Why did Keypath Education (ASX:KED) rise 50% this morning? Were the AGM speeches seriously that good to merit this?

![]() Nick Sundich, November 14, 2023

Nick Sundich, November 14, 2023

Keypath Education (ASX:KED) rose over 50% this morning despite there being no news other than the company’s AGM. What happened to spark the share price spike?

Keypath Education (ASX:KED) has had way more thin than thick as a listed company

Keypath listed in May 2021 but has struggled since then. Keypath Education is a company that runs online university courses (predominantly post-graduate) through its technology and data platform, making money through taking a share of course fees.

Its reputation was tarnished by being the first IPO run buy Macquarie since the disastrous float of Nuix (ASX:NXL). The state of the tertiary education sector didn’t help either, with classes shifting online and uncertainty as to whether students would keep paying the high fees they paid prior to the pandemic.

Only a couple of weeks ago, the company released its results for the September quarter where it reiterated its target of reaching EBITDA profitability from the second half of FY24. This failed to generate much investor excitement, but it was a different story this morning.

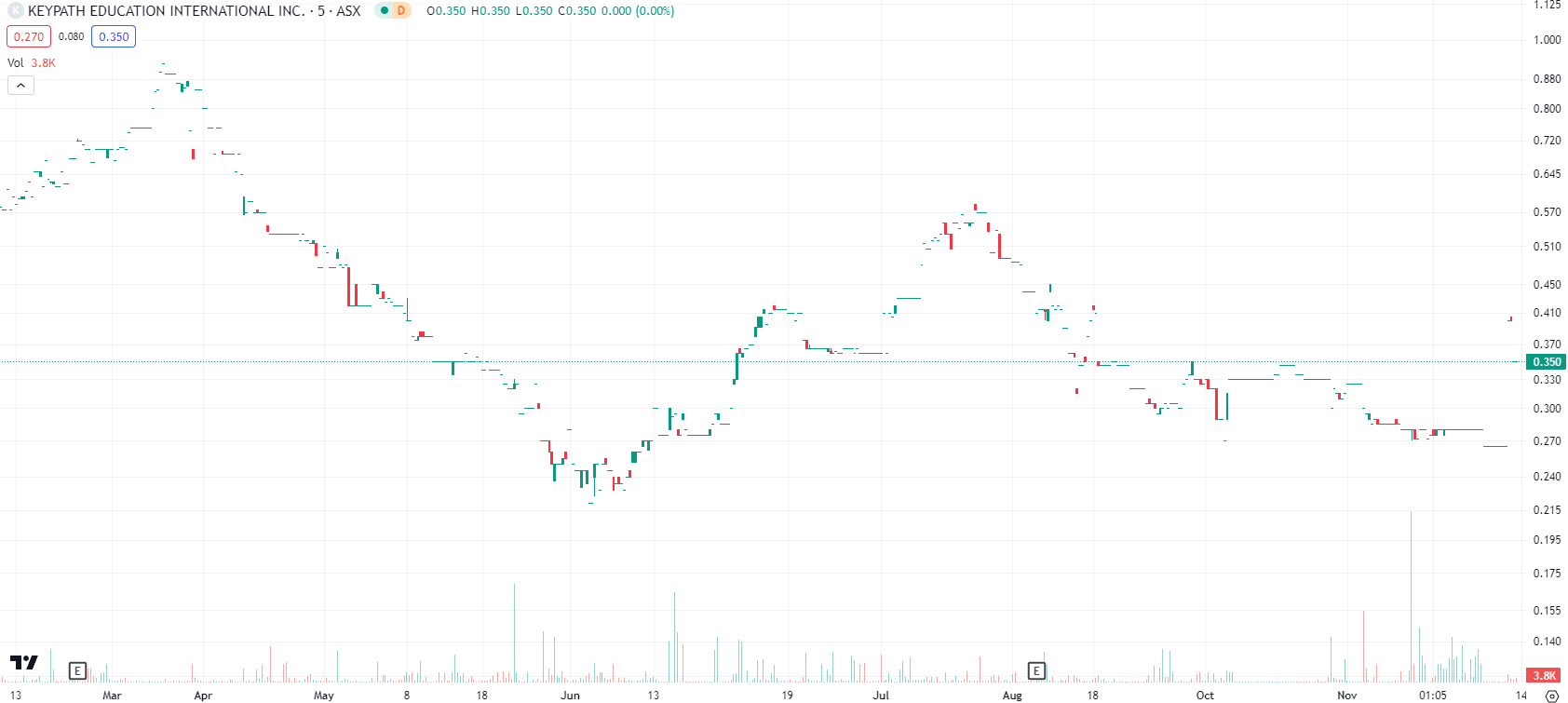

Keypath Education (ASX:KED) share price chart, log scale (Source: TradingView)

So what happened today?

As we noted today, the company held its AGM. We can’t see anything new that no one was aware of before. However, we would assume the company’s executives gave compelling speeches that reminded investors of the proposition before them.

Chair Diana Eilert told shareholders FY23 was a strategic year as it shifted its focus to the Asia-Pacific region and to the healthcare vertical – now that is one that won’t be displaced by free or low cost education platforms any time soon. It has a cash position of US$46.8m and reiterated its EBITDA ‘profitability’ goal.

In our view, good for investors who have made a quick profit on this one. But if you’re not in the company, it’ll be much harder to make a profit from here – it’ll take several months of a strong financial performance for similar gains to be made.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…