Inflation-proof stocks: Dominos’ position in the exclusive club is under threat

Inflation-proof stocks are inflation-proof until they’re not. Although fast-food companies have been perceived as inflation-proof stocks, this was not true of Dominos (ASX:DMP) in 1HY23.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Dominos no longer belongs to the ‘Inflation-proof stocks’ club

Theoretically, in tough economic times, fast food retailers should perform well as people look for value and they should be inflation-proof stocks.

This rang true for McDonalds during the GFC, not not Dominos.

Dominos released its 1HY23 result and the company’s EBIT and NPAT both fell by over 21%, coming in at $113.9m and $71.7m respectively.

Although global sales grew by 1.2% excluding the impact of forex, the statutory result was a 4% decline. Online sales fell by 4.5% as consumers returned to their carry-out habits from before the pandemic.

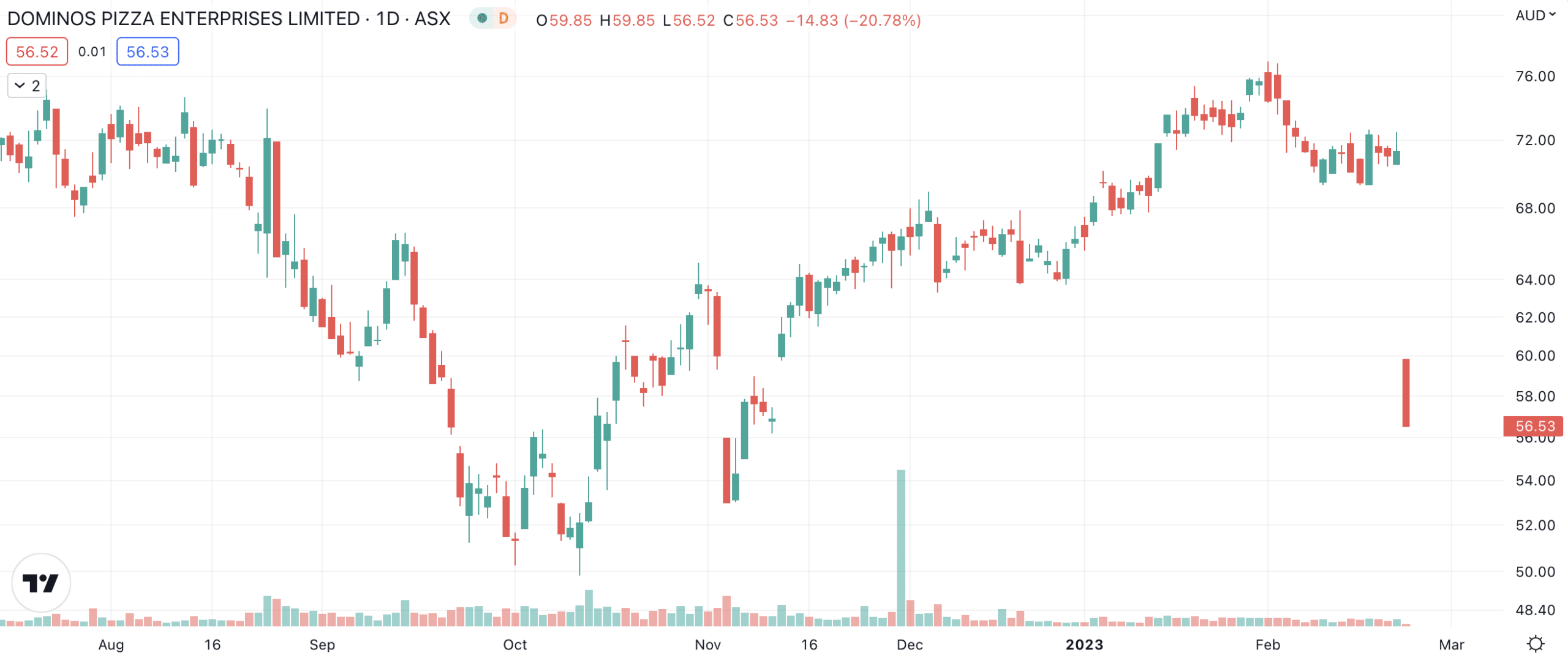

Shares in Dominos fell by over 20% at market open, as investors realised that its position as an ‘inflation-proof stock’ was under threat – to say the least.

Dominos Pizza Enterprises (ASX:DMP) share price chart, log scale (Source: TradingView)

Dominos goes back to the drawing board

Dominos admitted that its response to combating inflation had not been optimal. The company had thought it could just pass on costs to consumers while retaining the same customer numbers.

It promised shareholders it would provide menu items ‘for more price conscious customers’. This may help with sales, but will do little to help with margins.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…