3 reasons we like Australian Ethical Investment (ASX:AEF) right now

![]() Nick Sundich, April 12, 2024

Nick Sundich, April 12, 2024

Australian Ethical Investment (ASX: AEF) is one of the best ways to leverage the growth in ESG investing on the ASX, because it is right amid the action.

The ESG fund manager has experienced significant growth in its customers and funds under management in the past few years, both due to increasing awareness and desire for ethical investing as well as the solid performance of the company’s funds. But the stock has halved from its all-time high reached in October last year. So, should you buy AEF right now?

Introduction to Australian Ethical Investment

Australian Ethical Investment is an ethical wealth manager, offering superannuation, pension and investment funds – predominantly equities and fixed income. It was founded in 1986 and listed on the ASX in 2002. Much of AEF’s existence has been a slow and steady journey, only surpassing $1bn in Funds Under Management (FUM) in 2014.

But in recent years, ESG investing has become more and more popular as investors have become increasingly aware of ESG issues – such as climate change, carbon emissions and company governance – and such factors can positively or negatively affect investments.

People want to invest ethically

A survey by the Responsible Investment Association Australasia (RIAA), released in March 2024, found 88% of Australian expect their superannuation and other investments to be invested ethically. 76% said they would be willing to switch providers if their current fund didn’t align with their values.

Australian Ethical has successfully leveraged its market position and expertise to capitalise on these trends. Five years ago, it had $2.9bn in FUM and 45,000 superfund members. Today, it has $9.7bn in FUM and over 130,000 customers.

