Sandfire Resources (ASX:SFR): The best way to play the copper trade? Investors seem to think so

Sandfire Resources (ASX:SFR) is one of the ASX’s largest companies wth exposure to copper, and in our view, the best. It has pulled off something very few miners can boast of, transitioning from one asset to another with minimal disruption to shareholder value. With shares up 64% in the last year, and up 36% in the last 3 months, let’s look at what investors see in this company.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Sandfire Resources’ history

Back in 2009, Sandfire was just another struggling explorer. But it stumbled across the DeGrussa copper deposit in WA. The high grade hits resulted in shares surging from 4c to over $2 in just a matter of months. It became an operating mine in 2012 and produced over 650,000 tonnes of copper and 380,000 ounces of gold over the next decade before closing in 2022.

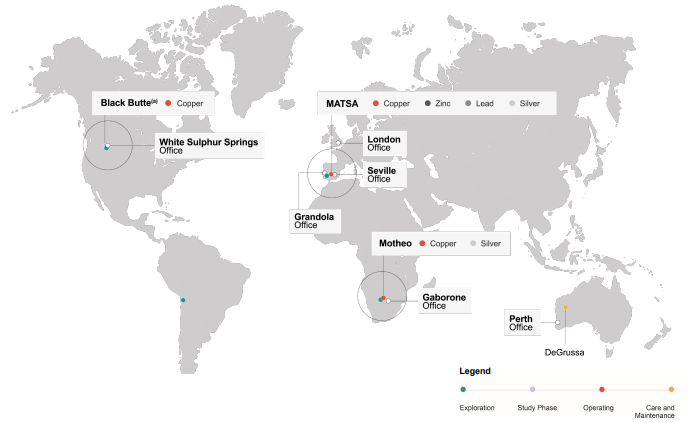

The company knew time was running out and so it looked elsewhere. It built a new mine at Motheo in Botswana in 2020. In 2021, it raised $1.2bn to buy a copper mine in Spain MATSA that came with the promise to deliver 100,000 tonnes of copper equivalent per year for more than a decade. And finally, it has a development project at Black Buttee in the American state of Montana. Overall, it has a resource base of 172.4Mt @ 1.3% copper and 2.9% zinc.

But it is MATSA that is most exciting.

Source: Company

What’s so good about MATSA

MATSA lies within a favourable mining jurisdiction. We will concede that no company will say it is not in a favourable mining jurisdiction, and even those that know deep down they are in bad jurisdictions will try and spin some positives.

Of course, Spain is unknown for many investors focused on ASX mining companies, but unknown is not necessarily risky. Spain (and the government in the local province of Andalusia that is in the country’s far south west near the border with Portugal) is a favourable jurisdiction with strong government support. There is established infrastructure – utilities, roads and the Huelva port. And it lies in the Iberian Pyrite Belt, one of the world’s largest volcanogenic massive sulphide systems.

MATSA is not actually a mine. It is a complex of 3 mines and a 4.7Mtpa central processing facility. And Sandfire owns a total of 48 concessions across ~3,280km2.

Here are some more things that are intriguing about MATSA: Turnover is lower than 3%, 22% of employees are women (over twice the local industry average), and the project contributes 5% of Huelva’s GDP. What’s more is that since Sandfire took ownership, there have been no fatalities (whereas there were under previous management) and the TRIF has gone down, all because of Sandfire’s changes to operations.

But most importantly, the company expects 90-100ktpa copper equivalent over the next 3 years and thinks there is further opportunity to increase metal production. The company anticipates a cost of ~$74-82/t ore processed from FY26 to FY28 and for further improvements to be made at both the production and cost lines.

It is important to note that MATSA is also prospective for zinc and it made 27% of revenues from zinc in 1H25. But it still made over 60% from copper.

It is a good time to be in copper

We’ve been bulls on copper for some time given its important industrial uses. Donald Trump’s threats to impose a 50% tariff on copper imports has caused a stir in the markets.

Of course, it will mean local copper will be more attractive, so good news for American miners. The question of what will happen to imports is another. And not just direct copper imports but finished goods that use copper from defence ammunition and hardware to regular consumer goods like phones. With the US heavily reliant on imports, some companies may just have to ‘pay the price’.

One way in which Trump may be good for Sandfire is that if its Montana project turns out to be anything, it could be quick to get off the ground. Rio Tinto strived to get its Resolution copper mine in Arizona for more than a decade, but only now under Trump has it been able to get the permitting done.

But in respect of MATSA, this will be an incentive for neighbouring European countries to support closer projects that won’t be subject to tariffs.

Sandfire shares have undergone a major rally in recent months

Sandfire are up 36% since September. It is difficult to identify a company-specific catalyst at that point, although its results up to that point surely would not have hurt. Its FY25 results, presented in a slide deck that began with the motto,’ We mine copper sustainably to energise the future’, showed positive results.

The period was headlined by record sales revenue of $1,176m. Copper production was up 12% to 152.4kt, even with weather and power disruptions, net debt down 69% to $123m, underlying EBITDA of $528m (from $362m the year before) and a $90m profit vs a $19m loss the year before.

For FY26, Sandfire guided to a more modest year with just 2% growth to 157kt, skewed to the back end of the year. It warned of double digit percentage hikes in underlying operating costs, exploration expsnes and capital expenditures even if partly because of Euro fluctuations and the construction of a new TSF at MATSA. Still, investors were promised they would see a PFS for Black Butte in Q2 of FY26 along with a maiden reserve at A1 (part of Motheo) by the end of the financial year.

The Motheo Mineral and Ore Reserves were updated to 59.5Mt at 1% copper and 13.6g/t silver, containing 570kt copper and 26.2Moz silver. 4.1Mt was measured, 45.2Mt was Indicated and 10.2Mt was Inferred.

Q1 of FY26 did little to quell investor enthusiasm for Sandfire. In spite of copper production retreating 7% on a group-wide basis, this was ahead of the company’s plan, and no change was made to its production, cost or capex guidance. The most recent news came in November when it signed a term sheet with Havilah Resources (ASX:HAV), whereby Sandfire may earn up to an 80% interest in the latter’s Kalkaroo Copper-Gold project in South Australia.

Getting this stake won’t come cheap, with Sandfire needing to pay $105m in upfront consideration (split 70-30 brtween cash and scrip) and a further $105m upon completion of a new PFS following a minimum 20,000m drilling program. But with an existing Ore Reserve of 100Mt at 0.47% copper and a Mineral Resource of 224Mt at 0.49% copper, there is cause for optimism.

Conclusion

Sandfire is one of the best ways for investors to gain exposure to copper – at least among pure plays. While shares may be volatile in the short-term, we are confident in the company’s longer-term potential given the quality of its project and the future upside facing it from new exploration work there.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors are panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…