MMA Offshore (ASX:MRM): A Surprising ASX Star, set for more growth in the next 12 months

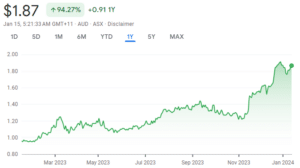

Imagine a stock taking a giant leap where others just step – that’s MMA Offshore (ASX: MRM) for you. In a sector where single-digit growth is the norm (namely, the marine services industry), MMA’s shares have more than doubled since mid-January 2023!

This isn’t just luck. It’s the result of smart business moves and a keen sense of market play. MMA isn’t just riding a wave; it’s making waves in the marine services sector, showing how solid strategy and strong fundamentals can really pay off.

A Closer Look at MMA’s Business

MMA Offshore is at the forefront of the marine services industry, playing a vital role for those who operate offshore structures like oil rigs and wind turbines. In today’s world, where energy security is a big concern, largely due to tensions in Europe and the Middle East, MMA’s services have become more important than ever. This demand has expanded their client list and, impressively, driven their financial growth. The result? A stunning 402% surge in their share price since early 2022, highlighting MMA’s significant impact in the energy sector.

Making a Name

MMA Offshore’s success goes beyond just meeting market demand. Their recent contract for the MMA Inscription, supporting LNG fields, is a clear example of their strategic thinking. This decision aligns well with market trends and strengthens their business model. It also positively impacts their day rates, a crucial element of their revenue. While MMA Offshore may not be widely known, such thoughtful business moves are gradually increasing recognition of the company’s potential.

Golden Days for MMA Offshore!

Taking a closer look at what MMA Offshore does, it’s easy to see why they’re grabbing attention. They’re not just any marine service provider; they offer specialised ships for tasks like servicing oil and gas rigs and fixing underwater equipment. This isn’t just a small part of the business – it’s crucial for the whole energy industry. Add to this the soaring demand for offshore vessels and not enough new ones coming into the market, and you’ve got a recipe for MMA’s success. This strategic edge is clearly paying off, with their stock value more than doubling just last year.

Optimism Continues to Brew

The buzz around MMA Offshore isn’t just a one-analyst show; it’s a chorus of agreement from the financial experts. Every one of the five analysts tracked by CMC Invest is singing the same tune: MMA is a strong buy. This united front of confidence really says something about where MMA stands in the market. It’s not just about their solid financials; it’s also about how their value is growing, thanks to rising earnings and expanding business reach. When all the experts agree like this, it’s a sign that MMA is doing something right.

MMA’s latest trading update has further boosted investor confidence. The company has announced that its EBITDA for the first half of 2024 is expected to be much higher than what the market was anticipating. This shows that MMA is doing well across all its business areas. What’s more, their costs are staying steady even as they take on more work, hinting at a bright future for their earnings. This blend of strong performance and smart cost management puts MMA in a great position in the offshore services industry.

The Big Picture

In the big picture of the ASX market, MMA Offshore’s story stands out. They may not be the name everyone knows, but their steady and remarkable rise in share price shows that the market really values what they’re doing. It’s not just about today’s success; it’s a nod to what they could achieve in the future. The fact that all the expert analysts are giving MMA a thumbs-up as a strong buy reflects a common belief in their bright future. This optimism is based on a mix of high demand for their services, not enough competitors, and MMA’s smart way of running its operations.

What are the Best shares to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Mesoblast (ASX:MSB) Reaches Multi-Year High as Ryoncil Revenue Targets US$30M: Is It Still a Buy?

Commercial momentum builds as Mesoblast targets two major 2026 catalysts: Adult label expansion and Revascor BLA filing. Mesoblast (ASX: MSB)…

TechnologyOne (ASX: TNE) Wins $54.7M Legal Battle: Is the 34% Dip Now a Buying Opportunity?

TechnologyOne (ASX: TNE) has finally put one of Australia’s longest-running employment disputes behind it. The Federal Court threw out a…

Austal (ASX: ASB) Secures A$1bn Defence Win: A Defensive Buy at 28x Earnings?

Austal (ASX: ASB) locked in more than A$1.16 billion in new contracts last week, cementing its position as Australia’s go-to…