The Bear Market in Small Caps may finally be over after 30 months!

![]() Marc Kennis, October 10, 2024

Marc Kennis, October 10, 2024

It’s been a rough few years for Small and Mid Cap Stocks!

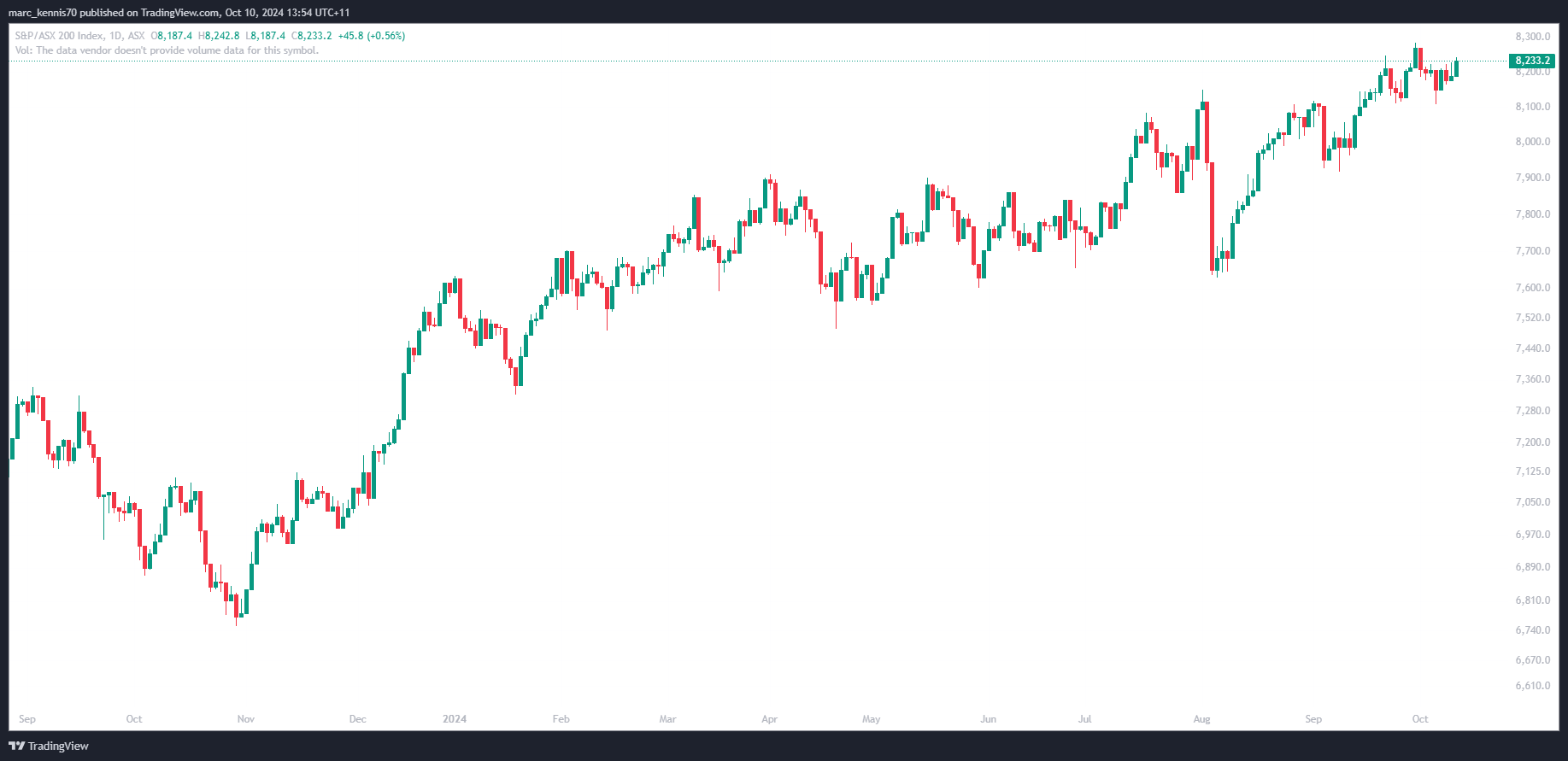

The Bear Market in Small Caps is now 30 months old. Ever since Central Banks around the world started raising interest rates in early 2022, large parts of the global equity markets have struggled, Small and Mid Cap stocks in particular. However, Large Cap stocks started to bounce back fairly quickly … as early as late 2022 and into 2023, although they traded sideways for much of that year. Then late 2023, Large Caps took off and never really looked back posting new record highs almost every day it seems! Just look at the chart below.