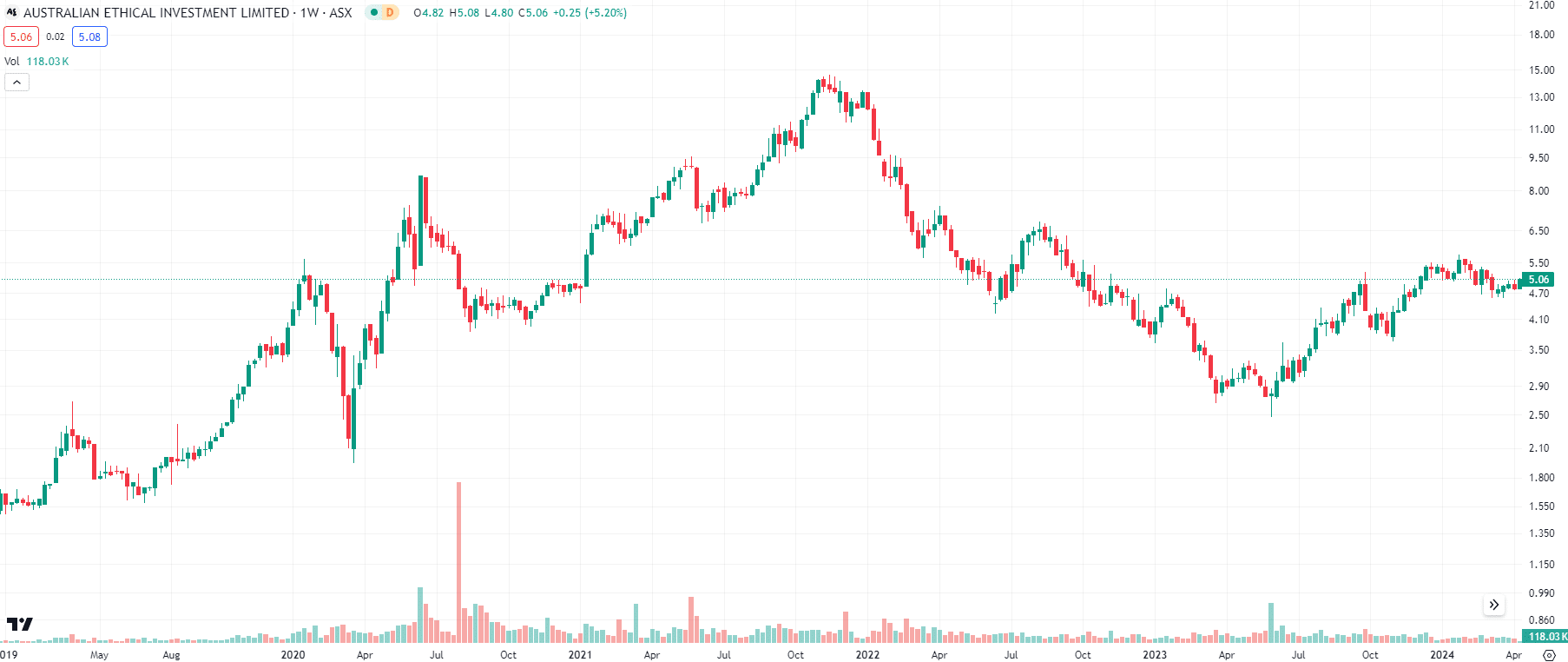

Australian Ethical Investment chart, log scale (Source: Tradingview)

Australian Ethical shares have been volatile

Australian Ethical’s share price has largely followed suit with the company’s growth, growing nearly 600% between May 2019 and November 2021. Shares had a torrid 18 months thereafter as interest rates rose and the market lost appetite for listed fund managers as the performances deteriorated.

Australian Ethical did not fare as badly as its peers, but still saw a drop in performance, even amongst its purportedly ‘defensive funds’. Furthermore, as a stock that had grown so much since the Corona Crash, Australian Ethical was an easy stock to sell.

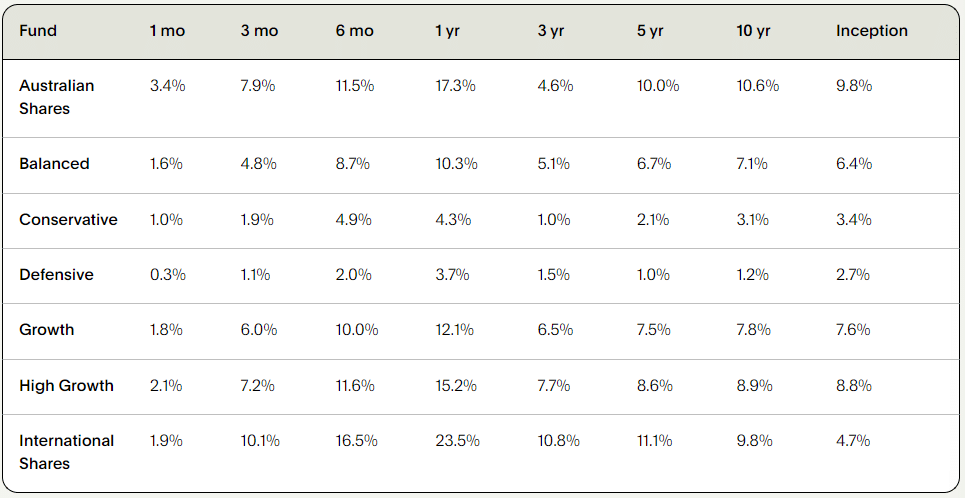

At the same time, those who have stuck in for the long-term have made good returns. Just check out the performance of its funds as at March 31, 2024. Obviously the more favourable market for stocks since October last year has helped, as this company is an avid stock investor.

Source: Company

So, is Australian Ethical a buy at the moment?

Yes. It has a proven track record of growth and we think We think Australian Ethical still has upside left in it as it continues to grow its FUM and investment performance.

We also observe that it trades at a discount to its peers even though many are continuing to stagnate and lack growth catalysts that would justify a higher valuation. AEF is trading at 17x P/FUM. Meanwhile, Magellan is trading at 43x, Platinum is at 23x, GQG is at 32x.

There are risks too

The biggest risk we see is global financial markets entering another correction, which would risk the performance of Australian Ethical’s investments. But we still believe, the company will grow in conjunction with ESG investing because for Australian investors, there are few (if any) other choices in that space.

So, in conclusion, at the current share price we believe AEF presents a good entry opportunity for long term investors, particularly those with an ESG focus. There is practically no other ethical fund manager on the ASX, and very few in the market generally with the proven track record that it has.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Frequently Asked Questions about Australian Ethical Investment

- What is Australian Ethical Investment?

AEF is an ASX-listed fund manager specialising in ESG type investments.

- Is Australian Ethical Investment an Australian company?

Yes, AEF is based in Australia with offices in Sydney and Melbourne.

- Does Australian Ethical Investment pay a dividend?

Yes, the company paid out 7 cents over the last twelve months to June 2023, followed by 3 cents per share for the six months to December 2023.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…