Has Whitehaven just sent a shiver down the spines of coal investors?

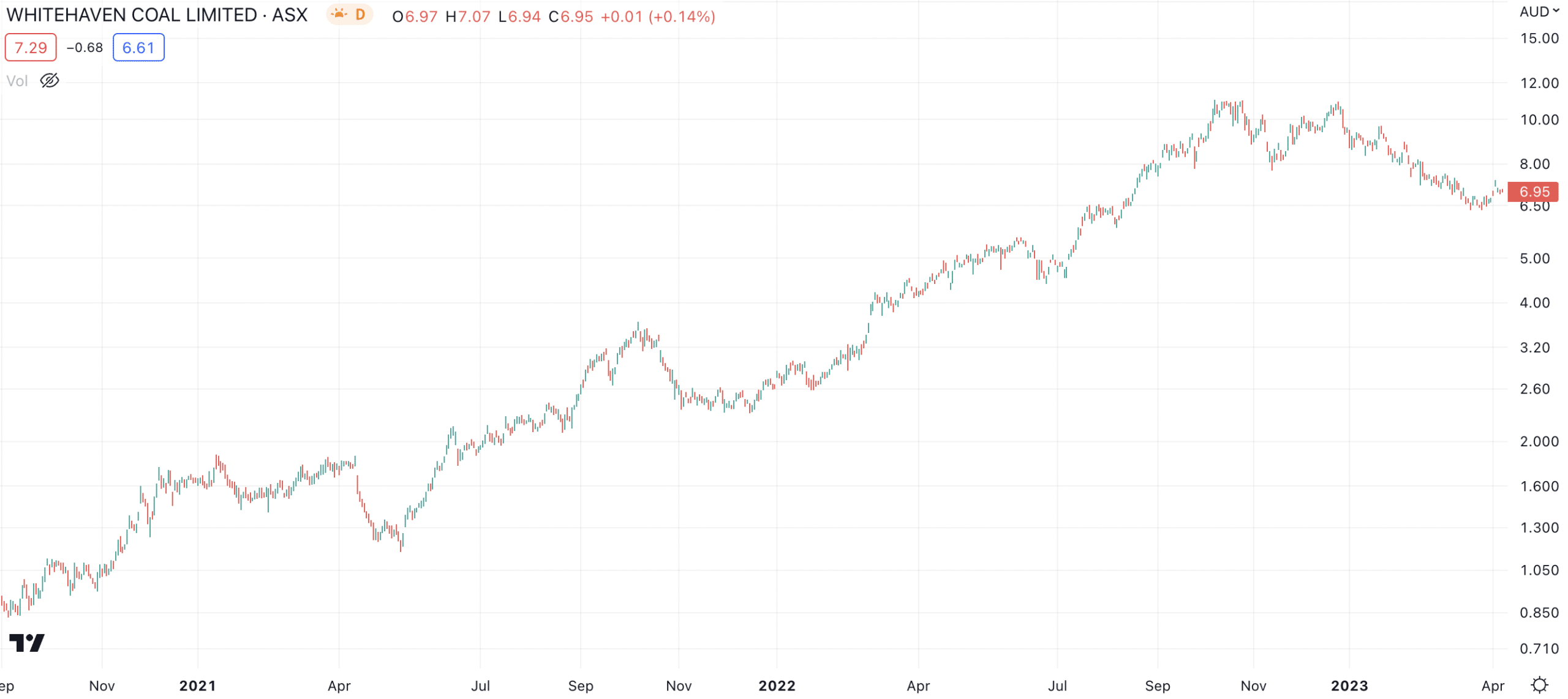

Whitehaven Coal (ASX:WHC) is one of several ASX coal stocks that have enjoyed a stellar run in the past couple of years. The company’s shares are up over 700% since September 2020. The key catalyst has been surging coal prices, driven by energy shortages resulting from the Russia-Ukraine war, consequently boosting the profits of coal companies, such as Whitehaven.

It also has helped that coal stocks have hardly put a foot wrong – until now.

Whitehaven Coal (ASX:WHC) share price chart, log scale (Source: TradingView)

Whitehaven updates its guidance

9 days ahead of its quarterly production report, Whitehaven updated its guidance for FY23. It warned labour shortages and other operational constraints were impacting production. Although the company expectes things to improve in the June quarter, some sales volumes would be pushed into FY24.

As a consequence, Whitehaven is expecting 18-19.2Mt production, down from 19.0-20.4Mt before. It is expecting to sell 15.3-16Mt, down from 16.5-18Mt previously. The unit cost of coal (excluding royalties) would be $100$107/t, up from $95-$102/t.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Hardly doomsday, but perhaps the end of the bull run

Whitehaven still told its shareholders that it would be a good quarter. It expects to report a $2.7bn net cash position and $1.2bn in cash from operations. And coal prices remain high, with an averages sales price of ~$400/t.

But this morning’s announcement illustrates that dream runs cannot last forever. The stock was down more than 7% in early morning trading, but has recovered some of the lost ground during the day.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…