Here’s what you need to know about dual class shares and why the ASX still bans them in 2025

![]() Nick Sundich, June 6, 2025

Nick Sundich, June 6, 2025

If you want to invest in the world’s biggest tech companies, you need to know about Dual class shares.

Even if you want to stay at home, you still should know. Because if some individuals are to be believed, the prohibition on dual class is why Australia is missing out on the world’s biggest tech companies – so it is said…by some of the companies themselves.

And in current public debate (i.e. an inquiry that ASIC is inviting submissions to as to how the ASX can be ‘reinvigorated’), many parties (including the ASX itself) are saying this could help. So here’s what you need to know.

Note: Article first published in 2023, last updated June 2025.

What are dual class shares?

Dual class share structures are a type of corporate structure in which two separate classes of stock are issued to shareholders. The two classes of stock entitled to different voting rights, dividend payments, and even additional privileges.

Generally speaking, one class (Class A) offers more voting power than the other (Class B), increasing the control that the founder or primary shareholder can exercise over decisions made by the company.

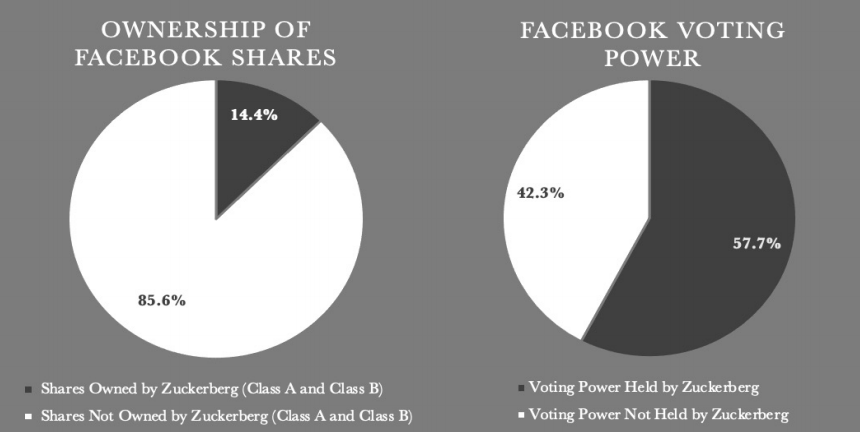

There may be other rights, Class A has over Class B. For example, Class A have a higher rate of dividend payments than Class B shares do. But the essential effect, as depicted below, is that minority shareholders have power over the majority.

Some companies may have even more classes. Alphabet (NDQ:GOOGL) has three structures – Class C have no votes at AGM, Class A have 1 vote each and Class B shares have 10 each.

Why do companies use dual class share structures?

The purpose of these structures is to allow founders and core investors continued control over their holdings while still allowing new investors access to company ownership via Class B shares. They may restrict or even outright prohibit the acquisition of higher class shares.

This helps create an incentive for those who invest in a startup early on but want to protect their interests as more investors enter the fray. The founders can maintain tight control over decisions that could affect the value of all shares, like acquisitions or product development decisions.

The dual-class structure is meant to provide stability and long-term growth opportunities for companies. Obviously this assumes the founders know what’s right!

Not all shareholders are created equal with dual class shares

Despite its popularity among tech stocks and startups, however, dual class share structures have also been heavily criticised by some investor groups due to their lack of transparency and accountability with respect to shareholder interests.

It is important to note that listed companies with a dual-listed structure typically have it as a legacy of when they were private. No public shareholders would agree to shares they bought being retrospectively having power taken away from them.

Dual class shares are banned in Australia

Regulations in some jurisdictions prohibit companies from issuing multiple classes of stock with unequal voting rights and Australia is one of them. Even in countries where it is allowed, like the US and Singapore, this is only allowed at IPO and this structure already exists. Companies cannot recapitalise and create a dual-class structure then.

There may be other restrictions too. Singapore requires IPO dual-class structure companies to have fast growth potential. Hong Kong has specific hurdles on financial status that must be overcome. It is important to note that Singapore (and Hong Kong) have only allowed this for a few years whilst the US has relied on it far longer.

The US (well, specifically the NYSE) allowed it in the 1980s when it had no choice when companies threatened to move to other exchanges like the NASDAQ. It was only banned in 1925 when Dodge proposed to issue shares with absolutely no voting power at all and there was public outcry. And oddly, Ford was allowed to list as an exemption in 1956. While the US has allowed it for some years, only in the last 10 or so has it come to prominence with many of the largest tech companies having dual-class share structures.

Both Singapore and Hong Kong saw the light and lifted restrictions within months of each other in 2018. This was because they perceived to be missing out on big listings. Hong Kong missed out on Alibaba’s listing, although the Jack Ma-founded company has since listed after the rules changed.

Atlassian bosses Scott Farquhar and Mike Cannon-Brookes both cited the ASX’s opposition to dual-class structured companies as why they went to list on the NASDAQ rather than the ASX.

Might we see dual class shares one day in Australia?

Yes. In earlier version of this article, we said no. We said: ‘We think the ASX recognises that it’ll never be as big as Wall Street and is content with the occasional big name coming here, such as Life360 (ASX:360), Down Under and nourishing high-growth companies of Australia’s own. Perhaps Atlassian would never have listed in Australia anyway, even had it allowed it.

However, if you want to invest in overseas markets, you need to be aware of dual-class share structures and we hope we’ve helped get you started with the basics’.

But when you have the ASX itself saying it may be open to it, it is a possibility. The ASX submitted to ASIC’s inquiry and acknowledged it was now out of step with other exchanges. It stated,’ There will be a range of views on dual-class shares, however [the] ASX is supportive of further consideration and debate on this topic with key stakeholders in the Australian capital markets ecosystem‘.

‘ASX’s overall aim is to be the most attractive and competitive place to list globally and seeks to offer investors a diverse range of investment opportunities‘.

The bottom line is while you may not see dual class shares next month, you may see them sooner than you think.

Some investors may be concerned about losing power, but we don’t see any companies recapitalising and retrospectively creating dual-class share structures. And even in new companies, it is possible we could have some restrictions like in Singapore and Hong Kong.

These exchanges, notwithstanding their permitting of dual class shares, do require the 1-share, 1-vote on some voting issues where it’d be in appropriate for just one or two people to have a say. These include the hiring and firing of directors or auditors, deciding on takeover offers and (crucially) and amendment to voting rights. Plus, multiple voting shares are capped at a certain number of votes per share (i.e. 10).

Would we invest in a company with dual class shares?

It would depend. For a company like Google with multiple co-founders and other management in the business, we would. But for a company like Meta with all the power in the hands of one person who has all control over the day to day operations too and is unlikely to depart anytime soon? Not a chance.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Webjet Sinks 22 Percent After Softer H1 Results and Weak Domestic Demand

Webjet Falls 22 Percent After H1 Revenue Dips and Domestic Flight Demand Softens Webjet (ASX: WJL) opened down 22 percent…

Javelin Minerals Jumps 2,900 Percent on Capital Consolidation

A Sharper Share Register Sets Javelin Minerals Up for Its Next Corporate Stage Javelin Minerals (ASX: JAV) surged an extraordinary…

Why Are Droneshield Shares Dropping and Should You Be Worried

DroneShield Selloff Tests Nerves, But Fundamentals Tell a Different Story DroneShield (ASX: DRO) experienced a sharp selloff this morning that…