What are ASX Small Cap Shares?

ASX small-cap shares represent stocks of companies that are smaller in size compared to large, well-established corporations. The market capitalisation of these companies typically falls between $300 million and $2 billion. Small-cap stocks are often in the earlier stages of growth, which means they may not have reached their full potential. However, they present an opportunity for investors to buy into companies at an earlier stage, before they expand significantly and gain the attention of larger investors.

Small-cap stocks are particularly attractive because of their ability to grow quickly, especially if positioned in emerging industries or with innovative technologies. However, the small size of these companies means they are often more vulnerable to economic downturns and market fluctuations. Due to their limited resources and lower visibility, they may also face challenges such as liquidity risks and high volatility. Nonetheless, with the right approach, small-cap stocks can be an excellent way to diversify a portfolio and achieve superior returns.

Why Invest in ASX Small Cap Stocks?

Investing in ASX small-cap stocks offers a variety of compelling advantages, making them an attractive option for investors with a higher risk tolerance. One of the most appealing aspects of small-cap stocks is their growth potential. Small-cap companies, particularly those in emerging sectors like technology, biotechnology or clean energy, can experience rapid growth if their business models are successful. This growth can translate into significant price appreciation, providing investors with high returns.

Another key advantage is that small-cap stocks are often undervalued by the market. These companies may not have the same level of institutional backing as large-cap stocks, leading them to be overlooked or mispriced. As such, savvy investors can find opportunities to purchase shares at a lower cost before the broader market realises the stock’s true value. In contrast, large-cap stocks often trade at high valuations, limiting the potential for dramatic price appreciation.

Small-cap stocks also provide diversification in a portfolio. By adding these companies to your investment mix, you can reduce the overall risk of your portfolio, especially if you are primarily invested in large-cap stocks or other asset classes. Small-cap stocks tend to be less correlated with larger companies, meaning they can perform well even when the broader market is experiencing a downturn.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out!

How to Choose the Right ASX Small Cap Stocks to Buy?

Selecting the right ASX small-cap stocks requires a careful analysis of various factors to ensure that you are making informed investment decisions. To begin with, look for companies with strong growth prospects. Small-cap stocks can be volatile, but those with solid plans for growth, including new products, market expansion or innovative technologies, are more likely to succeed. Consider the company’s potential to disrupt its industry or benefit from emerging trends in the market.

Additionally, it’s important to assess the financial health of the company. While small companies may not always show consistent profits, you want to ensure that they are financially stable, with manageable levels of debt and a solid cash flow. Strong financials provide a buffer during periods of market uncertainty and help ensure that the company can continue investing in growth initiatives.

Another factor to consider is the industry in which the company operates. Emerging industries like artificial intelligence, renewable energy, and biotechnology can offer significant opportunities for growth. Companies that are well-positioned in these growing sectors tend to have a competitive edge and the potential for rapid expansion. Additionally, pay attention to the company’s management team. A strong leadership team with experience in the industry is crucial for executing a successful business strategy and navigating challenges.

Lastly, market sentiment plays a key role in the performance of small-cap stocks. Investor sentiment can heavily influence the stock price, so it's essential to gauge how the market views the stock, as well as analyst reports and investor opinions. A company that is consistently viewed positively by investors is more likely to experience sustained growth.

