Perseus Mining (ASX:PRU): This successful Africa-focused gold miner is expanding its portfolio into Tanzania

Perseus Mining (ASX:PRU) is one of the ASX’s under the radar gold stocks. This is not just because it has nearly tripled 5 years, but also because it is one of the few to have thrived in Africa. In fact, the company is the 5th largest pure-play gold stock behind Newmont, Northern Star, Evolution and De Grey (with the latter only overtaking Perseus after a takeover bid.

This said, it trades at a big discount to the first 3 of those companies despite generating 9-figure profits and not suffering cost inflation and profit downgrades in the same way that companies with projects closer to home have.

Introduction to Perseus Mining and its projects

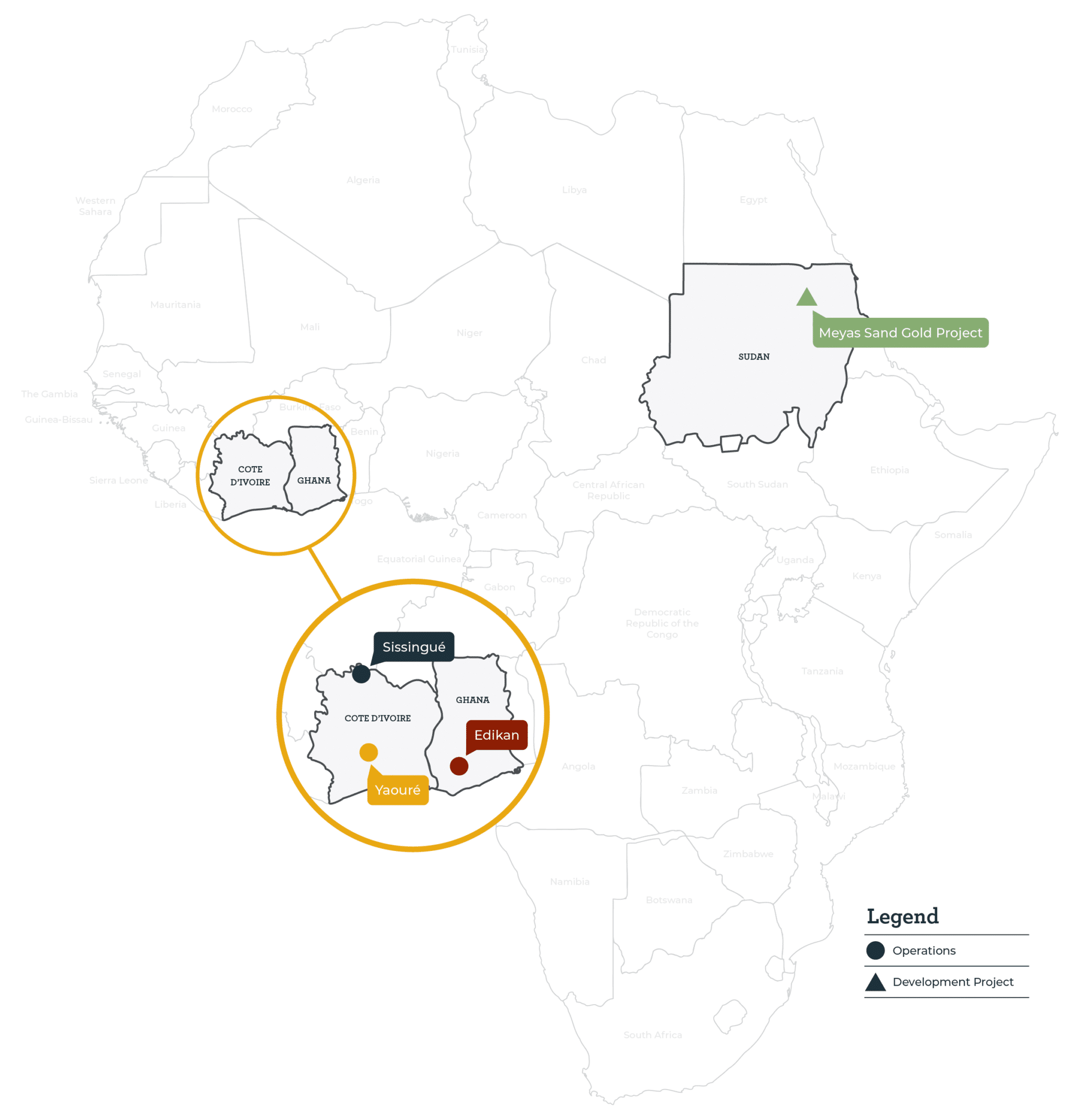

Perseus has 3 projects. The Edikan mine in Ghana as well as the Sissingue and Yaoure mines in Cote d’Ivoire. Twenty years ago, it was another small cap explorer but by 2012 had successfully bought the Edikan Gold Mine into development. Sissingue and Yaoure were bought into production in 2018 and 2021 respectively.

In 2022, it acquired the Meyas Sand Gold project in Sudan and seems all but certain to pick up the Nyanzaga project in Tanzania. But more on the latter project shortly.

