Australia’s Housing Crisis is Worsening, but Savvy Investors can Benefit in 2024

The Housing Crisis is not just about problems

Australia’s housing market is at a turning point. We’re seeing a serious housing crisis with rising prices, rents going through the roof, and not enough homes to go around. This is tough for everyone looking to buy a place or even rent one. But even in these tough times, there are real opportunities for investors who know their way around.

Let’s dive into why we’re not building enough homes, see how this is pushing up prices and rents and take a look at what might happen next in the market.

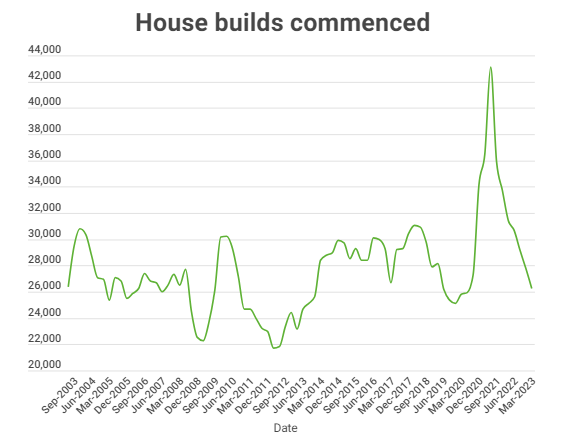

Why We’re Not Building Enough Homes in Australia

Tangled Rules Slow Us Down

A big reason why new homes aren’t going up fast enough in Australia is the tricky maze of planning and zoning rules. These rules mean a lot of red tape and strict requirements, which can hold up the start of new building projects. Local councils put tight controls on how land can be used, how tall buildings can be, and what they should look like, which makes it tough for developers to keep up with the ever-growing need for more housing.

Take Sydney, for example. Here, the process to get planning approval is a huge headache. Developers find themselves facing several bureaucratic steps that can push back a project’s timeline by years. This gap between how many new homes are being built and how many we actually need drives prices and rents up.

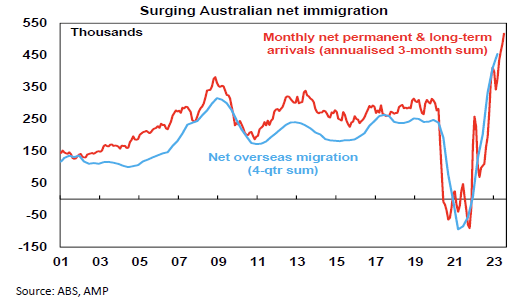

Population Boom Adds Pressure

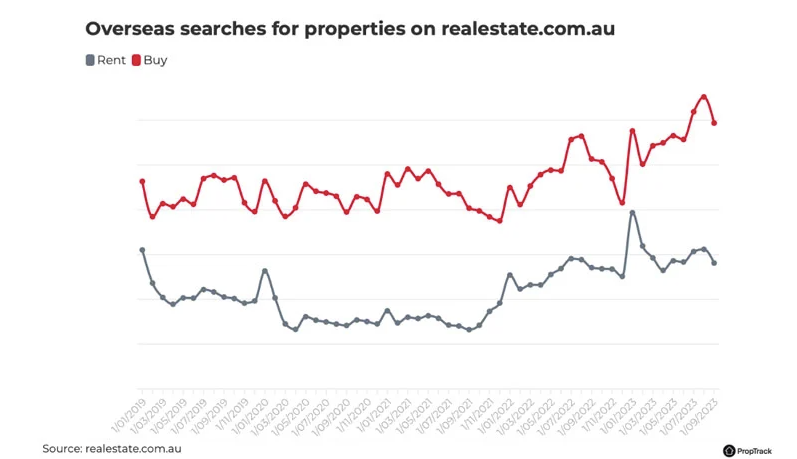

Another big part of the housing crisis is Australia’s booming population. Thanks to both a steady flow of immigrants and natural growth, more and more people are moving to cities like Sydney, Melbourne, and Brisbane. But, the construction of new homes hasn’t kept up with this jump in population, making the housing shortage even worse.

The Australian Bureau of Statistics points out that a lot of our population growth comes from people moving here from other countries, which has really ramped up the demand for housing in major cities. This surge in residents is making homes even more expensive and harder to find.

Building Industry’s Own Struggles

The folks who build our homes are facing their own set of problems. Costs for materials are climbing, it’s getting harder to find skilled workers, and too many construction companies are going out of business. According to the Australian Securities and Investments Commission, a record number of builders have had to shut down recently, which means even fewer new homes are being built.

On top of all that, the COVID-19 pandemic threw a wrench in the works by messing up supply chains. This led to delays in getting materials and drove costs even higher, making it tough for builders to finish projects on time and on budget. All of this adds up to a slower pace in building new homes, just when we need them most.

