Treasury Wine Estates (ASX:TWE): Here’s why there’s hope it can rebuild its business in China

Treasury Wine Estates (ASX:TWE) finally has realistic hope that it can rebuild its once-storied business in China. And the stock is one of the few bright stocks on a difficult day for markets.

Treasury Wine Estates (ASX:TWE) now has hope

Treasury Wine Estates is a business that distributes Australian wines across the world, including he famous Penfolds portfolio. It relied on China significantly prior to the pandemic because the rise of the middle class and its spending power meant there was strong appetite for luxury items such as wine.

Unfortunately, tariffs implemented by the Chinese government in November 2020 ruined its business in China. After several months with little hope on the horizon, now there is some.

The Australian government announced a review of these tariffs would commence. Although this could take up to five months, Treasury Wine Estates evidently thinks this could be a mere formality because it told investors of its plans to rebuild its business in China.

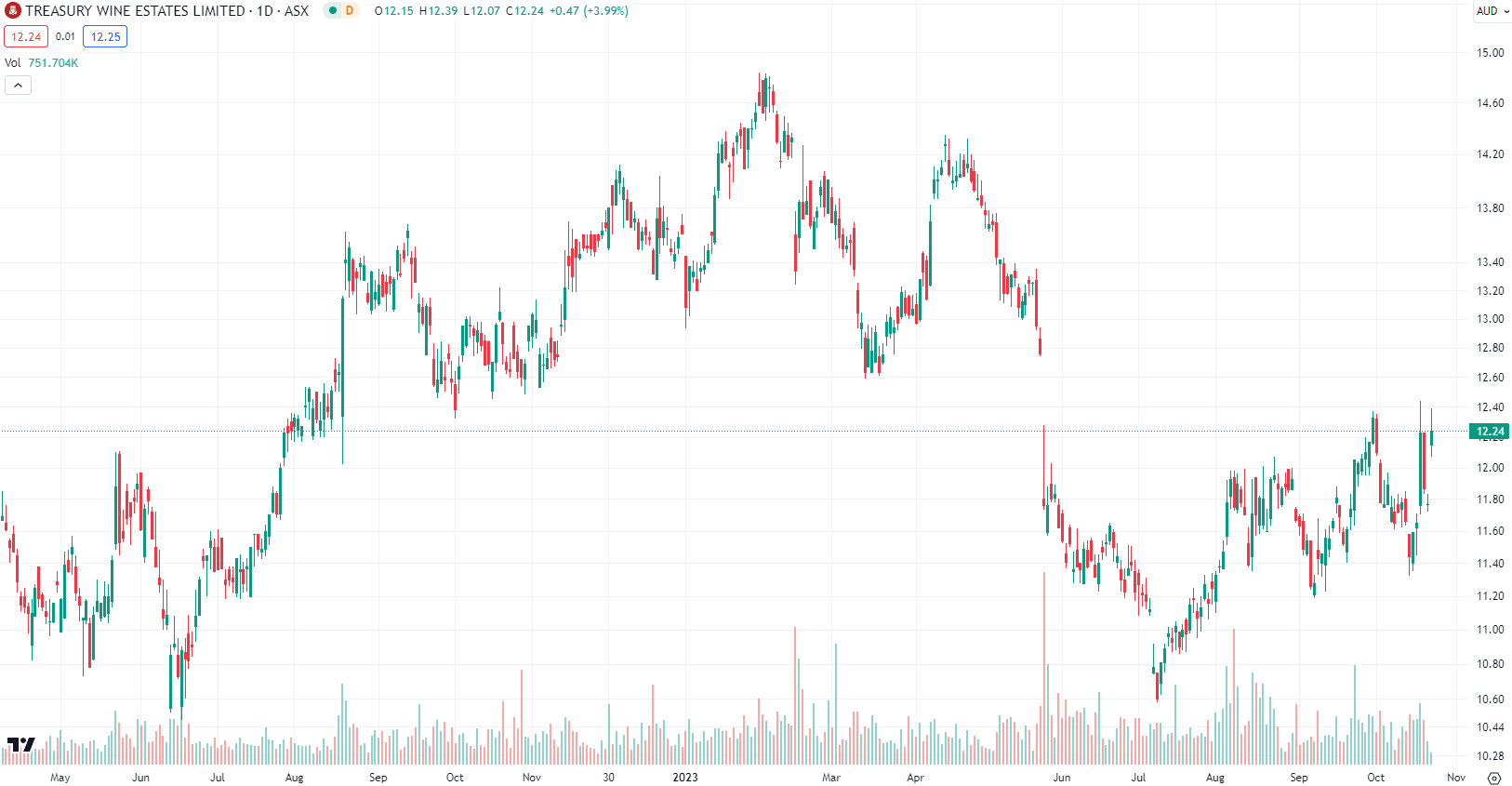

Treasury Wines Estates (ASX:TWE) share price chart, log scale (Source: TradingView)

Plans to rebuild

Treasury Wines Estates told investors its plans included investment in sales and marketing, incremental sourcing for luxury wines to meet future demand and reallocating certain wines from other markets to China. In our view, it is only logical that it would try and target the Chinese market once again.

But in taking stock from other markets to send to China, it seems that TWE has not learnt the lesson it should have from the pandemic in not putting all its eggs in one basket – especially a market like China where the door to the market can be slammed shut without a moment’s notice

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors at panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…