Arcadium Lithium (ASX:LTM): Meet the newest and most exciting large cap lithium stock on the ASX, capped at US$5bn

Many investors have never heard of Arcadium Lithium (ASX:LTM) and we can’t really blame them. But hopefully, we can change that.

Despite the fact that Arcadium is capped at over US$5bn, it has had an unconventional path to the market. It used to be known as Allkem and was a specialty lithium chemicals stock before it merged with Livent, in a deal completed in January 2024. And this occured barely 2 years after Allkem was formed, through a merger of Orocobre and Galaxy Resources.

Arcadium Lithium is traded on the ASX as a CDI, with its primary listing being on the NYSE trading under the code ALTM. The company, headquartered in Philadelphia, is one of the few ASX stocks offering exposure to the ‘downstream lithium sector’.

Meet Arcadium Lithium (ASX:LTM)

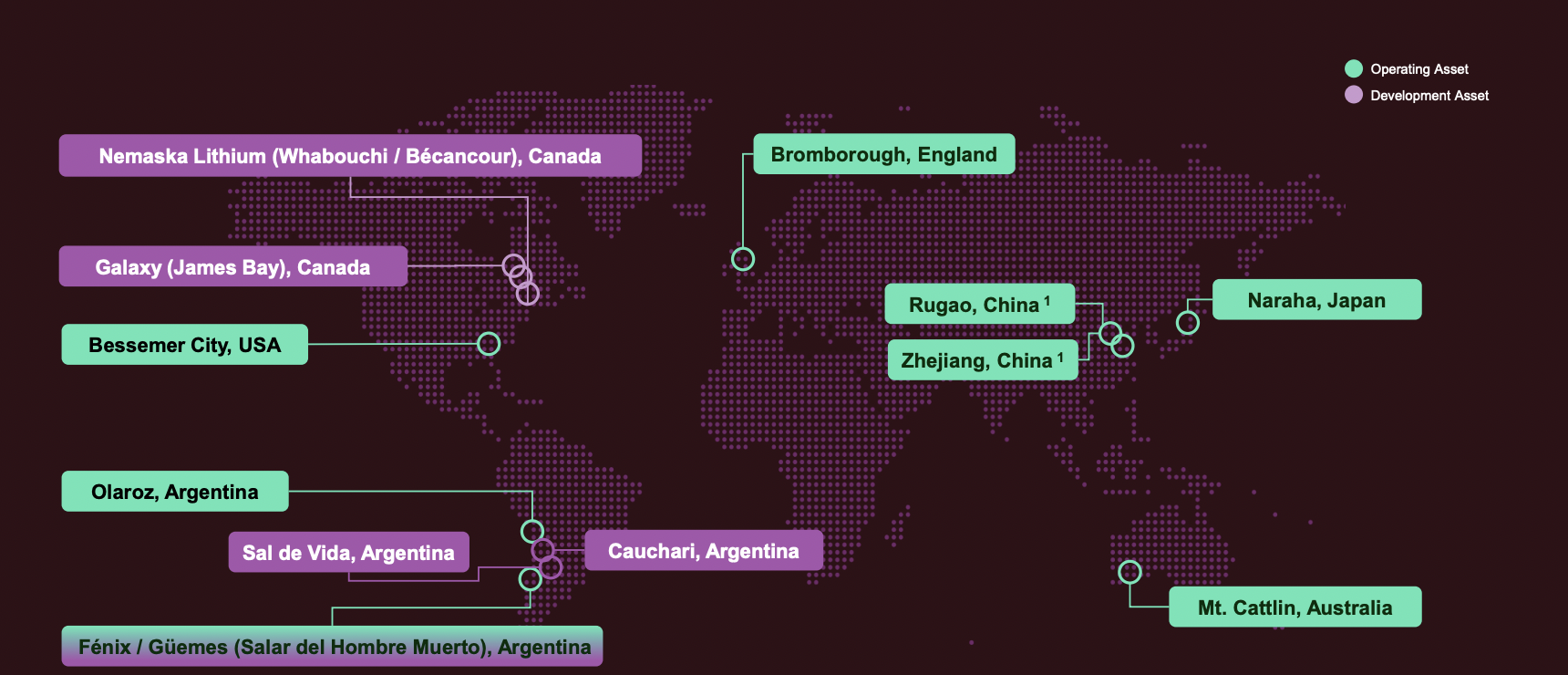

To know more about Arcadium, it is necessary to look at the assets of the companies that joined forces to create the current entity. Allkem Limited was a prominent player in the lithium industry, focusing on the extraction, production and sale of lithium and its derivatives. The company operated several projects across Argentina, Australia, Japan and Canada. Most of these came from Galaxy Resources, but Orocobre contributed its flagship Olaroz Lithium facility in Argentina) and Galaxy resources group (Another prominent Australian lithium mining company had several key assets).

