ASX gold stocks are back in vogue and these 4 stocks are benefitting

ASX gold stocks dominated the winners’ list on Monday morning for two good reasons. First, because in a time of macroeconomic uncertainty, gold is perceived as a safe haven asset. And second, because several gold companies on the Australian bourse had good news for investors.

Tietto and Tempest lead the charge of ASX gold stocks

Tietto Minerals (ASX:TIE) is one of the few sub $1bn gold producers as well as the newest one focused on West Africa. This company told investors it received a takeover bid from Chinese mining investor Zhaojin Capital, which already was a 7% shareholder in the company.

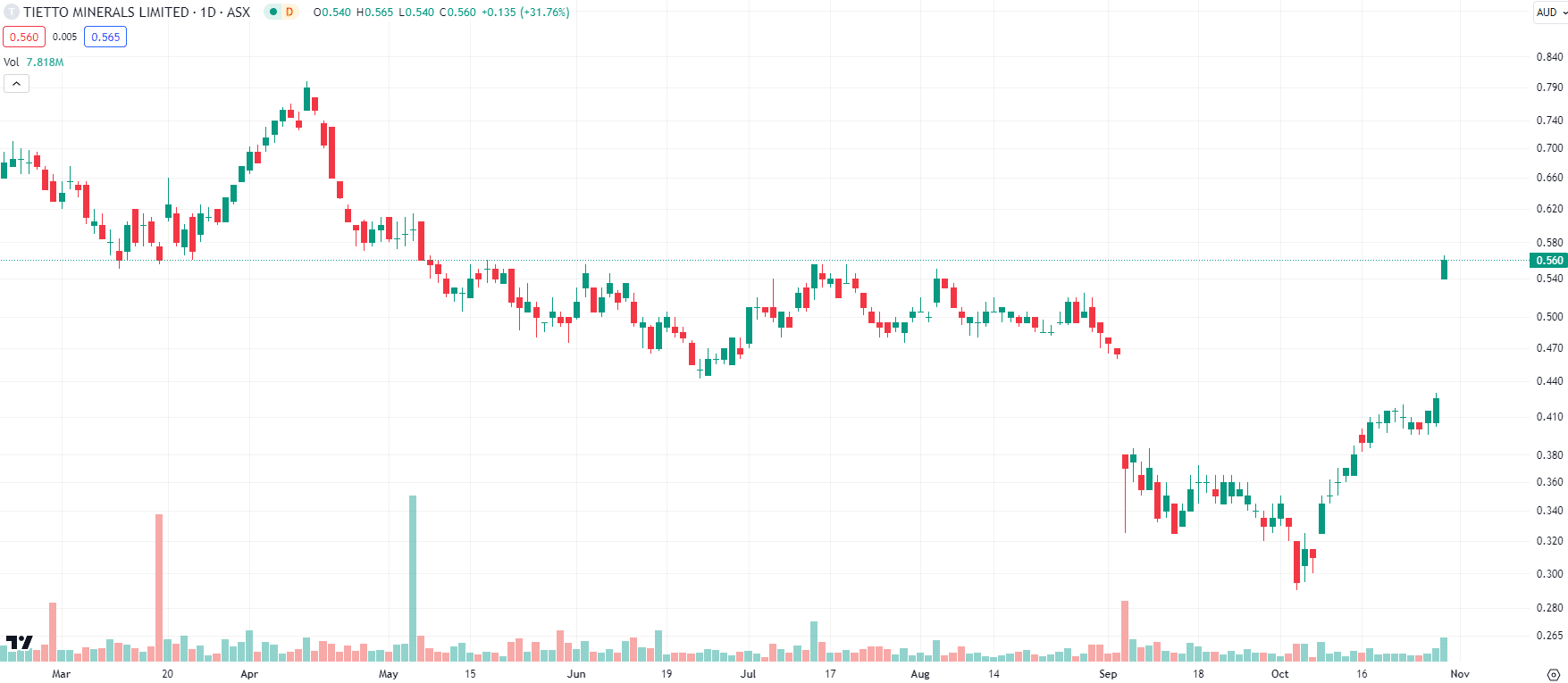

Although Tietto told investors there was no certainty that there would be a binding deal and no action should be taken at this stage, investors sent shares up nearly 30% this morning, to nearly match the 58c per share takeover price. Despite today’s price rise, it is barely higher in 6 months after a production downgrade in early September scared investors.

Tietto Minerals (ASX:TIE) share price chart, log scale (Source: TradingView)

Among explorers, Tempest Minerals (ASX:TEM) was the biggest winners, unveiling rock chip sampling results at its Yalgoo project in WA. In conducting rock chip sampling, Tempest is trying to identify targets for drilling next year. And it achieved some positive results, up to 7g/t gold, 0.2% copper and >60% iron. Like Tietto, Tempest shares had a healthy gain today, but shares have been headed downwards as investors faced uncertainty about the company’s future direction.

Tempest Minerals (ASX:TEM) share price chart, log scale (Source: TradingView)

Other gold stocks with good news

Amongst producers, Ramelius (ASX:RMS) had good news in the form of its update for the September quarter (1Q24). Ramelius produced 55,523 ounces of gold for the quarter and generated A$44.3m in operating cash flow. Investors were told the company was on track to meet its guidance and that it would produce 60,000-70,000 ounces during the current quarter.

Amongst explorers, Queensland-focused company Killi Resources (ASX:KLI) unveiled the results of soil sampling at its Mt Rawdon project. It identified multiple extensive copper-gold-molybdenum anomalies at surface. It identified two targets to test for drilling.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…