Propel Funeral Partners (ASX:PFP): The last surviving funeral provider on the ASX

It is said the only certainties in life are death and taxes and Propel Funeral Partners (ASX:PFP) is the only ASX company that makes its money from the former.

Its larger rival Invocare (ASX:IVC) was taken over by TPG Capital for $1.8bn in 2023 after struggling for some time prior. Propel has had good fortune and is >90% above its levels 5 years ago…but its shares haven’t had the best 2025 with a 12% decline.

What does the future hold? Could it be going the way of Invocare?

Introduction to Propel Funeral Partners (ASX:PFP)

Despite this company being the second largest funeral provider, you may not have its name before. This is because it is an owner of several franchises and we’d imagine you will have heard of some of them – White Lady Funerals and Simplicity Funerals just to name a couple.

Propel only came into existence in 2012 and was listed in 2017 at $2.70 per share. Many of its franchises go back several decades, however. It is 14.8%-owned by co-founders Fraser Henderson and Albin Kurti.

Australia’s 2nd largest provider

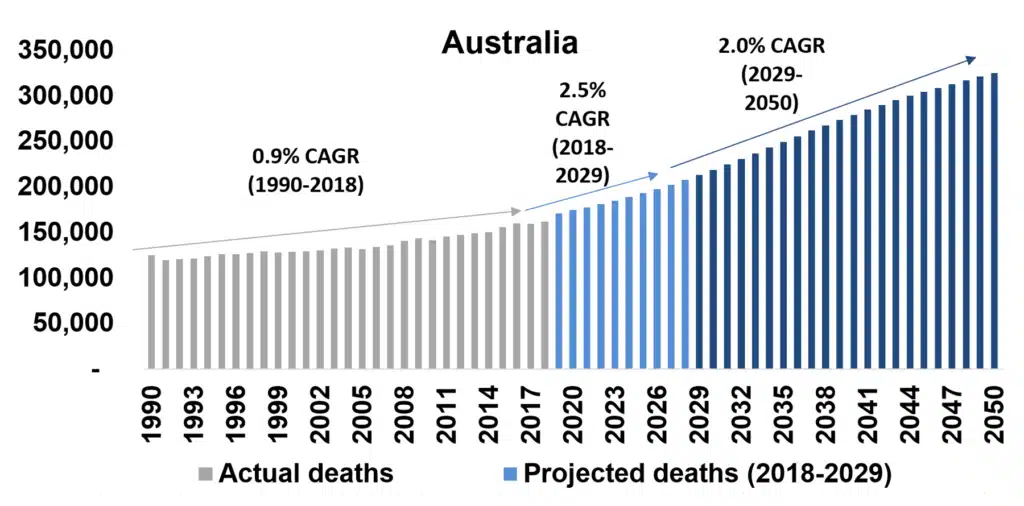

We’ve already noted that death is one of life’s two certainties. But it is also worth noting that funerals are a 24-hour, labour-intensive business with extensive planning and various facilities. And none of this comes cheap. Deaths in Australia are set to continue to grow in the years ahead. And Propel is the 2nd largest provider in the market with operations in 144 locations.

Source: Company

But fortunes don’t always favour it

However, deaths can fluctuate from year to year. The 2019 flu season was a good time for Propel. The start of the pandemic actually ended up being a bad time for the company because social distancing meant less deaths from the flu. Things changed once social distancing measures were dropped, however. And it showed in the company’s share price and results.

Propel Funeral Partners (ASX:PFP) share price chart, log scale (Source: Google)

In FY23, PFP delivered $168.5m in revenue (up 16%) and a $20.9m profit (up 18%). It paid 14c per share in dividends. The company performed 18,029 and made $6,398 per funeral.

And in FY24, PFP delivered $209.2m (up 24%) and an NPAT of $23.4m (up 12%). It paid 14.4c per share, representing a 2.5% yield and a payout ratio of 85% of distributable earnings, off the back of 21,655 funerals although this figure was inflated by M&A activities. Average Revenue Per Funeral was $6,635.

At its 1H25 results, the company revealed Albin Kurti would be retiring in August. This led to a share price decline when its results were released, even though revenue grew 12% and its operating profit by 21%. Ultimately, the company hired from within, promoting fellow co-founders Fraser Henderson and Lilli Rayner to co-CEOs.

Its full year result for FY25 was $225.8m revenue (up 8%, ahead of guidance and purportedly a company record) and a $21.6m profit (up 2.2%). It paid 14.4c per share in dividends and closed the period with $143m in available funding. 22,602 funerals were performed (up 4.4%) and its average revenue per funeral was $6,721.

Since listing, the company has spent $300m on mergers and acquisitions, and $13m was spent in FY25. One of these M&A deals was Decra, a supplier of headstones and monuments in New Zealand. PFP told investors FY26 had begun strong with a record revenue month in July 2025 and Average Revenue Per Funeral grew 2.7%. Helps to be in the flu season, no?

Good times to come, maybe?

Consensus estimates for FY26 call for $241m revenue and $0.17 EPS, with the latter representing a $23m profit. Then in FY27, $254m revenue and a $26.2m profit. The mean target price is $5.91, a 14% premium to the current price. Its P/E is 29x, its EV/EBITDA is 14x and its PEG is 2.1x.

It doesn’t appear cheap by any means, but if you wanted to value Propel on a takeover basis, it would be worth $6.66, nearly 30% higher than right now. This is using a P/E multiple of 37x, the implied takeover multiple of Invocare.

Getting offers of its own

Now, the company told investors last year that it received takeover offers without being specific as to who were bidders and what they offers. As a consequence, the share price has not moved that much, but don’t be surprised if it moves if binding offers are made and revealed to investors.

There is evidently some growth in this one, albeit as much potential as other ASX small caps we have covered in recent weeks unless you want to assume it will be taken over.

One for Invocare investors, but for other investors?

All things considered, we don’t think investors will do bad with this one, unless it significantly underperforms. If history with this company is any guide, it will depend on death volumes. Death is one of life’s two certainties, but the fact that they can occur when you don’t expect works both ways…death volumes can sometimes go down, and this is bad for funeral providers.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…