Block (ASX: SQ2) results disappoint, but FY23 is looking better

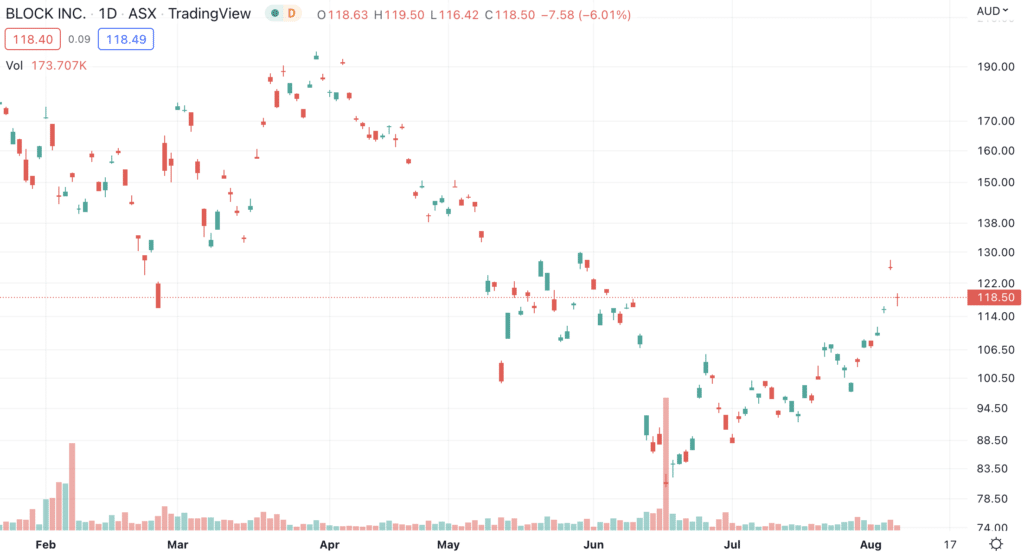

Block (ASX: SQ2) shares in Australia and on Wall Street fell on Friday after the company’s 2Q22 results. Shares had rebounded from 12-month lows reached in June in conjunction with the Tech selloff, but had begun to rebound in recent weeks as investor sentiment started to improve.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Who is Block?

Block is an American fintech company that was founded by Twitter founder Jack Dorsey and operates the ‘Cash App’ that allows users to make payments. It listed in Australia after acquiring AfterPay last year in the largest M&A deal in Australia’s corporate history.

Block runs a handful of other businesses, including in the crypto space, but Cash App is the best known with 70m annual active transacting users. And Cash App is where AfterPay fits in too.

Block shares sold off en-masse

The NYSE shares of Block hit an all-time high of US$281.81 on 5 August 2021, but shed roughly two thirds over the following 10 months during the Tech sell-off.

Investors are concerned about rapidly rising interest rates and inflation, and the threat they pose to Tech stocks. Specifically, rising inflation and interest rates will make it more difficult to raise capital and increase the likelihood that growth will slow or might even turn negative.

Shares had recovered in recent days, but were sent crashing back to earth after its Q2 results.

Block (ASX/NYSE:SQ2) share price chart (Graph: TradingView)

Q2 results disappoint

Block’s results were a mixed bag. But, judging by the share price reaction, investors saw more bad than good.

The bad news was that growth was expected to moderate, that it did not commit to a percentage growth figure for the Cash App and that its operating expenses are expected to increase by US$75m in Q2.

It also fell just short of consensus estimates for gross payment volume and suffered a 6% decline in revenue purely because of a decrease in bitcoin revenue.

And critically, it made a net loss of US$208m, something which would concern investors. Block has over US$4bn in cash so it won’t need to seek more finance any time soon, but this would nonetheless concern investors.

In better news, it achieved a gross profit of US$1.47bn for the quarter, up 29% year-on-year. If it hadn’t been for the drop in bitcoin revenue, its revenue would have been 34% higher compared to 12 months ago.

EBITDA growth makes SQ2’s valuation look better

FY22 consensus estimates call for $17.6bn in revenue and $692.6m in EBITDA, down 1% and 33% respectively from FY21. Looking to FY23, consensus estimates expect a bounce back – $21.1bn in revenue and $1.2bn in EBITDA, up 21% and 71% from FY22 and also ahead of FY21.

Block’s EV/EBITDA is 76.4x for FY22 and 44.5x for FY23. Despite the company’s large sell-off relative to the rest of the markets, Block is still priced well ahead of the market averages. In on our view, the company’s EBITDA growth rate for FY23 warrants that, assuming it can achieve these results.

It seems analysts are expecting inflation to moderate in the back end of FY23 and potentially for interest rates to start coming down next year. But everything that has happened to the global economy in the past few years, that no one saw coming, shows nothing is guaranteed in the short term.

Nevertheless we expect digital payments to become an increasingly bigger deal in the longer term. Therefore, we’ll be watching what Jack & Co do very carefully, even if we’re not jumping on the caboose right now. In the current environment, we would prefer to be in other sectors, such as consumer staples, that are less vulnerable to the current volatility.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

Get a 14-day FREE TRIAL to CONCIERGE now

No credit card needed and the trial expires automatically.

Block Frequently Asked Questions

- What is Block ASX?

Block is an American fintech company that was founded by Twitter founder Jack Dorsey and operates the ‘Cash App’ that allows users to make payments.

- Does Block own Afterpay?

Yes, Block bought Afterpay in 2021.

- What does Block own?

Block owns the ‘Cash App’ that allows users to make payments. After buying Afterpay, BNPL will be integrated into Cash App.

Block runs a handful of other businesses, including in the crypto space, but Cash App is the best known with 70m annual active transacting users.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…