Washington H. Soul Pattinson (ASX:SOL) beat the market by a whopping 20%

It has been a difficult twelve months for ASX-listed fund managers and their shareholders, including for Washington H. Soul Pattinson (ASX:SOL). But today, the ASX’s second oldest company, released its results for FY22 (the twelve months to 31 July 2022) and it told investors that it had beaten the market by 20%!

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Washington H. Soul Pattinson is getting better with age

Washington H. Soul Pattinson grew its Pre-tax Net Asset Value (NAV) by 13.8%, which was 20.2% ahead of the All Ordinaries Index (which fell by 6.4% in that time frame).

On a post-tax basis, NAV grew by 28.5%, which implied a 34.9% outperformance of the market. It also delivered a $834.6m operational post-tax profit (up 154%) and $347.9m in net cashflows from investments (up 93%).

It paid a special dividend of 15cps in addition to an ordinary dividend of 72cps, up 16.1% and representing a yield of 3.3%.

Washington H. Soul Pattinson also boasted of its long term records with a 20-year Total Shareholder Return (TSR) of 12.2% per annum, 3.4% higher than the market.

Can it continue to beat the market in FY23?

Shares in Washington H. Soul Pattinson gained a modest 1.5% at market open this morning, showing investors were cautiously optimistic about the future.

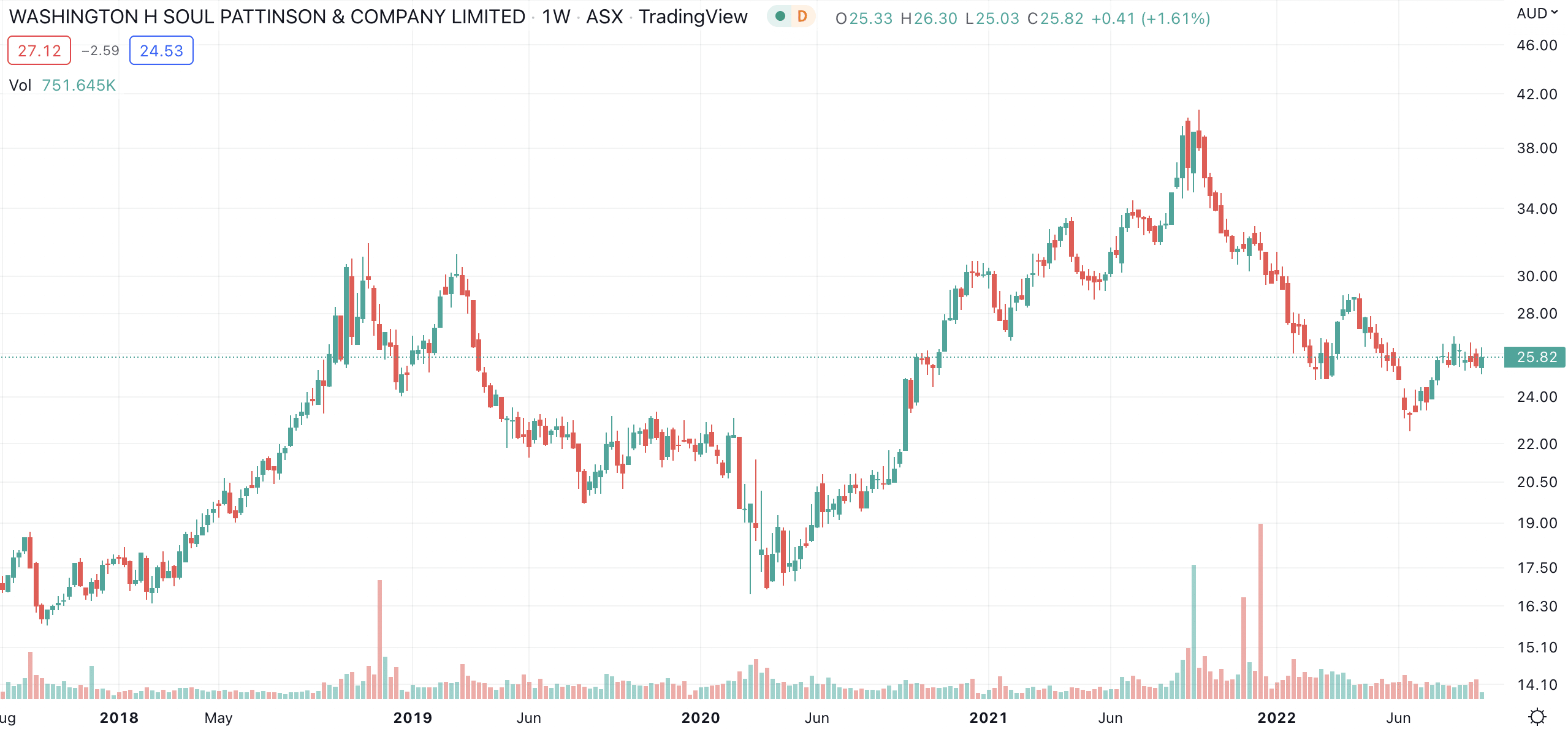

Washington H. Soul Pattinson (ASX:SOL) share price chart (Graph: TradingView)

The company’s managing director Todd Barlow was less cautious, noting that the lower valuations in asset classes represented opportunities for the future and that it had ample cash and liquidity to take advantage of them.

With a long-term track record and without the troubles facing other listed money managers, such as Magellan (ASX: MFG), it is easier to have confidence in this one relative to its peers. But a lot will depend on the decisions Washington H. Soul Pattinson money managers and analysts make in the next 12 months.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…