Tartana Minerals and its (potential) path to far north Queensland riches

Tartana Minerals (ASX:TAT) might be the best candidate to resurrect Chillagoe in far north Queensland as a serious mining centre. Chillagoe is (these days) a tiny town about 150 km west of Cairns, with a population of roughly 150. But once upon a time, from the late 1880s to the late 1920s, Chillagoe and the surrounding Shire of Mareeba was a hotbed of mining and smelting activity, producing significant amounts of copper, gold, lead, zinc and silver.

Tourists can still see the ruins of the old Chillagoe Smelters that powered this activity in the nearby Chillagoe-Mungana Caves National Park, but mining people dream of resurrecting Chillagoe as a serious mining centre, and the Sydney-based Tartana reckons it stands a good chance.

What are the Best ASX Resources Stocks to invest in right now?

Check our buy/sell tips

A different kind of copper

Tartana Minerals backdoor-listed on the ASX in mid-2021 with a somewhat unusual flagship asset. The old Tartana Copper Mine, which sits around 40 km north of Chillagoe, had first been worked early in the 20th Century, but between 2004 and 2015 it had produced, not copper metal or copper concentrate, but rather copper sulphate.

While farmers use copper sulphate to make sure their crops and livestock get enough copper as a nutrient and also as a fungicide, the main demand for copper sulphate is as a zinc activator in base metal processing plants such as Mt Isa, New Century, Dugald River, Macarthur River and Cannington. If the copper sulphate is not purchased from Tartana Minerals, it has to be imported through the ports of Townsville or Darwin.

Tartana Minerals acquired the heap leach/solvent extraction/crystallisation plan in 2018 and has since refurbished the plant and produced over 1,000 tonnes of copper sulphate pentahydrate. The product is sold to a firm called Kanins International which then sells it as a reagent to the north Queensland mining industry.

Welcome to elephant country

The Tartana operation was a pretty low-cost way to build early cash flow. Less than A$2m achieved the refurbishment, and Tartana Minerals had the plant commissioned by late 2023 with the first saleable shipment in May 2024, after the 2023-24 wet season was over.

The company didn’t have to have much in the way of copper ore to get started. It simply used copper in solution in the ponds and residual copper in the heap leach pads. The intention was to then re-open the open pit where there was still around 45,000 tonnes of copper at a grade of 0.5%.

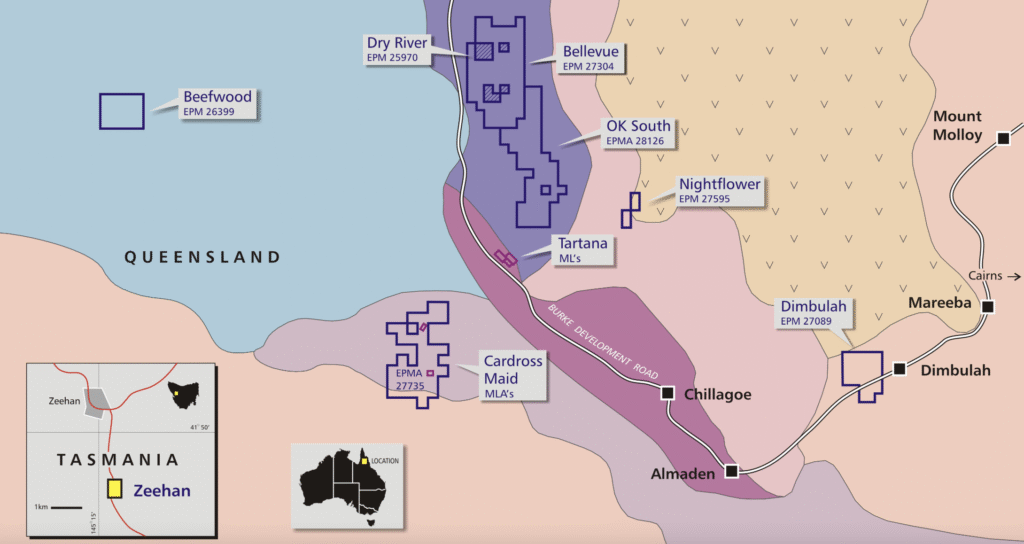

The copper sulphate operation continues to deliver for Tartana Minerals. In the June 2025 quarter, 135 tonnes were produced, worth just under A$600,000. That may seem small, however for Tartana Minerals it’s just the beginning. You see, in 2021 the company had five other conventional mineral exploration projects in the Chillagoe area and aimed to become the dominant player.

