Revascor’s FDA approval sends the Mesoblast rollercoaster upwards

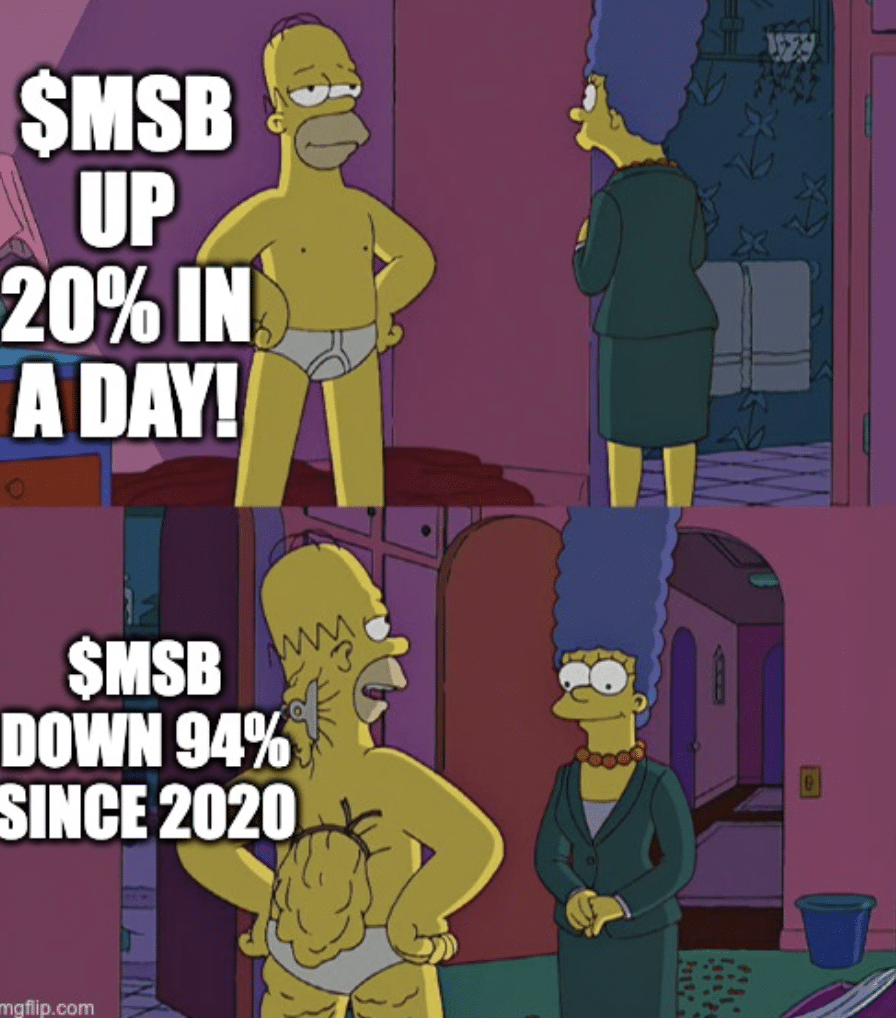

Its been a rollercoaster ride for Mesoblast (ASX:MSB) shareholders, and although its been mostly downwards, the FDA approval of Revascor sent shares in the other direction. Is this a dead cat bounce, or a new beginning for the company? Long suffering shareholders would be scoff at the latter question, although there is no denying there was good news.

Revascor: A Hope in Pediatric Cardiology

Revascor, also known as Rexlemestrocel-L, is at the forefront of a major medical breakthrough. It’s designed to tackle a rare but serious heart condition in children called hypoplastic left heart syndrome (HLHS). In HLHS, the left side of the heart doesn’t develop properly, leading to critical health challenges.

Mesoblast sees this drug as more than just a new product on the shelf. It’s a beacon of hope, a potential game-changer for young patients with few other options. HLHS, though not common, brings severe complications, putting Mesoblast’s efforts at a crucial juncture in the field of pediatric healthcare.

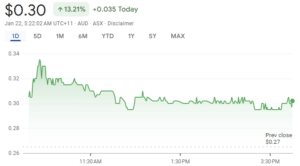

A Huge 21% Jump!

Right after the announcement about Revascor last Friday, the market reacted positively. Mesoblast’s stock value soared, climbing 20.8% to 32 cents in just the first hour of trading. We can’t blame investors for getting excited, but neither can we scorn naysayers.

To be clear, this was not the full green light to start selling Revascor in the USA. Instead, it was a ‘rare paediatric disease’ designation. This is given to drugs that offer major advances in treatment for rare diseases – diseases that affect fewer than 20,000 people.

It means that Mesoblast may be eligible to receive a priority review voucher which would be redeemed for priority review of a subsequent marketing application for a different product or sold to other companies. So it could get to market earlier but this is no guarantee. If Revascor gets to market, investors will look back at this day as a major step to that day, although ‘that day’ is some time away.

Most long-suffering shareholders just want some longer term appreciation in the share price. In our view, the best chance for shareholders to recoup their losses would be if and when the current clinical trial for Remestemcel-L is complete and the FDA is actually satisfied with it (which it was not last time around). When that will occur is anyone’s guess.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…