Perseus Mining projects (Source: Company)

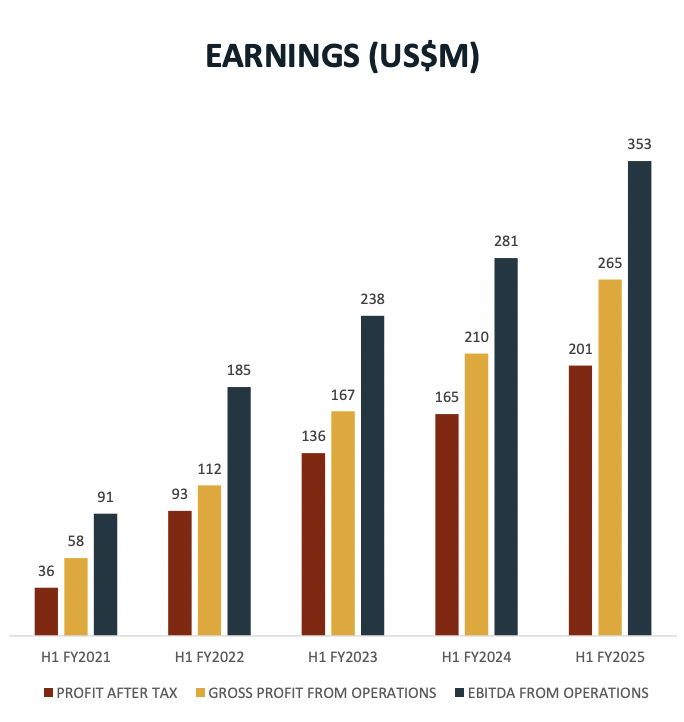

These assets now produce over 500,000/oz with an AISC of under US$1,200 and average sale price of US$2,350/oz. Perseus holds US$704m in net cash and bullion. In 1H25, it made $581.8m in revenue (up 19%) and a US$201m profit (up 22%), and paid an interim dividend of 2.5c per share. This isn’t the highest yield, at 1.87% as of the day of payment, but ahead of its target 1% yield and considering the company’s capex needs.

Source: Company

Edikan and Sissingue may be soon to pass their use by dates with Edikan only scheduled to operate until FY27 and Sissingue set earlier than that, although it is anticipated that the company may be able to extend its life by processing material from satellite deposits. Yaoure is easily Perseus’ most important for now, producing nearly 275,000oz gold at an AISC of US$755/oz and set to operate until at least 2035. Again, this could be extended if further gold is discovered at nearby deposits.

The company is hedging its bets, however. It picked up the Meyas Sand Gold project in northern Sudan in May 2022. Government support was not a problem, nor was the lack of a resource with 3.3m/oz in Measured and Indicated Resources. But the civil war there means it won’t be going anywhere with it anytime soon.

Meet the Nyanzaga project

Perseus has bought the Nyanzaga project in Tanzania. It was owned by OreCorp that had spent seven months backing a rival bid from Canada’s Silvercorp Metals. Perseus ended up winning out after increasing its bid and securing Tanzanian government approval. The bid was 57.5c per OreCorp share, or $269.9m all up.

The mine was expected to be in operation in the 2nd half of CY25 and produce 2.5n ounces of gold over a 10.7-year life span. There’s a capex bill of US$474m but a 2.6Moz resource, an NPV (using a discount rate of 5%) of US$926m and IRR of 31%. The AISC is US$954/oz. These estimates were from two years ago when gold prices were lower.

The trouble is that an FID is yet to be made as negotiations with the Tanzanian government have not yet been resolved. Tanzania is keen to secure its own share of returns from it. So now an FID is expected in the second half of CY25 and production would occur in early 2027.

Substantial upside to the share price

We’ve looked at Perseus on an EV/Resource basis. Taking into account a Mineral Resource of 8.5Moz across the 3 legacy projects and an Enterprise Value of $2.1bn, it is currently A$0.25. Its peers trade at an average of A$0.44 per share, and this would derive an EV of $3.7bn, or $2.73 per share. If you take into account Nyanzaga, it gets better – to an EV of $4.9bn or $3.34 per share.

Obviously, if any mines’ lives were extended, if its Sudanese project came online or if Perseus bought more projects, this could increase. PRU still has a war-chest of well over $400m and has no debt, although it may need to take some onboard to develop Nyanzaga.

Perseus is not one for dividends, but a solid stock for growth

One downside with this stock is that it is a low dividend payer. Generally aims for at least 1% yield, which isn’t much for an ASX company, especially one with a desired yield inked in. As disappointed as income-oriented investors may not be, growth-oriented investors would not be disappointed and may not be as content had the company distributed its profits rather than reinvested it into new projects.

As we noted above, it trades at a big discount to peers like Northern Star despite generating 9-figure profits all the same. You could argue it deserves a discount for Africa, although Ghana and Cote d’Ivoire are low-risk and Tanzania is less of a sovereign risk than a few years ago. Furthermore, it has not suffered cost inflation and profit downgrades in the same way that companies with projects closer to home have.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Nvidia (NASDAQ:NVDA) New Rubin Chip Is Here, A 25% Higher Price, A 10x Better Outcome

Rubin Is Here, The Real Story Is Cost per Token Nvidia has now unveiled its new Vera Rubin chips, and…

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors are panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…