Here is why the Carsales (ASX: CAR) share price is down over 10% this week

It’s been a difficult week for Carsales (ASX: CAR) shareholders. Their shares are down over 10% since it unveiled a deal to fully acquire American commercial trucks and RV listing business Trader Interactive.

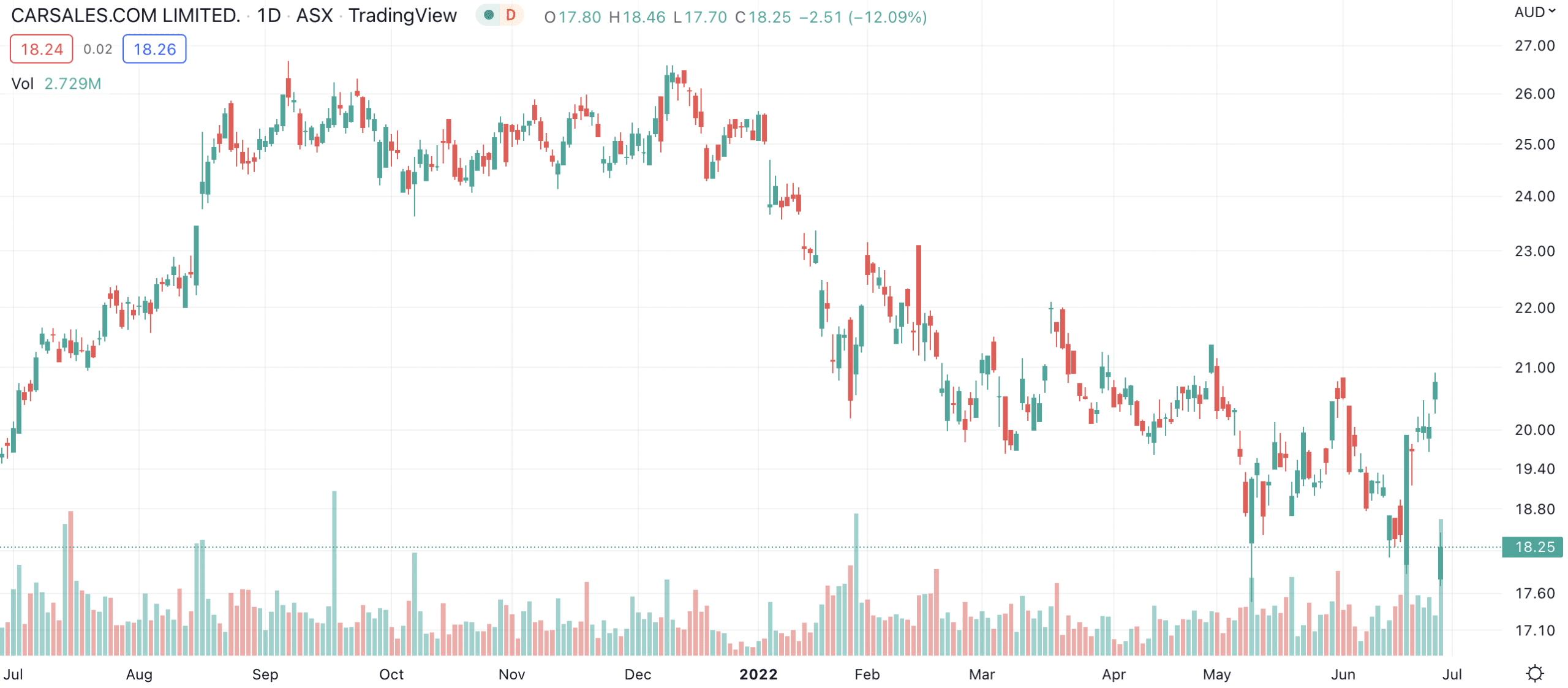

Carsales (ASX:CAR) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Why is Carsales buying Trader Interactive?

Carsales bought an initial 49% stake in Trader Interactive just over 12 months ago and is now acquiring the remainder of the company’s shares that it does not already own. To fund the deal, it has completed a US$842m entitlement offer at $17.75 per share, over 14% below the share price just before the announcement.

CEO Cameron McIntyre told shareholders the enthusiasm he and his company have for Trader Interactive has only grown stronger in the last 12 months and that owning the company outright will help it unlock further value.

Shareholders were told it has a market leading position in America, where the relevant verticals are 16x as large as Australia, and there are favourable structural trends in the industry.

Why don’t Carsales shareholders like the deal?

Most prominently, the deal is being done at a near 12-month low for the Carsales and a 14.5% discount to Friday’s closing price. Investors never like capital being raised at a big discount.

But arguably, investors are also concerned about the potential of a recession in the US slowing down the growth of Trader Interactive. The company has tried to calm shareholder concerns by pointing out its acquisition of Brazilian auto marketplace business webmotors in 2013 was completed just before a four-year recession, noting sales grew 20% for each of those four years. However, it does only account for 2% of annual sales and still loses money.

We also think investors are not too keen on the 21.3x EV/EBITDA multiple that the deal was priced at. This is even higher than Carsales’ EV/EBITDA multiple for FY23 of 18.3x.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…