The 3 Best ASX Small Cap Stocks to Buy In 2026

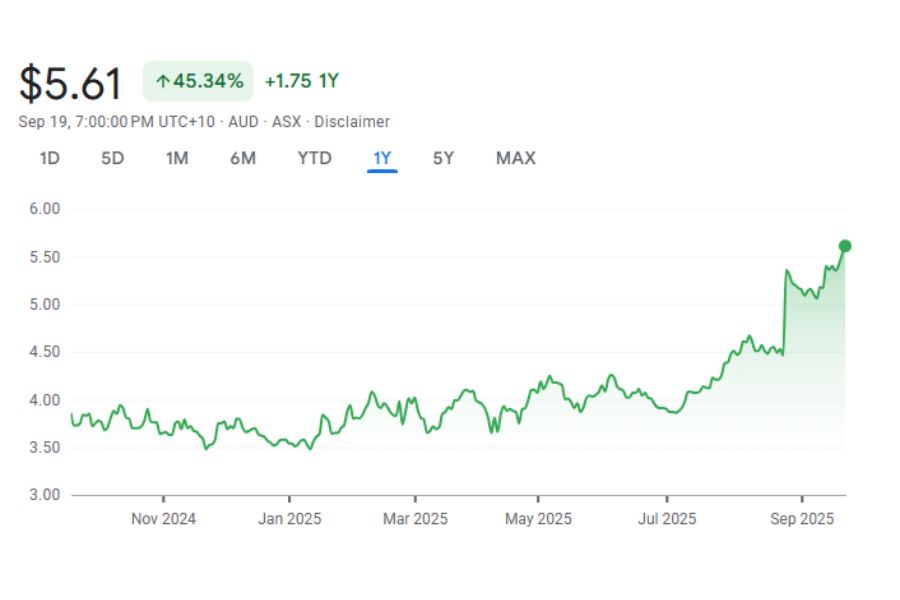

Integral Diagnostics Limited (ASX:IDX)

Integral Diagnostics is a leading diagnostic imaging provider operating across Australia and New Zealand. The company runs a large network of radiology clinics offering MRI, CT, PET-CT, ultrasound and X-ray services. Its scale expanded following the 2024 merger with Capitol Health , creating one of the region’s largest imaging platforms and improving geographic diversification.

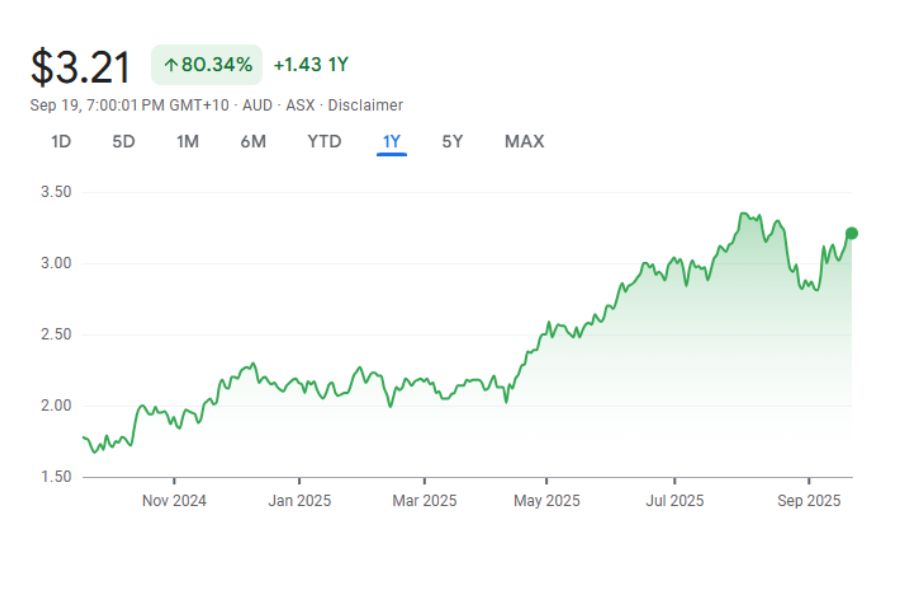

Kinatico (ASX:KYP)

Kinatico (ASX:KYP) operates in the workforce compliance and screening sector across Australia and New Zealand. The company provides background checks, identity verification and workforce credential management solutions to businesses operating in regulated industries.

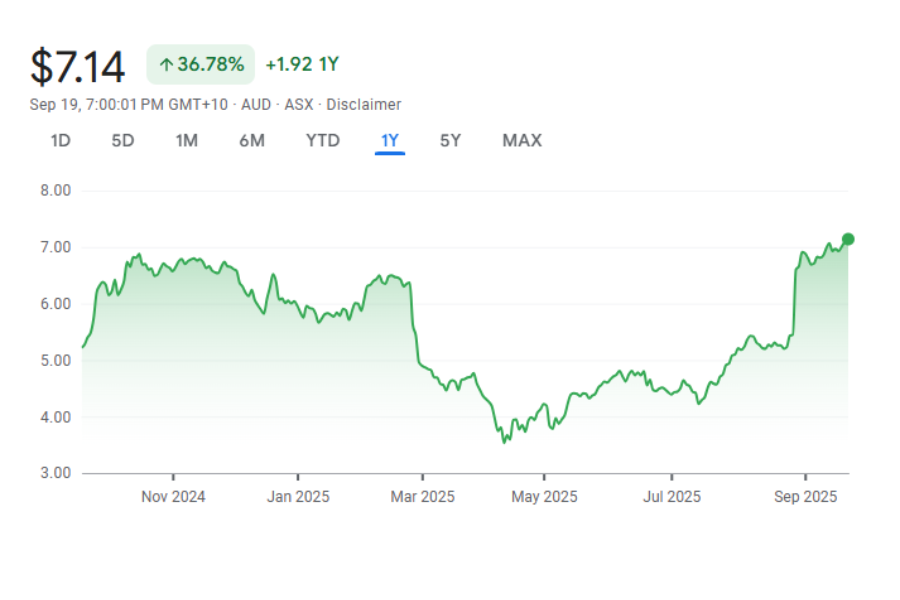

Praemium (ASX:PPS)

