How Australian Investors Are Changing Their Strategy After the RBA Rate Cut in 2025

When the Reserve Bank of Australia (RBA) cut interest rates back in August 2025, many Australians stopped to think about their money and investments. Lower interest rates result in cheaper loans and fewer returns on savings. As such, the way people invest will invariably change.

In this post, we’ll take a look at the circumstances behind the RBA interest rate cut in 2025, why it’s important, and what it means to investing Aussies.

What are the Best Bank stocks to invest in right now?

Check our buy/sell tips

Why Did the RBA Cut Rates in 2025?

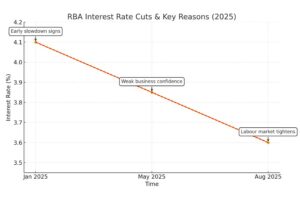

The RBA has cut interest rates three times already in 2025. It’s important to note that the most recent came in August, when the financial authority reduced the official interest rates by 25 basis points to 3.60%.

The reason behind the RBA’s move to cut rates for the third time this year was due to the Australian economy slowing down. For context, businesses weren’t growing as quickly, and it became more difficult to get or retain a job.

Due to the challenging situation the country found itself in, the RBA decided it was time to lower interest rates. The financial institution did this in an attempt to revive the economy.

How the RBA’s Rate Cut Affects Different Investments

Here’s how rate cuts have affected popular investment vehicles.

Australian Stock Market (ASX)

The Australian stock market 2025 has witnessed a steady rise since the last rate cut occurred back in August. This is the case because lower interest rates prompt Aussies to borrow more money and make investments in financial vehicles like dividend stocks ASX for higher returns.

According to a recent report, the ASX 200 climbed by 1.3% to hit a record high of 9,108.70 on October 15. Projections show that these numbers could rise further if another rate cut is implemented by the RBA.

Australia Bond Yields

When the RBA lowers interest rates, bond yields in Australia tend to drop. As such, if you key into new bonds, you’d receive fewer profits than you’d have gotten from older bonds. This makes old bonds more attractive, increasing their market value in the process.

Cash Savings

For those who have their cash stored in banks, the RBA cash rate cut isn’t good news. This is because your savings account will now give you less interest than you would’ve received before interest rates were lowered. As such, many investors are looking towards more avenues that’ll see them earn more, regardless of the risks involved.

Property Investment

If there’s a winner following the latest RBA cash rate cut, it’ll be those who are into property investment in Australia. Since loans now have lower interest rates, it’s easier to buy properties or refinance existing loans.

In the meantime, those not ready for large spending are taking smaller steps to stay in touch. The Australians try some casual entertainment, and with extras like a 50 free chip no deposit deal, testing the waters becomes no mean feat. These bonuses allow them to try out different titles and have some fun without tying up serious deposits.

Summary of What’s Happening to Different Investments After the RBA Rate Cut

| Investment Category | What’s Happening |

| Australian Stock Market | Steadily rising, with more investors putting their money on dividend stocks ASX due to their promise of massive returns. |

| Bonds | Older bonds are more attractive and have better yields. Newer bonds pay out less interest. |

| Cash Savings | Cash savings accounts are getting lower returns from banks across the country. |

| Property Investment | Loans getting cheaper has resulted in more people buying properties. |

Aussies Seeking Balance: Entertainment and Everyday Fun

With financial returns slowing down, many Australians are also looking for simple ways to unwind and enjoy their downtime. Platforms like Ice Casino have become popular among those who want entertainment. Since there is no financial gain involved, such platforms offer an attractive way to spend free time and take a break from the constant market news.

How Regular Investors Are Reacting

The recent RBA monetary policy has got Aussies thinking differently about the way they invest. To earn more money, investors are now:

Purchasing High-Dividend Stocks: Instead of leaving their money in savings accounts yielding less returns due to rate cuts, Australian investors are now looking towards stocks with high dividends.

Investing in Property: Since loans now have lower interest rates, Aussies are now investing in properties to enjoy decent to massive profits in the long run.

Portfolio Diversification in Australia: How Investors Are Spreading the Risk

With the RBA rate cuts, portfolio diversification in Australia isn’t just smart, but essential on all fronts. When you put your money into different investment vehicles, you can still get reasonable returns even when one fails to hit your desired target.

Here are some notable ways you can diversify your portfolio in 2025:

Property and Infrastructure: Most investors count physical properties as “real wealth.” This is because they remain valuable, even in times of economic uncertainty.

ASX Stocks: ASX investment trends have changed after the RBA rate cut. Now, investors are putting their money into buying shares in companies rooted in dividend-paying sectors such as finance, technology, and construction.

Overseas Investments: Some investors spread their funds into the US and Asian markets to tap into their growth potential and protect themselves from any downturn experienced by the Australian economy.

What Experts Are Saying: Forecasts for 2025-2026

The RBA interest rate cut hasn’t just ushered in a new set of Australian investment strategies; it has sparked debates among financial experts. While some think that more cuts will come soon if the economy keeps slowing down, others assert that the current rate cuts are having the desired effects.

Experts at the Common Wealth Bank of Australia expect the next rate cut to occur in early 2026 if things don’t pick up as expected. Conversely, a report from The Guardian suggests that due to unemployment rates jumping to 4.5% in September, the chances of another rate cut occurring as soon as November 2025 cannot be ruled out.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…