Xero (ASX:XRO) delivered another stellar result in FY25, but is there further upside? Here are 3 reasons why we think it does

Xero (ASX:XRO) is one of the ASX’s best-performing tech stocks over the last decade, offering accounting software helping SMEs do business. After halving between November 2021 and November 2022 amidst the Tech Wreck, it has gained 150% since then and is still sitting in positive territory in CY25.

Xero (ASX:XRO) share price chart, log scale (Source: Google)

Just look at its results and you’ll see why. In FY25 – the 12 months to March 31, 2025 – the company recorded:

- NZ$2.1bn in revenue (up 23%),

- 4.41m subscribers (up 6% and 254,000 from 12 months prior),

- $45.08 in average revenue per user (up 15%)

- An 89% gross margin

- A $227.8m profit (up 30% from the year before and marking the second straight year of profitability).

And we think it has significant potential to grow further, and there are good reasons why.

1. Xero is useful and loved by its customers

Xero is all about helping small & medium sized businesses do business. The company, which has over 3 million subscribers, primarily sells accounting software that helps businesses keep books, pay bills and send invoices. But it has gradually developed features useful beyond book-keeping, such as storing files, converting currencies, keeping track of inventories and creating professional quotes.

Clearly, Xero is an essential service to its customers….it’s very hard to switch it off just to save a few bucks. And what incentive is there to switch to another solution like an MYOB? Very little. Whatever few bucks would be saved, would be lost in the long-run. Xero’s tools are estimated to save its customers on average 5.5 hours of manual work per week. We guess that is why its churn is less than 1% and the total lifetime value of subscribers is over NZ$15bn, even amidst inflation.

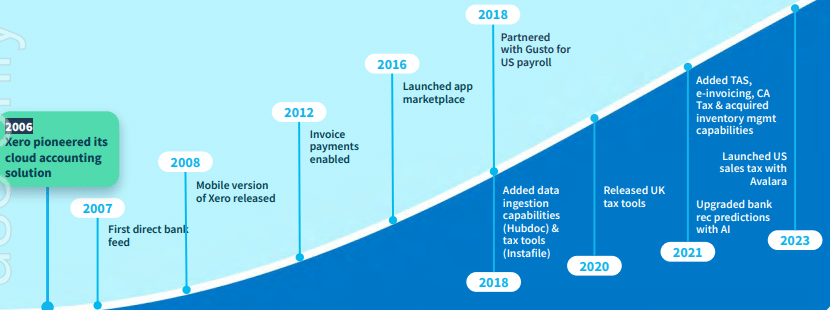

2. Xero keeps innovating and expanding

We touched on this above, but the innovation of the company ensures it remains ahead of its competitors. This is a testament to the company’s leadership.

Source: Company

The company went through a pivotal period with Rod Drury retiring after over 15 years leading the company and the CEO’s seat being taken by Sukhinder Singh Cassidy, who started in February 2023. Clearly investors have had little issue with her so far. One telling sign that the company is moving forward is that Ms Cassidy is based in San Francisco rather than Wellington or Sydney, a sign that it is becoming a truly global player.

Consider that in recent years, its non-ANZ revenues have grown stronger than its ANZ revenues (24% vs 21% in FY25) and the average revenue per user has been higher ($49.82 vs $41.66). Of Xero’s $2.1bn revenue, $926m came from overseas and $578m of the $926m came from the UK.

3. Still more potential for growth

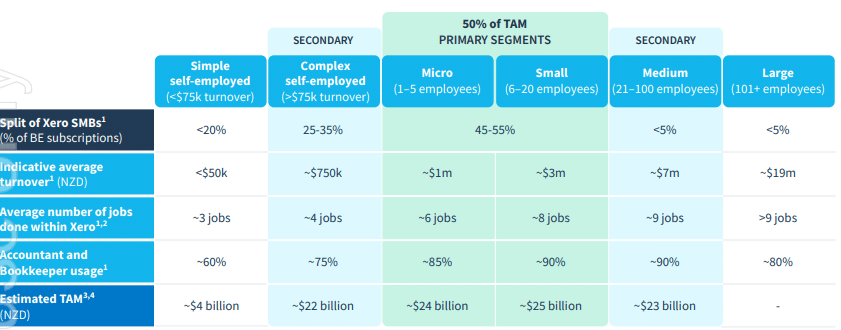

Xero has some bold medium term goals. At the first Investor Day following its FY23 results, it told investors it believed it had the opportunity to double the size of ‘our business’, alluding to the company’s revenue in that year was $1.4bn in FY23. It told investors it is still underpenetrated in many markets, even its core segments.

Two years on, it is halfway there at $2.1bn.

Source: Company

The company believes the TAM (Total Addressable Market) is NZ$100bn and that is just the top 3 jobs its software is used for – Accounting, Payroll and Payments. Adjacent Tasks, including other tasks such as inventory, CRM and project management, could be another $39bn.

OK, so how much will it grow?

So far as specific guidance for FY26 is concerned, it has only given these points:

- Keeping total operating expenses as a percentage of revenue to around 71.5% although it has warned that the ratio may be higher in the first half.

- Abiding by Rule of 40. This states that if a SaaS company’s revenue growth rate is added to its profit margin, the combined value should exceed 40%. This was achieved in FY24 and FY25 – with the value being 44.3% in the latter year.

- The goal of doubling revenues from FY23 the end of FY27.

Let’s turn to consensus estimates, drawn from 16 analysts. In FY26, analysts expect the company to record NZ$2.5bn in revenue and a $241.2m profit. In FY27, $2.9bn in revenue and a $347.2m profit. In FY28, $3.0bn in revenue and a $566.8m profit.

Still lots of upside

The mean share price is A$183.40 per share, a 5% premium to the $173.86 share price it closed at on May 14, 2025. Granted, the estimates range from $92.73 on one extreme and $221.91 on the other. The company is trading at 83.2x P/E and 35.7x EV/EBITDA for FY26…quite high.

Looking at Xero’s raw valuation, it is A$27bn on an equity value basis. This makes it very big for an ASX stock, particularly a tech one, although it is not irrelevant to note that Intuit in America is worth >US$180bn.

Potential risks for Xero investors

We think the biggest potential risks are worsening economic conditions and market volatility. But at the end of the day, businesses need accounting services and even if you could save money by going with MYOB – you lose a lot of features and so there’s no incentive to switch.

Ultimately, in our view, Xero is one of the best companies on the ASX and has good growth potential in the years ahead.

What are the Best ASX Technology Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…