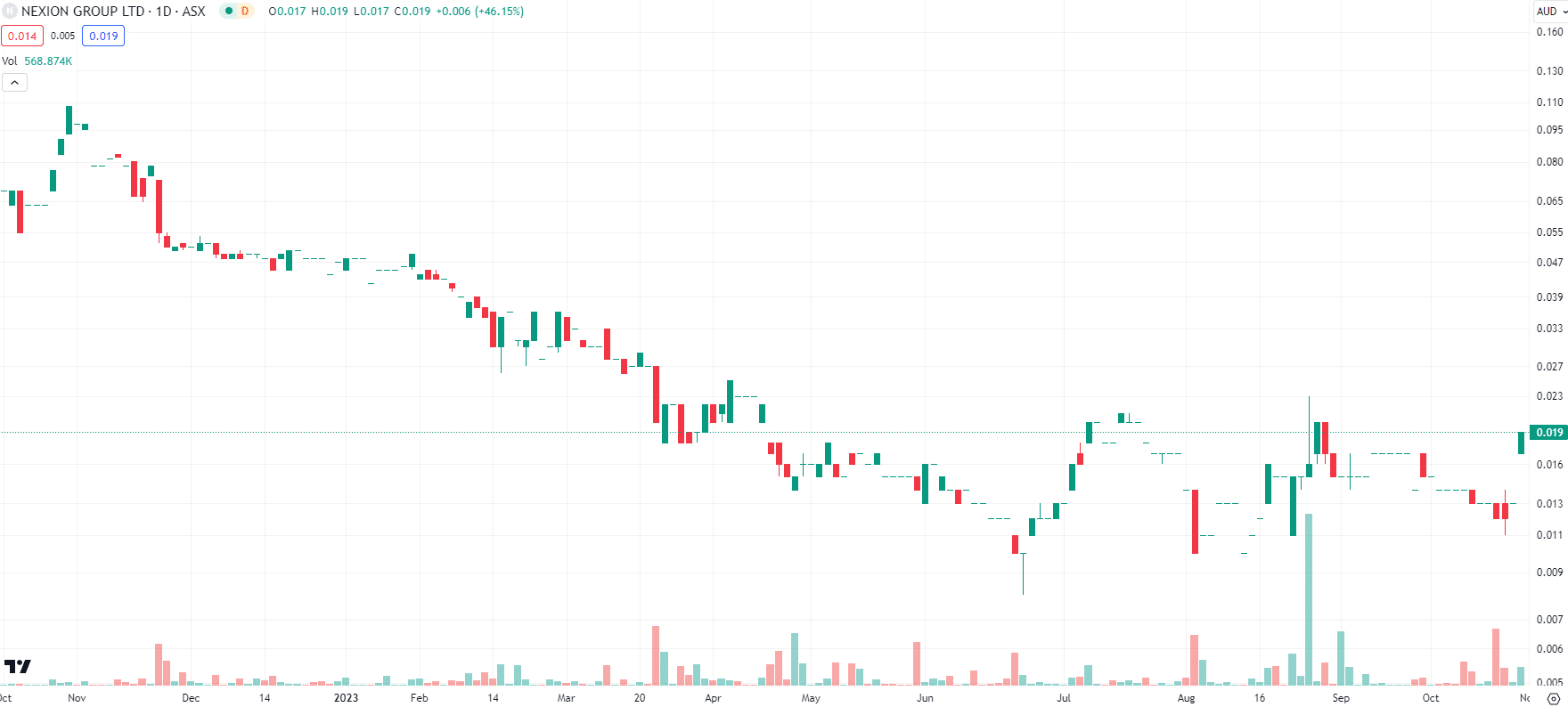

Naturally, the ASX’s Market Announcements Platform is full of these announcements this morning. As well as this, the list of winners and losers is dominated by companies that had good or bad quarterlies. The company that performed the best, with a 40% share price gain, was…Nexion (ASX:NNG).

Nexion (ASX:NNG) share price chart, log scale (Source: TradingView)

Was Nexion’s Appendix 4C really that good?

Nexion is a Cloud software company that is focused on Enterprise Asset Management Solutions. The company told investors that it delivered $2.1m in revenue, a figure that has stabilised and represents over $8m on an annualised basis. Most importantly, it delivered an unaudited EBITDA of $301,000 for the quarter and also achieved a positive EBITDA result for each month in the quarter.

M&A deals coming?

Looking to its cash flows, it had a wafer-thin $4,000 positive result from operating activities and closed with $139,000 in available funding, along with a $4m funding facility that is currently on hold. Finally, the company teased investors with the prospect of M&A activity. ‘Nexion continues to investigate and has made significant progress on several M&A initiatives, but has yet to conclude any material interest’, it said.

Good news for shareholders

It has been a difficult time to be an ASX tech stock, especially a small cap company. But, some companies that are moving towards profitability have been rewarded by investors and Nexion is evidently one of them. But, there are plenty of other companies that have not done so well today.

Best of luck to all investors who have not had their companies’ quarterly released yet.

Slowly getting through the final day 4C releases… pic.twitter.com/v7sTvBnYYa

— Microcap Jesus (@Saintly96) October 30, 2023

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…