How Rising Costs are Changing the Game for Renters and Home Buyers

What’s Happening Right Now

The pinch in Australia’s housing market is really starting to squeeze, with rents and house prices both skyrocketing. CoreLogic’s latest figures show house prices in big cities hitting the roof. In Sydney alone, you’re looking at a median house price of over $1.3 million. Melbourne and Brisbane aren’t far behind with their own steep climbs.

For renters, the situation isn’t any rosier. According to the Australian Bureau of Statistics, rent prices have shot up at their fastest pace in more than a decade. Some places are seeing annual rent hikes of more than 10%, and in certain cities, it’s even more. This spike in rents comes down to a simple problem: there just aren’t enough places to rent for everyone who needs one.

What Might Happen Next

Looking ahead, it doesn’t seem like things will ease up anytime soon. With Australia’s population still growing and builders struggling to keep up, we’re likely to see high prices and rents stick around for a while.

That said, there’s a glimmer of hope with some new government plans trying to tackle these issues. For instance, Sydney is working on changing zoning laws to let builders create more homes faster. And there’s talk about dialing back student migration a bit to take some heat off the rental market.

Government Steps In With Solutions for the Housing Crisis

To get a handle on the housing crisis, the New South Wales government is changing up zoning rules to pack more homes into the same space. This should help ease the tight squeeze by letting more high-density housing projects pop up, especially in areas where they can make the most impact.

And it’s not just about building more homes. The Australian government is also throwing a lot of money into making housing more affordable. They’ve set up funds like the $10 billion Housing Australia Future Fund and the $2 billion Social Housing Accelerator Fund to boost the construction of homes that won’t break the bank. They’re even offering tax breaks and grants to encourage the private sector to build more affordable housing.

So, while the road ahead looks tough, these moves by the government could start to make a difference in the housing crisis, giving everyone a better shot at finding a place to call home without emptying their pockets.

Who’s Winning in the Housing Shortage Game

Current Winners

- Property Developers: Top players like Mirvac Group and Stockland Corporation are making the most out of the housing squeeze. They have a lot of land ready for building and are working on big housing projects. With so many people looking to buy, these companies are selling homes fast and at high prices.

- Construction Companies: It’s a tough time for builders, but firms like Lendlease Group that focus on big projects are in a good spot. As the government pushes to increase housing, these companies are finding lots of work helping build the infrastructure we need.

- Real Estate Investment Trusts (REITs): Trusts like Scentre Group and Vicinity Centres, which handle both shopping centers and residential properties, are seeing a boom. With rents and property values climbing, these REITs are a smart pick for investors wanting a piece of the real estate market through rental income and property value increases.

Who Might Win Big Soon

- Affordable Housing Developers: Groups like Housing Choices Australia and Community Housing Limited are set to gain from government funds and perks. They’re key players in providing homes for families who need an affordable option and will likely expand as funding increases.

- Modular and Prefab Home Builders: As the industry looks for quicker ways to build, companies making modular and prefabricated homes are on the rise. Businesses like Fleetwood Corporation and Modscape are known for their cost-effective and speedy building methods, which could help speed up how quickly we can get new homes built.

- Real Estate Tech Firms: Property tech companies such as Domain Holdings and REA Group are gearing up for more action in the housing market. These companies offer tech solutions that make it easier for everyone involved—buyers, sellers, and investors—to find what they need and make smart decisions quickly.

Each of these players is finding ways to thrive amid the challenges of Australia’s housing crisis, turning tough times into opportunities for growth and innovation. Whether it’s through building, managing, or providing tech solutions, they’re shaping the future of our housing industry.

If you’re keen to make a difference while also making money, think about putting some cash into affordable housing bonds. These bonds fund the building and upkeep of budget-friendly homes and are often backed by the government, making them a secure investment that also packs a social punch.

Conclusion: Never Waste a Good Housing Crisis

Australia’s growing housing crisis is no doubt a big problem, but it’s also filled with opportunities for the astute investor. By understanding what’s driving the crisis and spotting the companies likely to benefit from it, you can position yourself for a profitable venture. Whether you choose to invest in developers, REITs, bonds, or innovative housing technologies, each path offers a way to capitalize on the urgent need for more homes down under. As we see more reforms and government action to tackle the housing issues, those who navigate carefully will find plenty of chances to succeed.

What are the Best ASX Real Estate Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

West African Resources (ASX:WAF) Hits All-Time High After Record Gold Output: Buy, Hold, or Wait?

West African Resources: A Strong Gold Producer to Watch West African Resources (ASX: WAF) hit an all-time high of A$3.32…

The Metals Driving Australia’s Market in 2026

Australia will still be a metals market in 2026; that part is not up for debate. What is changing is…

Patagonia Lithium (ASX:PL3) Surges 53% on Ameerex Partnership: Is This Lithium Explorer a Buy?

Patagonia Lithium Secures Key Partnerships for Growth Patagonia Lithium (ASX: PL3) surged 53% to A$0.13 on Friday, hitting its highest…