Praemium is a financial technology company providing investment platform and portfolio administration services to financial advisers and wealth managers. Its platform supports managed accounts, reporting tools and custody services, generating recurring revenue linked to funds under administration. The business benefits from the ongoing digitisation of Australia’s wealth management sector and increasing demand for outsourced investment administration solution.

The 3 Best ASX Small Cap Stocks to Buy In 2026

What to Look for When Investing in Small Cap Shares

Investing in small-cap stocks requires a detailed approach to ensure you’re selecting stocks that align with your investment strategy. Here are a few key aspects to focus on:

Volatility and Risk Management

Small-cap stocks tend to be more volatile than larger companies, so it’s essential to have a tolerance for price fluctuations. While this volatility presents opportunities for high returns, it also exposes investors to greater risk. Be sure to diversify your portfolio and avoid putting too much of your capital into any one small-cap stock.

Liquidity

Liquidity is another important factor to consider. Small-cap stocks can sometimes have lower trading volumes, which means it might be harder to buy or sell shares without impacting the stock price. Ensure that you are comfortable with the level of liquidity before making a purchase.

Company News and Updates

Stay informed about the company’s performance, leadership changes, earnings reports, and other news that might impact the stock price. Timely information can help you make adjustments to your portfolio based on the latest developments.

Pros and Cons of Investing in Small Cap Shares

Pros:

- High Growth Potential: Small-cap stocks often provide investors with the chance to experience significant returns as the companies grow and gain market share.

- Undervalued Opportunities: Many small-cap stocks are undervalued by the market, offering a chance to buy in before the stock price rises.

- Diversification: Including small-cap stocks in your portfolio can help diversify risk, especially when combined with large-cap stocks or other asset classes.

Cons:

- Volatility: Small-cap stocks are subject to greater price fluctuations, which can result in higher levels of risk.

- Liquidity Concerns: Lower liquidity in small-cap stocks can make it difficult to enter or exit positions without moving the market.

- Lack of Stability: Small-cap companies may not have the financial stability of larger firms, and their growth prospects may be more uncertain.

Are ASX Small Cap Stocks a Good Investment?

ASX small-cap stocks can be an excellent investment opportunity for those willing to accept the risks associated with their volatility. These stocks offer significant growth potential and can provide higher returns compared to larger, more established companies. However, investing in small-cap stocks requires careful analysis and a solid understanding of market trends, financials, and industry dynamics. With the right approach, small-cap stocks can be a valuable addition to an investor's portfolio.

FAQs on Investing in Small Caps Stocks

Small-cap stocks are shares of companies with a market capitalisation of between $300 million and $2 billion. They represent emerging businesses with high growth potential but come with higher volatility compared to large-cap stocks.

Our Analysis on ASX Small Cap Stocks

ASX Cannabis Stocks in 2026: Is the risk worth the reward?

It has been a while since we’ve looked at ASX Cannabis Stocks, and we are sure we are not the…

Shape Australia Corporation (ASX:SHA): On track for >$1bn revenue this year even in a tough construction market

How has a late 2021 IPO focused on commercial fit outs – as Shape Australia Corporation (ASX:SHA) was and is;…

Sports Entertainment Group (ASX: SEG) Doubles EBITDA and Upgrades Guidance – Is This Small Cap a Buy?

Sports Entertainment doubles EBITDA and lifts guidance Sports Entertainment Group (ASX: SEG) was in serious trouble two years ago. In…

ASX Company Spin: Here are 7 occasions when management tries to sell bad news as good news

In all our years, we have seen our fair share of ASX Company Spin. It is repeated because often investors…

Why Investors Are Rotating Into ASX Small Caps- 5 Top Picks for 2026

ASX Small Caps Are Back on the Radar for 2026 An interesting development occurred on the ASX in 2025. While…

Rhythm Biosciences (ASX:RHY): Since picking up Genetype, it has never looked back and is more than a one-trick pony!

Investors may remember Rhythm Biosciences (ASX:RHY) for its ColoSTAT test, but it is Genetype that is arguably more exciting. The…