Sovereign Wealth Funds: How do they work and how does Australia’s stack up?

In this article, we look at Sovereign Wealth Funds. They are worth knowing about because they have a bigger role in equity markets than you think – they’re not just ‘saving for a rainy day’.

What are sovereign wealth funds?

A sovereign wealth fund (SWF) is a state-owned investment fund that is managed and invested by the government on behalf of its citizens. SWFs are set up with funds generated from various sources, including taxes, trade surpluses, contracts for natural resources extraction, or proceeds from asset sales. The money in SWFs are then invested into a variety of assets, such as stocks, bonds, and real estate. The main purpose of SWFs is to help governments invest in their economies and secure their financial stability.

How do they Work?

SWFs are typically managed by government agencies or investment professionals who have the responsibility to make decisions about how to invest the funds. Generally, these funds are used to diversify and stabilise the national economy by investing money into assets that can produce a steady return over time. SWFs may also invest in private companies or venture capital projects, in order to encourage economic growth and job creation.

In most cases, SWFs are managed within strict guidelines that dictate how much of the fund can be invested in certain types of assets, and how the returns from these investments should be used. For example, some funds may require that the returns from their investments be reinvested back into the fund or used to pay for public services like healthcare.

Meet Australia’s sovereign wealth fund

Australia’s sovereign wealth fund is the Future Fund. Established in 2006, it is Australia’s long-term savings vehicle for funding major initiatives and liabilities. It is overseen by an independent Board of Guardians who are responsible for investing and managing the Fund to meet its objectives.

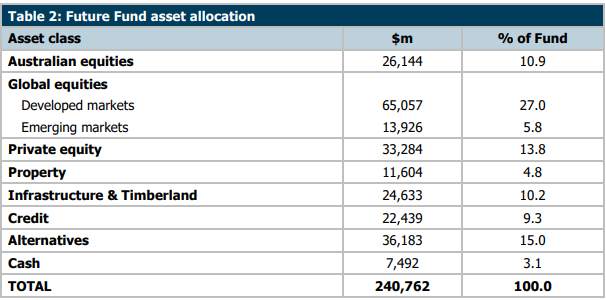

The Fund was initially capitalised with AUD$60 billion drawn from Australia’s Future Taxation revenue and now has >$300bn in funds under management. $240.8bn of these assets are invested into a wide range of asset classes – as outlined below.

Source: Future Fund

The remaining ~$60bn is invested into funds for individual needs – for instance, a Medical Research Future Fund and a DisabilityCare Australia Fund – in fact, more than two thirds is invested in these 2 funds.

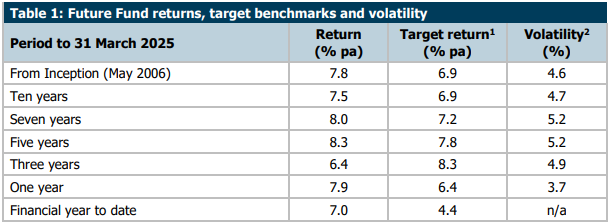

So far in FY25, our Future Fund has delivered a 7% return but nonetheless exceeded its target has returned higher in the longer term.

Source: Company

Of course, it has been impacted by Trump’s tariffs. Future Fund bosses described conditions as difficult given ‘consequential changes in geopolitical, economic and market environments at the moment’. But it achieved a return nonetheless, and its 7.9% return in the 12 months to the end of March 2025 added $17.8bn to the fund’s balance.

Norge’s Bank

One other sovereign wealth fund that ASX investors should know about is Norges Bank (the fund of Norway), because it invests in Australian companies from time to time. Many investors don’t follow substantial holder movements that closely but 2019 was an exemption. The Norwegian Parliament passed a tightened set of ethical investment rules and it had to divest its holdings in major ASX resources and energy stocks including BHP and Oil Search.

It still holds stocks in the ASX from time to time.

The bottom line

Overall, SWFs are an important tool for governments to manage and invest their financial resources and help ensure a stable economic future for their citizens. And Australia’s own Future Fund is no different, even if investors are often unaware of its existance or actions.

What are the best stocks to buy right now?

Check out our top 4 stock picks

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…

ReadyTech (ASX:RDY) Down 57%, Where’s the Operating Leverage?

ReadyTech Soft Half Keeps Pressure on the Stock ReadyTech has had a rough 12 months. The stock has fallen from…

Adisyn (ASX:AI1) Graphene Makes Drones Harder to Detect

Big Step in Drone Stealth With Graphene Adisyn (ASX:AI1) has successfully completed an early proof of concept demonstrating that graphene…