What are ASX Vanadium Stocks?

ASX vanadium stocks refer to the companies that are listed on the Australian Securities Exchange. These companies are engaged in the exploration, mining, and production of vanadium. These companies also focus on developing vanadium-related technologies to improve their production. Vanadium stocks primarily focus on vanadium mining projects, vanadium batteries, and supplying the steel industry, where vanadium is widely used in metal alloys for high-strength applications.

Why Invest in ASX Vanadium Stocks?

There is an appeal to investing in vanadium stocks. This primarily lies in vanadium’s versatile role in two critical areas: renewable energy storage and high-strength steel production. As renewable energy sources like wind and solar continue to expand, vanadium redox flow batteries (VRFBs) offer a sustainable solution for energy storage. Due to this virtue of vanadium, it is favored over lithium for large-scale applications.

Vanadium also has a long lifespan and recycling potential. Furthermore, vanadium’s demand is increasing because of the demand in the steel industry. Vanadium in this sector enhances the strength and durability of steel products. Australian Vanadium is highly sought after because the country is filled with rich vanadium mines. Vanadium-based companies on the ASX are seeing considerable vanadium production. Australian vanadium resource is currently the focus of the attention of many investors today.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

Vanadium's Market and Production

The vanadium market is primarily driven by demand from the steel industry. With around 90% of global vanadium consumption used to produce high-strength steel, this metal is highly gaining attention in the resource sector. Another growing application is in vanadium flow batteries. This is crucial for supporting renewable energy grids and energy storage. Countries such as China, Russia, and South Africa are the largest producers, but Australia, with its crown jewel projects like the Australian Vanadium Project and Windimurra Vanadium Project, is emerging as a potential player in the global vanadium production market.

3 Best ASX Vanadium Stocks To But in 2025

Australian Vanadium Ltd (ASX:AVL)

A leading vanadium producer in the industry, AVL is currently focusing on their Australian Vanadium Project in Western Australia. The project, granted Major Project Status by the Australian government, has a high vanadium pentoxide...

Liontown Resources (ASX: LTR)

With a focus on producing ferrovanadium for the steel industry and exploring potential vanadium redox flow applications, the company's project holds an inferred resource capable of meeting global vanadium demand for both traditional and ...

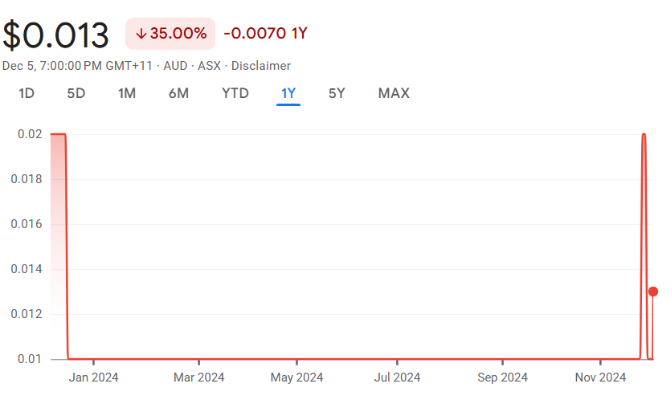

King River Resources (ASX: KRR)

This exploration company is making significant strides in Australian vanadium production. King River Resources has shown a steady commitment to advancing its exploration and metallurgical research, aiming to maximize the economic...

3 Best ASX Vanadium Stocks To But in 2025

Factors Influencing Vanadium Supply and Demand

Certain factors determine the exploration and production of vanadium.

- Steel Industry Demand: Vanadium is used as an excellent alloy in steelmaking to increase strength and durability. Vanadium also supports infrastructure and construction industries worldwide.

- Renewable Energy Shift: The demand for vanadium is fueled by its role in vanadium redox flow batteries for energy storage, particularly for solar and wind energy. As these renewable energy sources require efficient storage solutions, vanadium chemicals and vanadium demand is driving the production of vanadium.

- Geopolitical Factors: Major vanadium-producing regions like China and Russia control a significant share of the market, meaning shifts in their supply can influence vanadium prices globally.

- Australian Mining Boom: Australian vanadium projects such as the Gabanintha Vanadium Project are tapping into the growing demand, potentially positioning Australian vanadium as a notable vanadium supplier.

How to Choose the Right ASX Vanadium Stocks?

Investors looking to add ASX vanadium stocks to their portfolio should evaluate the company’s project portfolio, geographic location, production capacity, and financial health. Here are a few factors to consider:

Look for companies with projects in the bankable feasibility study stage, such as Australian Vanadium Ltd and Technology Metals Australia, which signals readiness for vanadium production. High production capability and established vanadium mines add value, as these companies can benefit from vanadium demand in the battery and steel industries. Companies involved in emerging technologies, such as vanadium redox flow batteries for energy storage, may have a competitive edge.

Future Outlook of ASX Vanadium Sector

As global demand for renewable energy increases, the ASX Vanadium sector is well positioned for growth. Vanadium, one of the critical metals in flow batteries in energy storage, will highly be in demand. With ongoing projects across Western Australia and rising investments in vanadium technology, the sector holds a great deal of promise for investors. This could be a great opportunity to learn and get more exposure to the growing market of energy storage.

Pros and Cons of Investing in ASX Vanadium Stocks

The investors will gain a significant amount of exposure to the renewable energy sector. With essential flow batteries made of vanadium are highly in demand today, investors can understand the industries involved in its production. Another major industry looking to profit from the surge in vanadium is the steel-making industry. Being a sturdy and flexible material, vanadium is versatile and highly used in steel manufacturing. As a critical metal in energy storage solutions, vanadium has a strategic importance to its usage. This could be why vanadium stocks will see a rise in their performance.

The ongoing geopolitical tensions will cause the disruptions in supply chain of vanadium. Vanadium volatility will be inevitable if this phenomenon occurs. However, the price fluctuations last for a short period, it is vital to consider the market trends during that time as well. There could be an unexpected delay in projects involved in the production of vanadium. Along with high capital investment for vanadium mining, this can become a drawback for vanadium stocks.

Are ASX Vanadium Stocks a Good Investment?

Diversifying the investment portfolio to spread the risks associated with the stocks is a common way investors manage their portfolios effectively. Investing in ASX Vanadium stocks can be a compelling option for those looking to diversify into the renewable energy and steel sectors. However, like all commodity markets, vanadium investments carry risks tied to price fluctuations. Investors should stay informed about developments in the vanadium market and assess their risk tolerance before investing.

FAQs on Investing in Vanadium Stocks

Vanadium, a silvery-gray, hard metal, is frequently employed in the reinforcement of steel and other metal alloys. Vanadium is predominantly utilised within the steel industry. However, vanadium is also increasingly utilised in vanadium redox flow batteries for energy storage due to its exceptional properties.

Our Analysis on ASX Vanadium Stocks

JORC Resources: Here’s What’s Crucial For Investors to Know Before Investing

Investors will often hear of JORC Resources or a JORC Code and may think companies are alluding to a mere…

Stocks Down Under’s Top 10 Hottest ASX Stocks to Look At in 2026!

Today, on the first trading day of 2026, Stocks Down Under publishes its its 10 Hottest ASX Stocks to Look…

Our 5 ASX Predictions for 2026!

This article outlines 5 ASX Predictions for 2026 that Stocks Down Under puts its neck on the line to assert…

Here are 6 ASX mining services stocks to look at (other than Mineral Resources)

There are plenty of ASX mining services stocks doing well right now due to the booming gold and iron ore…