ASX health stocks in the US market: These 2 companies had good news this morning

ASX health stocks in the US market have the odds stacked against them, but 4DMedical (ASX:4DX) and Artrya (ASX:AYA) received news that place them in good position to succeed in the market.

4DMedical gets a non-negotiable asset for ASX health stocks in the US market

To sell in the US market, ASX health stocks require FDA approval for their drug or medical device. 4DMedical told its investors that its CT-based ventilation product CT LVAS received regulatory clearance.

This is the second product that 4d Medical has approved in the FDA approval, with the first being XV LVAS, that is X-ray based rather than CT-based. But both products are Lung Ventilation Analysis Software, by name and by their actions. CT LVAS was already approved in Australia, although the US is easily the larger market for the company.

4D Medical also told shareholders it re-risked the regulatory pathway for its next product, CT:VQ which is a ventilation perfusion product.

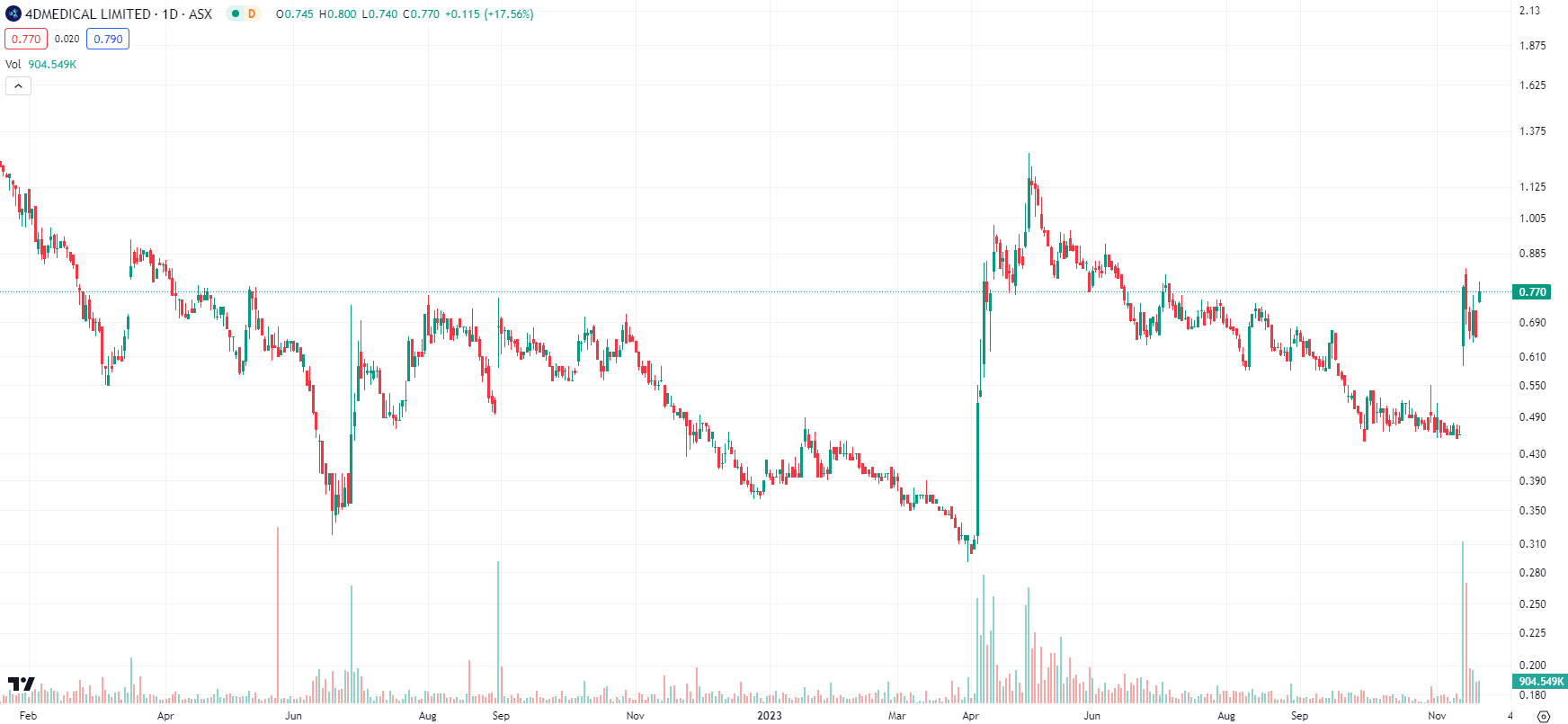

4DMedical (ASX:4DX) share price chart, log scale (Source: TradingView)

Good news from Artrya too

Artrya, another company on the list of ASX health stocks trying to make it in the US market, is commercialising Salix, an AI platform that detects key coronary artery disease imaging markets. Although it is not FDA approved just yet, Artrya announced its first commercial deal in the USA. Northeast Georgia Health Ventures and Artrya have entered into a deal to provide Salix to the former group’s patients once it is FDA approved.

