Terrain Minerals (ASX:TMX) and the potential for a really critical mineral

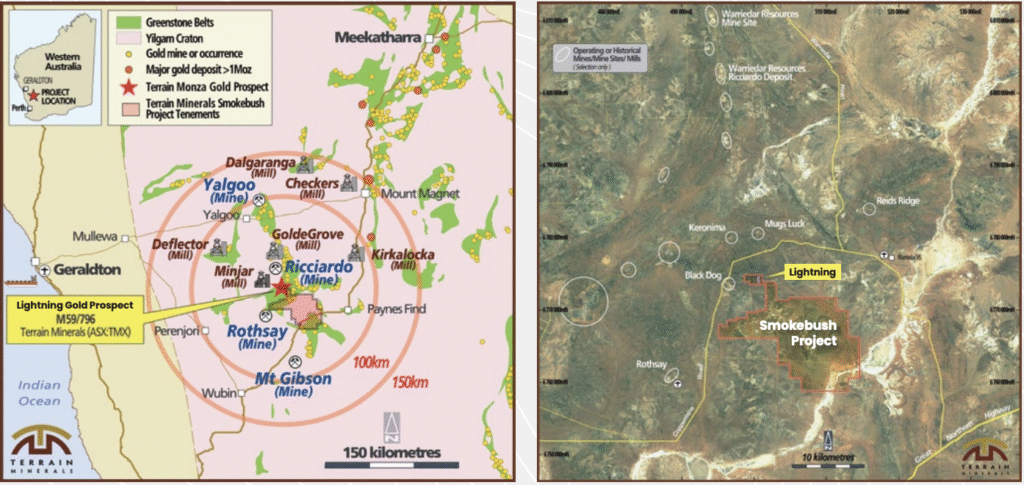

Just before Christmas 2019 the Perth-based mineral explorer Terrain Minerals (ASX: TMX) farmed into a gold project called Smokebush in the Murchison Region of Western Australia. The project was around 65 km to the west of Paynes Find, the old gold mining town on the Great Northern Highway about 420 km north of Perth.

Source: Company

The location was interesting because Smokebush sits in the Yalgoo Singleton Greenstone Belt, with its various granitoid intrusions that are yet to be fully understood by geologists. This is the belt which gave us the world-class Golden Grove VMS camp as well as the Rothsay gold deposit. Moreover, Smokebush sat right next door to a tungsten deposit called Mt Mulgine which was being worked on by Tungsten Mining (ASX: TGN). So, this ground was potentially good for a few commodities.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Element No 31

Your author first took notice of Terrain in 2024 when meeting the company’s longtime Executive Director, Justin Virgin. ‘You know we’re found gallium at Smokebush?‘, Justin asked. You mean Element No. 31, we replied, as in, gallium nitride, the stuff that makes conventional silicon semiconductors look slow? The same, said Justin.

Terrain Minerals now has a JORC exploration target on 5% of the 27 sq km Larin’s Lane prospect at Smokebush related to gallium, having previously identified some clays where drilling had yielded intersections up to 64 metres wide and grades up to about 54 ppm Ga2O3, that is, gallium oxide. Our 2024 conversation with Justin took place not long after China had banned the exports of gallium, and the rest of the world was trying to figure out how to guarantee future supply. (We spoke with him again in March 2025 for Stocks Down Under – you can watch the interview here!)

Between late 2019 and that 2024 conversation Terrain had added to the Smokebush project area and increased its interest to 100%. It had shown that Smokebush was potentially good for gold thanks mainly to two prospects, one called Monza, and another called Lightning which was the fruits of an Induced Polarisation (IP) survey done in 2023. The whole thing is now called Lightning.

Lightning strikes

The Lightning prospect has yielded some decent intersections close to surface in multiple drill campaigns, but it’s only been in the last twelve months that Terrain’s geologists have figured out what they think are the appropriate the structural controls. They now think there are multiple shears at work and potentially, the high grades they’ve been seeing are associated with several large dolerite entrapment zones.

This theory will be drill tested shortly but looks very likely given that most of the big Western Australian gold projects have all associated with dolerites. The most recent drilling at Lightning, reported in September, has validated a lot of this work and led to some great intersections such as 11 metres at 6.03 g/t gold plus – and this is an interesting development – 43.5 g/t silver from 75 metres. Silver results are still pending from the September results. However, even without silver, this campaign had a lot to offer, such as 3 metres at 6.12 g/t gold from 26 metres and 22 metres at 2.71 g/t gold from 105 metres.

We think there’s potential for a decent sized gold discovery at Lightning when you consider that Warriedar Resources (ASX: WA8) with its Golden Range project just a bit further north now has a 1.3 million ounce resource generated by similar kinds of shears. And Lightning, with its new geological model, is not the only gold target at Smokebush. Also interesting has been Wildflower, which Terrain has drilled with success, and which has recently been the subject of an IP survey for which results now pending. Wildflower has been known about since 2020 and seems to be associated with the same shears that host Rothsay.

And rare earths as well

The gallium potential of Smokebush first became apparent around August 2023 when Terrain was drilling some pegmatites it had identified in the project area and came back with intersections like 10 metres at 37.6 g/t gallium oxide within a larger 86 metres from surface grading 17.4 g/t Ga2o3.

Another good one was 9 metres at 30.9 g/t within 16m at 24.1 g/t from 11 metres. Later on, around March 2024, came gallium intersections and also rare earth intersections at Larin’s Lane. How’d you like 13 metres at 1,069 ppm TREO from 80 metres and 4 metres at 2,516 ppm TREO from 72 metres?

As 2024 progressed the data from Larin’s Lane continued to impress, so by November the company had outlined the exploration target we noted above. It’s 25-33 million tonnes at 880-980 ppm TREO and 19-21 g/t gallium oxide, which will be impressive if Terrain can follow through.

In December 2024 Terrain announced that the Minerals Research Institute of Western Australia, a research effort focused on critical minerals and funded in part by the Western Australian government, had agreed to conduct metallurgical test work on the samples from Larin’s Lane. The work is now ongoing at a lab at Curtin University and is due back in December 2025. It’s reasonable to expect that, should the Curtin folks come up with a processing pathway that makes economic sense, a lot more eyeballs will be on Terrain.

Will Smokebush catch fire?

Terrain has yet to establish a maiden resource for Smokebush, because not enough drill holes have been put down to warrant it as yet. We see potential for that to change in 2026, with capital becoming easier for gold plays, with Lightning starting to strike, and with Warriedar doing very well at Golden Range.

Smokebush isn’t the only iron in the fire for Terrain. It’s got a copper/gold project near Biloela in central Queensland. It has some lithium-prospective ground southeast of Port Hedland at a place called Carlindie, where soil sampling is now being conducted along strike from the Tabba Tabba project of Wildcat Resources (ASX: WC8). And it has some rare earths ground at Lort River in the Albany-Fraser Belt of Western Australia.

Smokebush, however, is where the near-term focus will be. And where’s there’s Lightning, there’s potential for fire. Investors ought to put this on their watch list.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Anthropic Draws a Line With the Pentagon

The AI-First Military Agenda with Anthropic The Pentagon is moving aggressively to bring cutting-edge commercial AI into defence work. A…

88 Energy (ASX:88E) Doubles on Alaska Upside, Here’s What’s Driving It

The Market Just Repriced Alaska Exploration Optionality 88 Energy surged 100% today on the back of a corporate presentation that…

Oil Jumps to US$111 as Hormuz Stays Shut, ASX Slides Hard

The Oil Chokepoint Shock Brent crude jumped 20% to US$111 per barrel, while the ASX 200 fell 3%, with companies…