US CPI data led the ASX 200 to a 1.5% gain this morning

The latest US CPI data led to a strong session in New York, and the ASX is following suit with a gain of over 1.5% in both the ASX 200 and All Ords. Was it really as good news as you would imagine from the gain that has occurred?

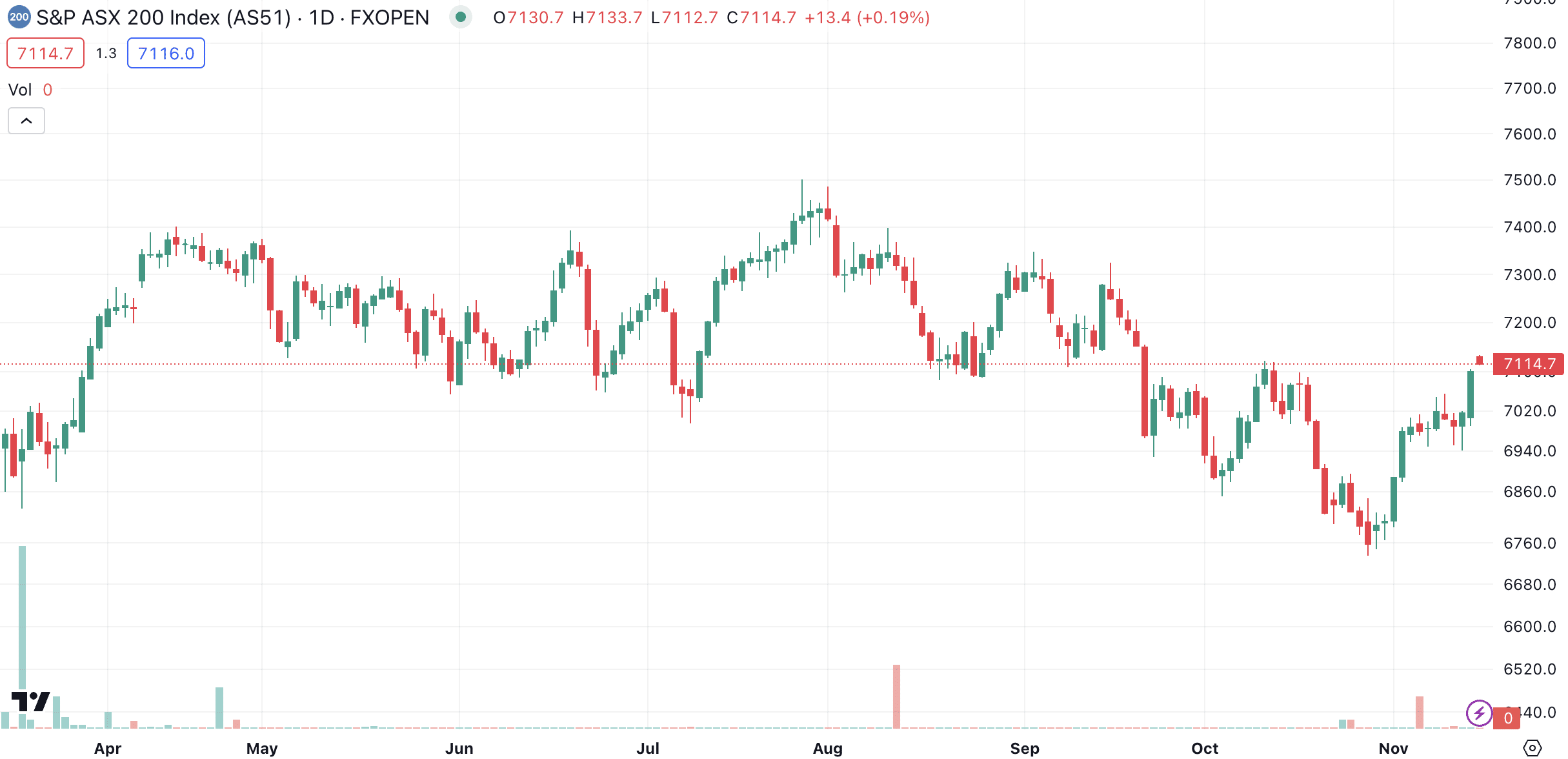

ASX 200, log scale (Source: TradingView)

US CPI data looks good

Simply put, yes. Inflation in America was 3.2% higher in the 12 months ended in October, down from 3.7% in both September and August.

Comerica Bank chief economist Bill Adams declared that the inflation fever had broken, not just because inflation was lower but because prices were essentially flat.

This will mean that there will likely be no further rate hikes, and rate cuts may occur sooner.

What does this mean for Australia?

In our view, not much, given inflation is proving much harder to tame. It wouldn’t surprise us to see more rate hikes from here.

Nonetheless, the US CPI data could be good news for some ASX stocks that are heavily focused on the US, because it could mean that better times are ahead. At the same time, it could be bad news for stocks that have gained from high inflation, particularly discount retailers and utility providers.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Omega Oil & Gas (ASX: OMA) Surges on Beach Energy JV Deal- Is It a Buy Before Drilling Begins?

Omega Oil & Gas (ASX: OMA) surged as much as 18 per cent on Tuesday after landing a major vote…

CSL CEO Paul McKenzie has departed, now what for the fallen biotech giant?

In a bombshell 4pm announcement, investors learned that CSL CEO Paul McKenzie was departing the company effective that very afternoon…

This company just made an IND submission to the US FDA, here’s why its a big step!

Imagion Biosystems (ASX:IBX) just made a IND submission. This is a big deal for the company, and we thought it…