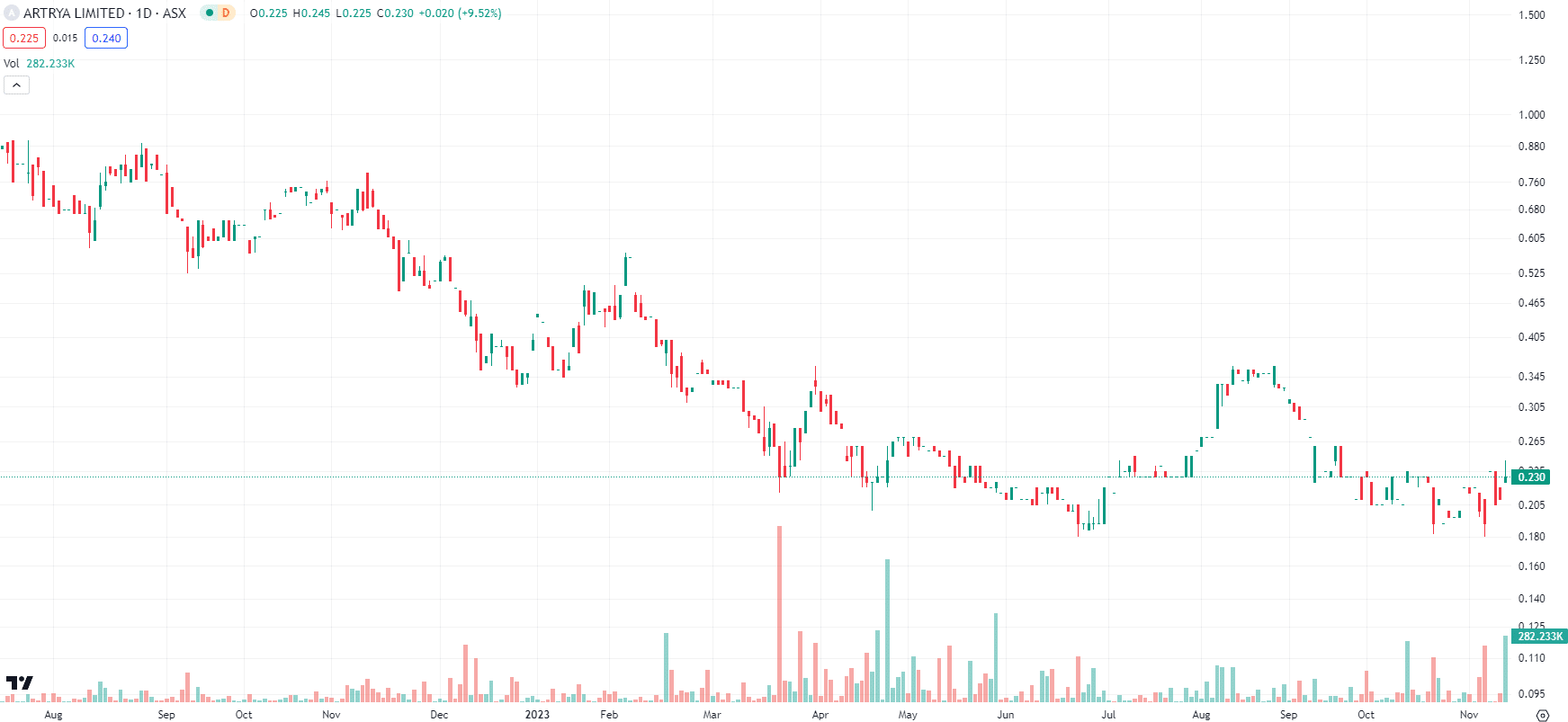

Artrya (ASX:AYA) share price chart, log scale (Source: TradingView)

The deal won’t be a case of ‘sit and wait’, however. Preparations will occur while it is going through the approval process and the pair will develop and expand specific use cases for Salix. Artrya told its shareholders that there was a market opportunity of US$320bn ahead of the company and that this deal alone could see it reach 5 hospitals that provide heart disease treatment to over 100,000 per year.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…