Origin Energy benefits from high gas prices in the next 2 years

Origin Energy (ASX:ORG) is hosted its AGM and told the market that high gas prices would boost its earnings for the next two years.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Origin Energy set for a solid couple of years

Origin Energy told shareholders that it was expecting underlying EBITDA from its Energy Markets Division of $500-$650m in FY23. This would be 36-78% higher than FY22’s $360m total. Without providing specific guidance, it anticipates further growth in FY24.

This guidance was provided on the basis that market conditions and the regulatory environment would not materially changes and would result from higher energy costs successfully passed on to consumers.

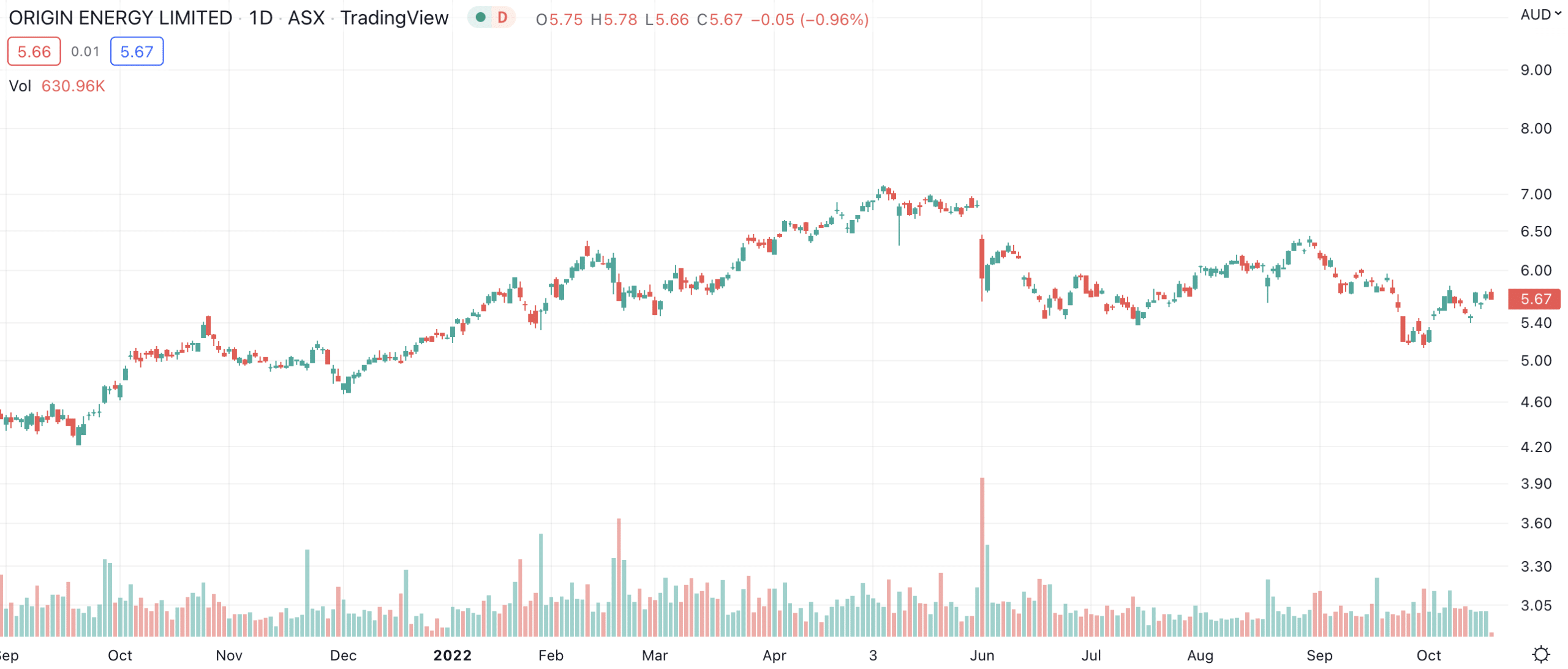

Origin Energy (ASX:ORG) share price chart (Graph: TradingView)

Is it all good news for shareholders?

36-78% EBITDA growth is undoubtedly good news. But remember that this growth is just for the Energy Markets Division, not the entire company. Still, consensus estimates suggest 21% growth for FY23 with the stock trading at an EV/EBITDA multiple of just 4.8x.

However, even if the short-term turns out this positive for Origin Energy, there’s no guarantee that this will last in the long-term as the Green Transition occurs. The company will be closing its only coal-fired power station, will exit the Beetaloo gas basin in the NT and has already cut its holding in the Australia Pacific LNG export venture to just 27.5%.

So, even if Origin Energy is a stock for the short-term, it may not be for the long term.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…