As for Livent, it begun as a spin off from FMC Corporation (A diversified chemical company that was involved in the production of lithium and other specialty companies). The firm was similarly focused on extraction and processing of lithium brine, mainly from its flagship site in Argentina. However, the company had a heavy focus on converting this lithium into high-purity lithium hydroxide and lithium carbonate, essential components for rechargeable batteries.

The world’s leading lithium chemical producer

Sound like a complicated puzzle? Let’s make things simple. In Arcadium Lithium, you have the worlds leading lithium chemical producer that has operations globally and boasts a vertically integrated supply chain with end-to-end capabilities across the extraction and production of Lithium products. The corporation is focused on the production of high-performance lithium compounds, which are essential for a range of application including electric vehicle batteries, energy storage systems, and specials polymers.

Investors wanting exposure to upstream assets are catered for. The company has a portfolio of both brine and hard rock assets. It has 100% ownership in ‘Hombre Muerto’ a Brine mine located in Argentina. The project is currently currently has two additional staged expansions expected to increase capacity by 150% by the end of 2030. Additionally, Arcadium owns a 66.5% ownership in a similar Argentina Brine project ‘Olaroz’ that commenced production in 2015. Finally, the company is developing another Brine project in Argentina ‘Sal de Vida’ currently under construction set for first production in 2H 2025.

Arcadium Lithium’s hard rock assets include ‘Mt Cattlin’ located in Western Australia that commenced production in 2010 and bought in nearly A$1bn in revenue and over 130,000t of spodumene concentrate in FY23. It also a handful of assets in Canada that are set to enter production in the next couple of years.

Working downstream as well

Now let’s look at its downstream assets. The firm has a 50% stake in a lithium carbonate to lithium hydroxide conversion facility which commenced production in Oct 22 and commercial production from May 23. The project is still in ramp-up to nameplate capacity phase with plans to increase capacity and achieve full capacity by the end of 2027. The firm also has a 50% stake in Quebec asset a proposed spodumene concentrate to lithium hydroxide conversion facility scheduled to commence production from 2026.

Arcadium Lithium assets (Source: Company)

The short-term lithium outlook isn’t good, but the company is looking longer term

It’s difficult to sell a lithium stock right now given lithium prices are in the toilet given the oversupply in the metal as EV vehicle sales slow. There’s no debating that. But what is up for debate is if and when prices will recover. Arcadium Lithium is investing substantially in itself and is expecting to grow its combined lithium carbonate and hydroxide volumes by ~40%. And it claims to be unaffected because of the varying price mechanisms with its clients that aren’t flat market rates. Some are variable, some are fixed annually, some have floors and or ceilings.

Whatever the shorter-term holds, the longer-term demand outlook is robust and expected to grow significantly in the coming years driven primarily by increased demand from Electric vehicles. By 2030, it is expected that electric vehicles will be 44% of all sold vehicles, up from 16% in 2023 according to the Rho Motion EV Battery Outlook. As such a large player with exposure to both upstream and downstream lithium, Arcadium is poised to be one of the biggest beneficiaries.

Conclusion

Arcadium Lithium offers investors exposure to the largest, most diversifies exposure to lithium, encompassing carious modes of upstream production, diverse asset location, comprehensive downstream processing, and a broad range of customer markets.

What are the Best ASX Lithium Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Aussie Broadband (ASX:ABB): A likeable telco that can reach for the skies again

Aussie Broadband (ASX:ABB) is a good illustration of a Telco stock you can like (as opposed to Telstra). Since listing on…

Here are 5 ASX Mining Stocks Commencing Production in 2026! Is it Time to Buy?

There are a handful of ASX Mining Stocks Commencing Production in 2026. This article recaps 5 such companies and looks…

Alkane Resources (ASX:ALK) Hits 5-Year High After 188% Rally: Time to Buy or Take Profits?

Alkane Resources: A Strong Buy After 188% Rally? Alkane Resources (ASX: ALK) jumped 11 per cent last week to reach…