Investors are still liking NDIS stocks like Intelicare (ASX:ICR) amidst rumours of a clawback

If the 40% share price rise of Intelicare (ASX:ICR) is any guide, it appears talk of the demise of NDIS stocks has been greatly exaggerated. That is, if there ever was any talk at all.

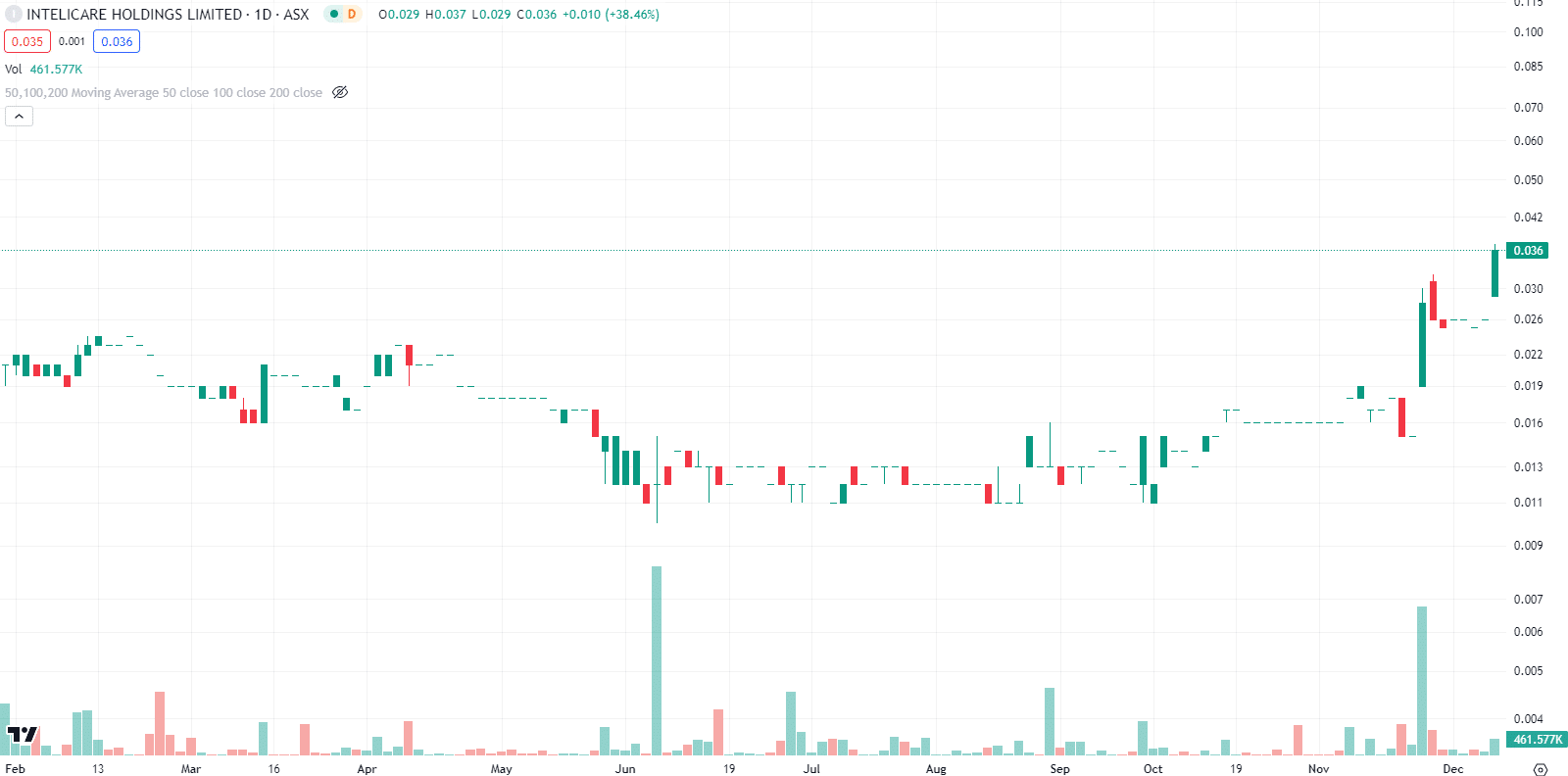

Intelicare (ASX:ICR) share price chart, log scale (Source: TradingView)

Could NDIS stocks see their market shrink

Since the NDIS was introduced over a decade ago, costs have continued to blow out year on year. $39.8bn will be spent over the 2023-24 fiscal year by the Commonwealth and state governments. The government’s own Treasury has estimated costs could increase by a further $17.2bn in absence of any actions taken to the scheme. There have been many suggestions made such as paying for results rather than a volume of services, eliminating overcharging providers, cutting back eligible conditions.

Any of these might potentially mean less opportunity for NDIS stocks such as Intelicare. However, based on this morning’s announcement made by the company, it appears things will be fine, at least for now.

Intelicare is marching on

Intelicare provides predictive analytics hardware and software package for use in the aged care and people living independently at home. Its products are NDIS-approved. This morning, the company announced a binding Reseller agreement with JNC Technologies. This is another software company, specialising in software and algorithms to address challenges in the aged care and NCIS sectors.

A great revenue opportunity

ICR told its investors this was the largest deployment of its products in its history, not to mention a substantial revenue opportunity. This deal is for an initial term of 3 years, with 12-month extensions possible thereafter. Best of all, the deal provides for ICR to retain 66.6% of the margin generated from the hardware reselling fees and application software reselling fees.

It is not surprising that shares rose this morning, although we don’t think investors should completely ignore the potential impacts of any possible changes to the NDIS on the company.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Develop Global Wins $200m OceanaGold Contract- What It Means for Investors

Develop Global (ASX: DVP) climbed 4% to A$4.36 on Friday after securing a A$200 million underground development contract with global…

Nova Minerals Drops 14% on $20m Capital Raise- Buy or Avoid?

Nova Minerals (ASX: NVA) dropped nearly 14 per cent to A$0.90 following the announcement of a US$20 million (approximately AUD…

WiseTech (ASX:WTC) Rises After Richard White Cleared of Misconduct – Should You Buy the Dip?

WiseTech Global (ASX: WTC) climbed 3 per cent to A$70.18 on Friday after founder and Executive Chairman Richard White was…