Here’s why this pot stock gained a stunning 40% this morning

As of 10.30am this morning, the biggest gaining ASX stock with news was pot stock ECS Botanics (ASX:ECS), all thanks to a $24m offtake deal.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Is this pot stock coming alive again?

The fortune of pot stocks rise and fall with changes in global regulations that investors anticipate will lead to the market being unlocked. They rise when changes are announced but then fall when investors realise that either it isn’t unlocked or even when it is, the company they thought would be in for a windfall is just a little fish in a big pond.

So it has been for ECS Botanics, a company that claims to be Australia’s largest B2B medicinal cannabis cultivator & manufacturer. But, today’s news was nothing to be snuffed at.

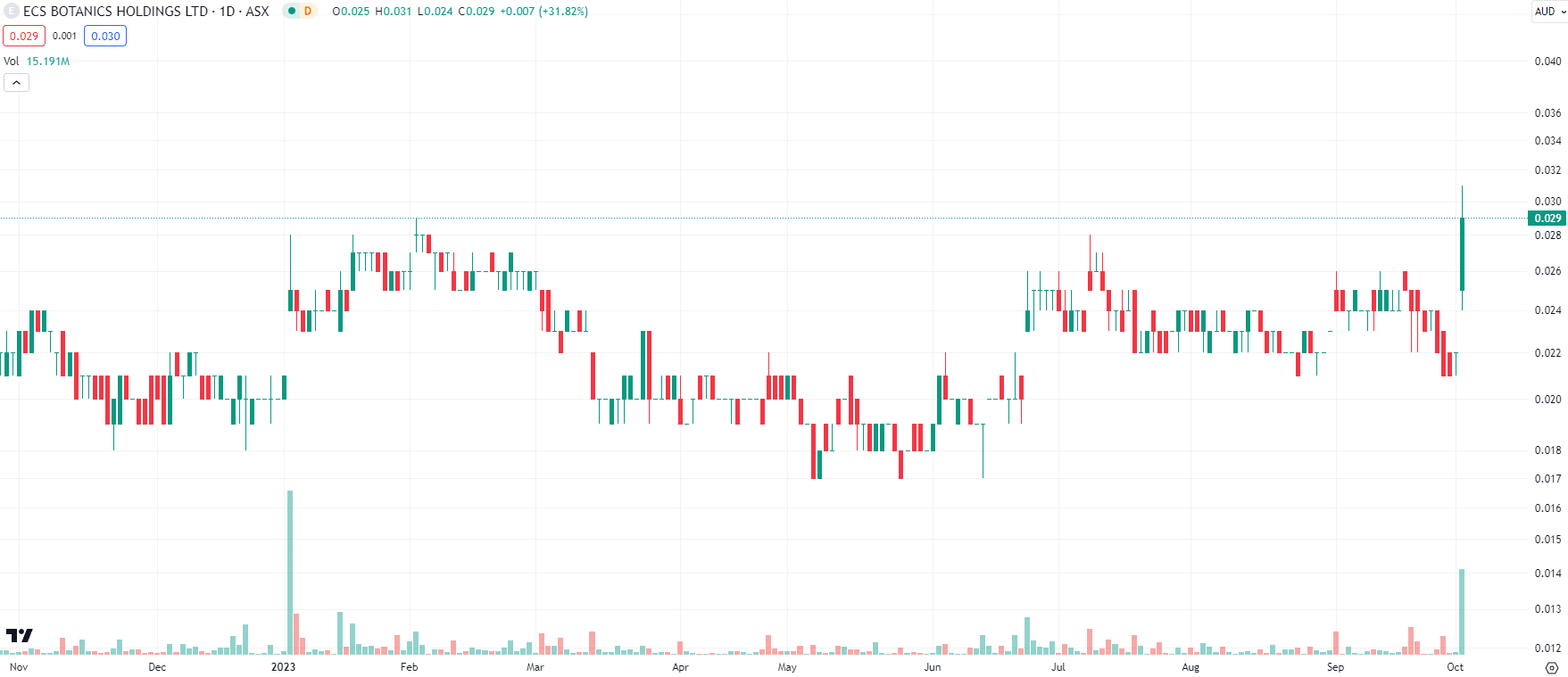

ECS Botanics share price chart, log scale (Source: TradingView)

ECS told its shareholders it secured a five year offtake deal with MediCann Health. This binding deal will see ECS supply MediCann with $24m of medicinal cannabis dried flower, starting in January 2024. This builds on an existing deals it has with MediCann that is worth $11.9m.

Is this pot stock for real?

ECS is certainly better poised than a company that has a non-binding MoU. But investors should remember that the medicinal cannabis industry is still relatively nascent and highly regulated, both in Australia and globally.

There is potential for long-term investors to make money if they back the right company, are prepared to deal with short-term volatility and wait for a few years. But not for short-term day traders trying to profit off the next regulatory change.

What are the Best biotech stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Aussie Broadband (ASX:ABB): A likeable telco that can reach for the skies again

Aussie Broadband (ASX:ABB) is a good illustration of a Telco stock you can like (as opposed to Telstra). Since listing on…

Here are 5 ASX Mining Stocks Commencing Production in 2026! Is it Time to Buy?

There are a handful of ASX Mining Stocks Commencing Production in 2026. This article recaps 5 such companies and looks…

Alkane Resources (ASX:ALK) Hits 5-Year High After 188% Rally: Time to Buy or Take Profits?

Alkane Resources: A Strong Buy After 188% Rally? Alkane Resources (ASX: ALK) jumped 11 per cent last week to reach…