These 4 lithium shares began 2023 with a big bang!

2023 has begun with a bang for several lithium shares. Essential Metals (ASX:ESS) kicked off the action amongst lithium shares, unveiling a $136m takeover bid on Monday. And there has been more news from the sector over the past couple of days, especially among explorers that have given shareholders some indication that all their hard exploration work is paying off.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s nothing like a project with a US$1.5bn NPV

Among all lithium shares, the biggest news came from European Lithium (ASX:EUR) this morning. This company is expecting to unveil a DFS for its Wolfsberg project in Austria, during the first quarter of 2023. In advance of the release, the company unveiled the Net Present Value (NPV), which was US$1.5bn, based on the Measured and Indicated resource of 9.7mt at 1% lithium from the 2018 Pre-feasibility Study (PFS). The stock was up more than 4% on the back of this news.

Lake Resources is expanding its resource base

Another company that’s trying to pin down just how much of a resource it has is Lake Resources (ASX:LKE). This company, which has the Kachi lithium brine project in Argentina, doubled its Measured and Indicated resource to 2.2Mt of lithium carbonate. In addition to this is a further 3.1Mt in Indicated resources.

I love the smell of good drilling results in the morning

Also this morning, Aruma Resources (ASX:AAJ) unveiled drilling results at its Mt Deans project in Western Australia. Results included grades of up to 1.94% lithium with an average of 0.84%.

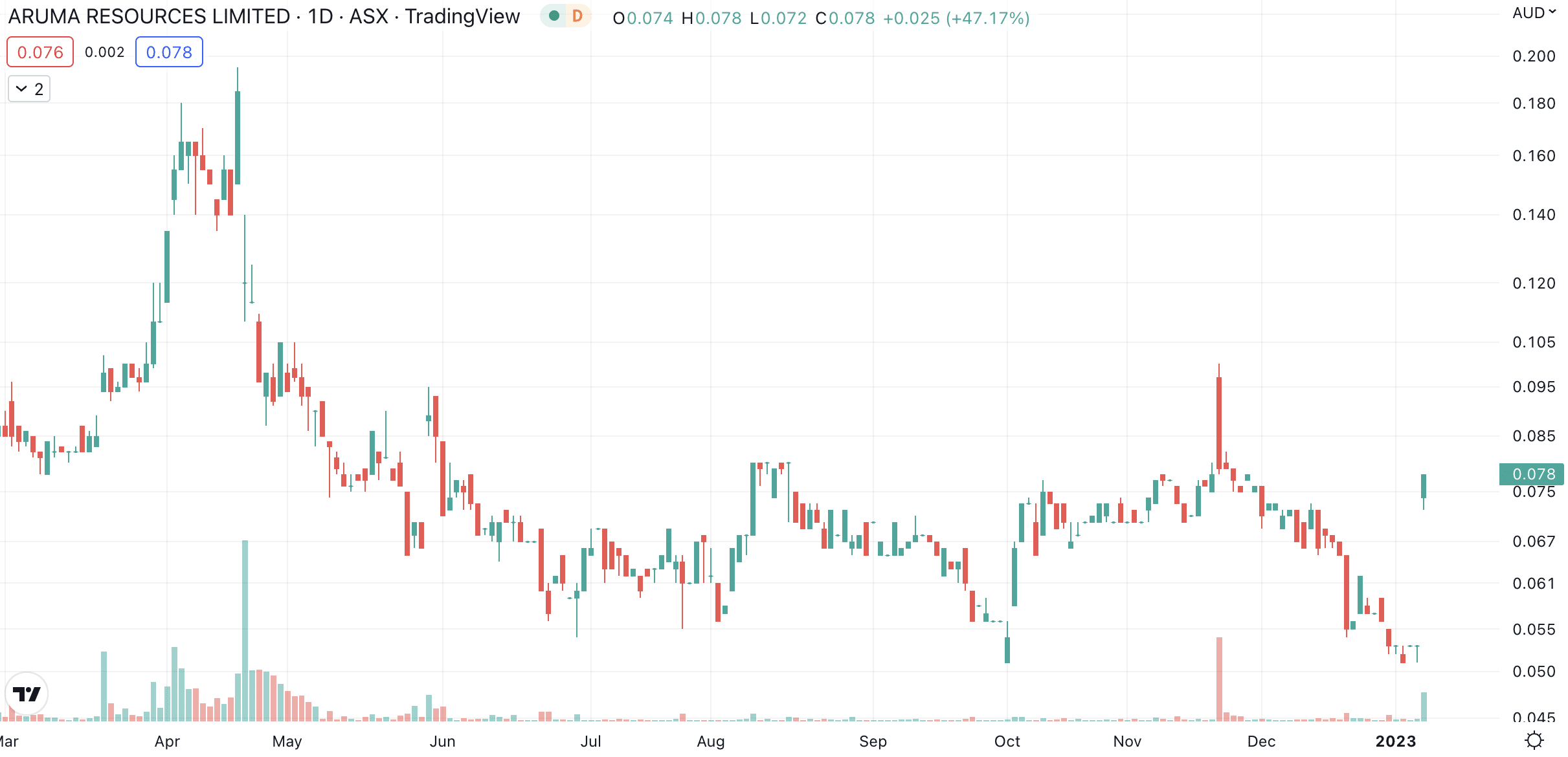

Excited shareholders sent Aruma’s share price up by over 45% this morning. This illustrates that there’s nothing like exploration results to get investors in lithium shares excited!

Aruma Resources (ASX:AAJ) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

How Nuclear Energy Became the World’s Most Feared Energy Source

Why Nuclear Energy Still Scares Us and What Really Went Wrong Many investors may remember periods when nuclear energy captured…

Dateline Resources (ASX:DTR) From 60c Highs to Hard Lessons

A Rare Earth Story the Market Loved Then Questioned For investors who have followed Dateline Resources (ASX:DTR), the past year…

Light and Wonder Surges 16% as A$190M Settlement Clears Major Legal Overhang

The Legal Overhang Is Gone Light and Wonder (ASX:LNW) saw a sharp and positive market reaction this morning, with the…