Source: Company

Chillagoe is ‘elephant country’ for both precious and base metals because of the Palaeozoic-aged rocks of the Chillagoe Formation. Within this formation are numerous ‘skarns’, that is, limestones altered by contact with intruding granites from the nearby Palmerville Fault, and those skarns have proved excellent hosts of mineral deposits. One of them contained the Red Dome gold-copper deposit, which was discovered in 1978 and mined for a decade until 1997 when ore reserves were exhausted.

Later on, beginning in the early 2000s, a Perth-based company called Kagara developed the larger Red Dome/Mungana/King Vol complex, which put the Chillagoe region back on the mining map. Since 2018 Tartana Minerals has built out its Chillagoe-area project portfolio on the reasonable assumption that there are large discoveries waiting to be made.

Benefiting from others’ mistakes

The trouble with previous efforts to restore Chillagoe to its former glory is scale and metal prices. Kagara’s effort ended in 2012 when that company was placed in administration, with the assets ending up in an ASX-listed company called Atherton Resources. Auctus Resources with the backing of Denham Capital, conducted a hostile takeover of Atherton Resources in 2015 and then proceeded to complete the development of the Mungana Processing Plant and the King Vol and Mungana underground mines.

However, with extraction limitations in the underground mining providing lower than ideal throughput and low commodity prices, Auctus also went into administration. A sales process ensued with the assets being purchased by Aurora Metals, which in 2020 – you guessed it – also went into administration. Again, low production levels combined with low commodity prices were to blame. The latter company’s misfortune, however, could prove to be a company-maker for Tartana thanks to an April 2025 Heads of Agreement related to the Mungana Processing Plant.

The Mungana plant, which has a rated capacity of 600,000 tonnes p.a., had been processing ore from the now-idle King Vol and Mungana Mines. The mortgagee-in-possession of the plant, called Mt Garnet Mineral Finance Pty Ltd (MGMF), is seeking to establish a Venture agreement with Tartana for the mining of open pit ore from Tartana and processing this ore through the Mungana plant to produce a conventional copper in concentrate for sale to third parties.

Start small and then get bigger

The Tartana-MGMF Venture will start small, initially targeting a 5,000 to 10,000 tonnes range of copper in concentrate for sale to third party smelters. However, the April 2025 agreement is significant for two reasons. Firstly, it potentially helps to take the Tartana open pit to the next level at low levels of capital costs, with Mungana plant restart capex estimated at less than $10m, much of which can be staged. Secondly, the joint venture with the Mungana plant owners could expand to take in various Tartana projects, and, significantly, other projects such as – get this – a restart of the now-shuttered Mungana and Red Dome mines.

For the Tartana operation itself the company has designed a drilling program which could increase the contained copper resource underneath the open pit. But it’s the other projects in the Chillagoe area that could really deliver some serious shareholder value for Tartana Minerals. For instance, a copper-gold project called Cardross Maid, which covers historic workings, has already been subject to a resource estimate over a deposit called Mountain Maid way back in December 2010.

At that time, under JORC 2004, a cut-off grade of 0.3 g/t gold yielded a deposit of just under 200,000 ounces. However, at the time gold was only around US$1,400 an ounce, and in 2025 Tartana’s geologists see the scope for the resource to be much bigger once mineralisation continuity is followed through.

Another project called Beefwood was previously looked at by Newcrest and Tartana wants to put 800 metres of drilling at one of its targets in September 2025, funded by the Queensland’s government’s Collaborative Exploration Initiative. A silver-lead project called Nightflower has been found to have significant antimony credits, which is important given what has happened to that commodity since China restricted exports in September 2024. And so on. Tartana has been continuously adding to its Chillagoe area holdings over the last four years.

Source: Company

This time it seems to be different

The naysayers, having watched Kagara’s demise in 2012, will likely be sceptical of Tartana Minerals in 2025. The difference is the price environment and the ability to keep the Mungana mill full given the flexibility in mining a large scale open pit in comparison to the previous narrow underground King Vol mine. Copper above US$4.00 a pound and gold above US$3,300 an ounce provides strong economics once one company controls the riches of the Chillagoe area. Tartana with its methodical approach to building out the potential of the area could be worth paying attention to.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…