Tim Goyder stocks: Check out this $11m explorer that just joined the exclusive list

The list of 3 so-called Tim Goyder stocks just welcomed a new member in Battery Minerals (ASX:BAT), soon to be Waratah Minerals (ASX:WM1).

Who is Tim Goyder and which companies are so-called Tim Goyder stocks

Tim Goyder is a mining executive and investor who has an estimated net worth of over $1bn. The bulk of this success has been achieved with Liontown Resources (ASX:LTR) and Chalice Mining (ASX:CHN), which both discovered major battery metal deposits in the Kathleen Valley and Julimar deposits. He also has a stake in DevEx Resources (ASX:DEV).

Joining the list is Battery Minerals, a company that is somewhat different to the other companies he holds a stake in. Goyder and Northern Star (ASX:NST) boss Stuart Tonkin participated in a $560,000 placement that gave him a 7.3% stake in he company. Tonkin owns 9.89% having already owned just over 5% prior to the deal.

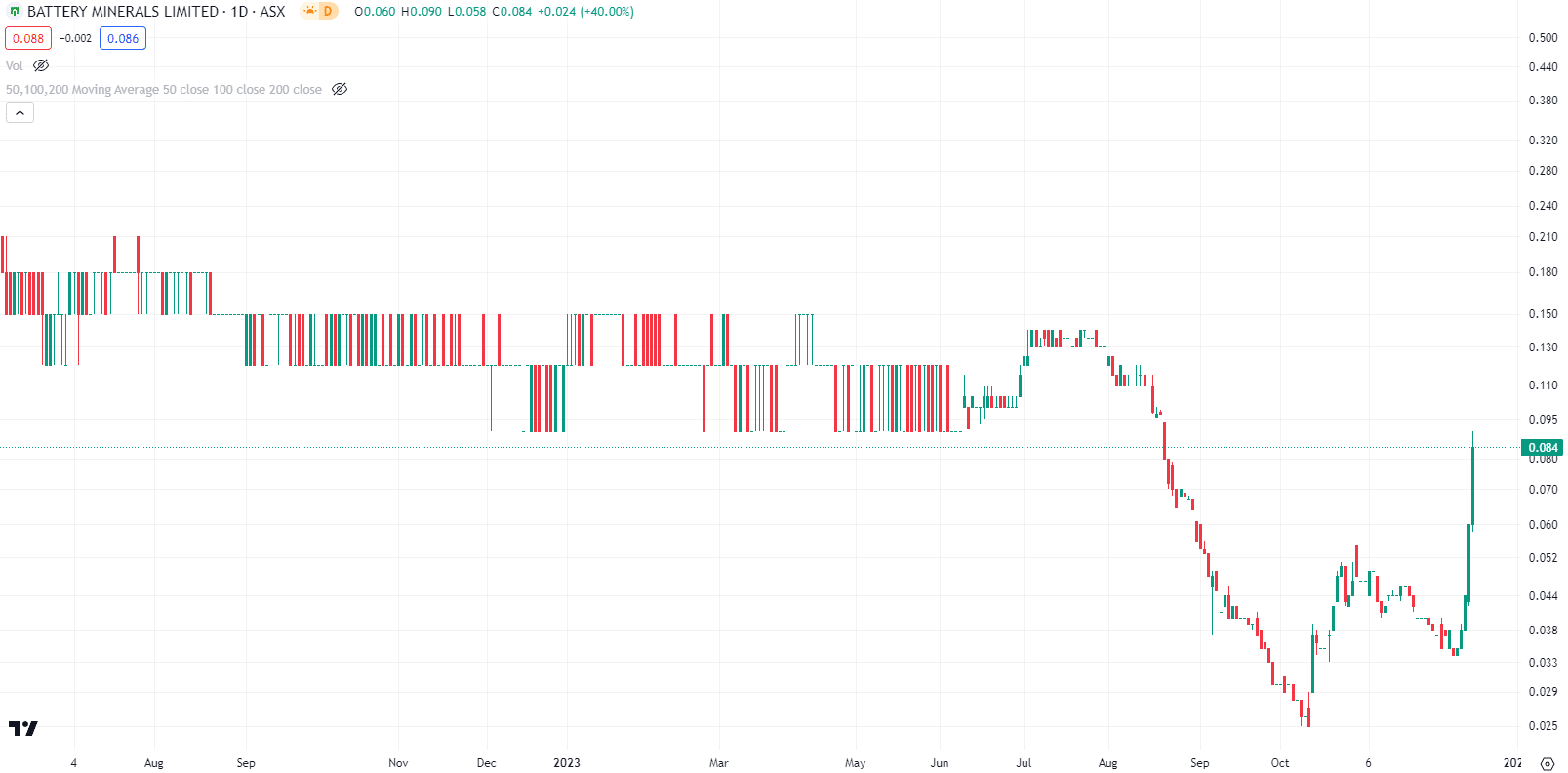

Battery Minerals (ASX:BAT) share price chart, log scale (Source: TradingView)

Why he bought into Battery Minerals

Obviously, Goyder must see something in this stock that he likes. This company recently acquired a project in NSW’s East Lachlan Ford Belt that lies just 14km from Newcrest’s Cadia Valley mine. This is a project that has had some exploration work while in private hands, although mostly for copper rather than gold, and the results do not go deep. An initial exploration campaign is set for January.

It seems Tim Goyder is the resources sector equivalent of Bevan Slattery, one who can send shares surging just by buying into the stock – as occured with Slattery and Intellihr and Pointerra. If those case studies are any guide, shareholders can expect momentum in the short-term, although whether or not it lasts will depend on whether or not the company delivers on its promises.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

South Korea KOSPI Crashes 7.2% as Samsung and SK Hynix Break the Market’s Back

South Korea’s Chip Rally Just Unwound The South Korean stock market was hit hard on Tuesday, with the KOSPI falling…

Scalare Partners (ASX:SPX) Up 43% on a Huge H1, But It’s an M&A Story Now

Revenue Up 370%, The Market Loves the Tank Stream Labs Deal Scalare Partners Holdings surged 43% today after reporting a…

China’s New Submarines Could Threaten the US From Close to Home

The Undersea Arms Race Is Heating Up Senior U.S. naval officials are starting to sound the alarm over China’s rapidly…