Peninsula Energy (ASX:PEN): It was arguably the ASX best uranium play, but 2025 was an annus horribilus

This week we are taking an in-depth look at Peninsula Energy (ASX:PEN). It is one of a handful of uranium stocks that are re-starting mothballed projects after a prolonged period of downward prices.

But a number of issues meant that 2025 has been a difficult for the company with a number of operational issues meaning its production guidance was significantly ramped down. We think those issues are behind it and there could be upside in this one…but investor confidence is far easier lost than gained.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Peninsula Energy and the Lance Project

Peninsula’s flagship Lance project lies in Wyoming, USA and it is undergoing final construction before production starts again.

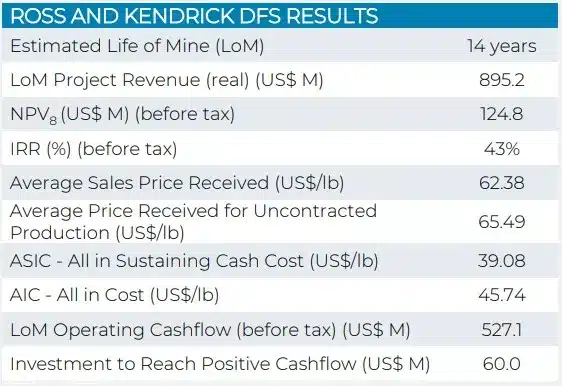

Lance is one of the largest US uranium projects with 53.7Mlb of JORC Resources. The conservative DFS, completed in August 2022, estimated a 14-year mine life generating 14.4Mlb, deriving a 43% pre-tax IRR, US$895.2 project revenue across the life of the project and a US$124.8m pre-tax NPV.

Source: Company

Lance was designed to kick start in 2 stages, Stage 1 will see 800,000/lb produced per annum while Stage 2 will see 2Mlb. The latter will occur within roughly 20 months after Stage 1.

In case the economics were not compelling enough

What makes the Lance product further compelling are 3 factors.

First, Peninsula Energy will produce with the low-pH ISR method to produce. The method involves recovering minerals from a suitable orebody before dissolving them and pumping the solution to the surface where the minerals can be recovered, thereby generating no tailings or waste rock. This means the project, which is the only US project authorised to use this operation and it will be a low-cost operation.

Second, there is virtually no sovereign risk with this project, given it is in the USA. Investors in uranium shares have been made all too aware of the issue after the Namibian mining minister made to Bloomberg that ‘local ownership must start with the state’ and that there should be a minimum equity percentage that would be free-carried. This made investors worried that their stakes will be diluted – or worse, that companies wouldn’t be able to proceed with production.

There’ll be no such troubles here. This is not just because America’s regulations tolerate mining, but because uranium is needed by the country. After dominating the world’s uranium production in the 1980s, it has been reliant on Russia for is nuclear fuel (which accounts for 52% of its clean energy). Peninsula Energy itself delivers uranium to the country’s strategic uranium reserve.

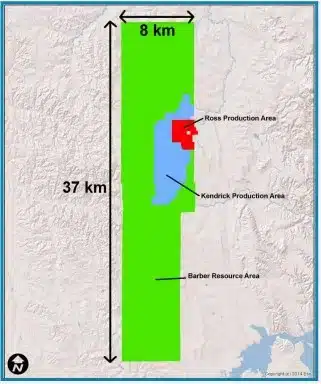

Third, there may be further upside in Peninsula Energy from exploration work conducted at the project. It is important to note that the DFS excluded the bulk of Peninsula’s total land holdings (specifically, all of the Barber Resource Area) and this accounts for over 30Mlb of Inferred Resources. If further exploration work can convert that resource to Indicated and/or Measured, it may be accounted for in the project’s economics and further enhance it.

Lance project area (Source: Company)

A good time to be in uranium

Uranium is a non-renewable resource with low carbon emissions, making it an attractive alternative to traditional fossil fuels. It has a wide range of applications in nuclear power plants and can be used for medical research and other industrial processes. The uranium market has never reached its pre-GFC highs (of over US$140 per pound), being hit by that crisis along with the Fukushima nuclear tragedy.

But as the push for decarbonisation grows, uranium has become increasingly sought after as an effective fuel source with minimal environmental impact. And prices have rallied to levels that will enable several mothballed projects (including Lance) to restart and deposits with potential to grow into operating mines suddenly become appealing to explore at. Now, we have to admit that prices haven’t had the best 12 months. But…prices are still at near-decade highs and at levels companies like Peninsula see it fit to restart production.

But company issues have dragged it down

We last wrote about Peninsula Energy in November 2024 at which point the plan was re-start Lance in the following weeks (i.e. December 2024), as the project in the final stages of construction right now. But the company had been selling uranium thanks to stockpiled reserves.

It was about the time we last wrote about Peninsula when the company released an announcement where it:

-

- downgraded its CY25 production profile from 700,000-900,000lbs to 600,000lbs,

- Found the final capital cost would be US$9.5m than previous estimations (from US$39.3m to US$48.8m), and

- Announced MD Wayne Heili would depart next year.

We thought investors shouldn’t have been too concerned as the company had US$68m in cash and was well funded beyond first production – or so we thought.

Production re-started on schedule but there were operational issues meaning it ended up having to be paused and restarted, then the guidance was revised. The re-start happened in September 2025 and the company ended up having to raise $70m in the middle of the year. The revised production guidance was:

- Up to 50,000lbs for 2025

- 400-500,000lbs for 2026, and

- 500,000-600,000 for 2027.

The company had to terminate many of its offtake contracts to align its obligations with the updated guidance.

To be fair Peninsula is not the only uranium company to have had a difficult year – ask Boss Energy. Arguably the worst is behind it. After all, the company is now in production, albeit with less production for 2025-27 than anticipated. The mean target price amongst analysts is $1.70, more than triple the current price.

But with prior expectations sky high and missed – and with such a big downgrade – investors will be far more nervous about trusting this company going forward.

What are the risks?

Beyond reputational risks, the key risks with Peninsula Energy are financing, operational and commodity price risks. The company will need ongoing capital to bring the project back into full swing.

The company is mostly set for Stage 1 with US$24.7m required, but US$265.9m will be needed for Stage 2. Some of this could foreseeably be funded with free cash flows from Stage 1, but it will inevitably need to go to market at some point in the next couple of years to bring it online.

The very reason Peninsula Energy mothballed Lance in the first place is because of low uranium prices and another downturn would be a gut punch to the company and its peers. Nonetheless, we think the risk is lower than a decade ago given how important nuclear energy will be to the world’s decarbonisation push.

In summary, investors should watch Peninsula Energy closely in the coming months as there is a lot of upside left in this one. But it could be longer than we previously anticipated before it will be realised, if for no other reason, because of the reputational damage it suffered from its year from hell in 2025.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…