ASX200 last 12 months

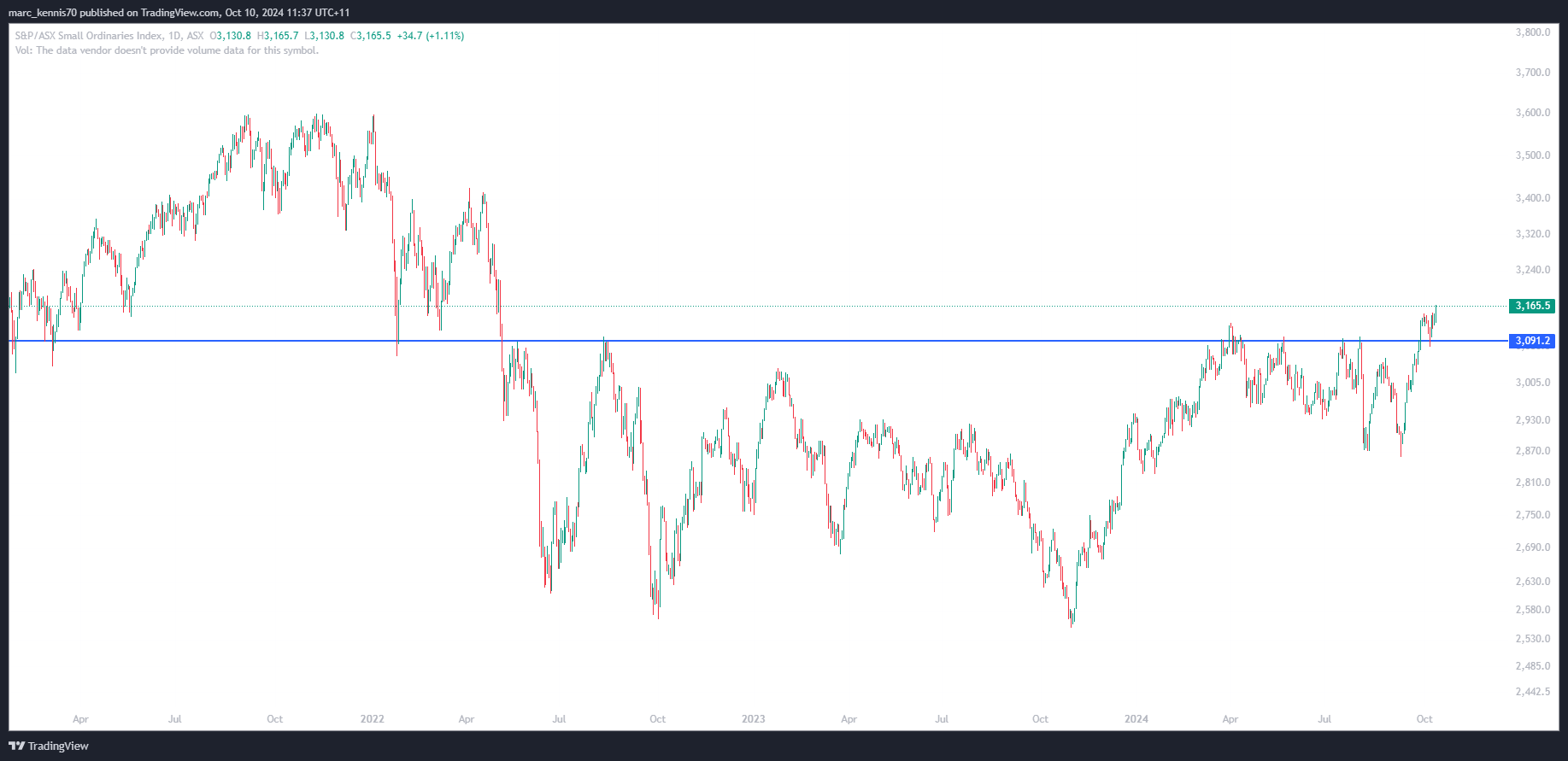

The story is different, though, for Mid Cap stocks and especially for Small Caps that are still in a Bear Market! Most of them continued to trade lower throughout 2023 and 2024. They didn’t really bottom out until October 2023. The broader group of ASX-listed stocks 101 through 300, as measured by market capitalisation, combined in the S&P/ASX Small Ordinaries Index (XSO), bounced up at that point to make up for some of the lost ground. But these smaller stocks on average have only traded sideways from April 2024 onwards (see chart below) while the ASX50 added more than 8% since 1 January 2024.

S&P/ASX Small Ordinaries Index

Small Caps have done even worse than Mid Caps

The picture is even more grim for Small Caps, or what could arguably be considered Micro Caps. The S&P/ASX Emerging Companies Index (XEC), which captures 200 Australian microcap companies ranked between 350 to 600 by market capitalisation, is still almost 18% below the peak of January 2022! So, definitely still in Bear Market territory. Part of this is for good reason. Some of these small companies have really struggled operationally in the last few years of high interest rates, high inflation and weak consumer spending, depending on what sector you look at. Many had to raise fresh capital at depressed valuations, leading to high dilution for existing shareholders.

Another reason has been the flight of institutional money, away from Small and Micro Caps towards Large Caps. Many of Australia’s Small Cap funds experienced substantial outflows in the last 2 years as investors opted for “safer haven” Large Caps. And when investors want their money back, the funds have to sell shares to cover these redemptions. So far, these investors haven’t been in a hurry to come back to Small Caps and, by default, neither have the Small Cap funds.

But the Small Cap Bear Market seems to be ending

There is good news, however. In the last few weeks, we at Stocks Down Under and Pitt Street Research have been seeing some green shoots come through! Specifically, stocks that had been declining for two years have been able to stop that decline in 2024. Many of them have subsequently been consolidating at these lower levels for several months and are now starting to go up again. Could this be the end to the Bear Market in Small Caps?

We believe these green shoots are largely attributable to interest rates coming down globally. The US FED started lowering rates in September, while the ECB, the BOE and other central banks have also started to ease off on their restrictive policies recently. And while the Australian RBA wants to appear touch on inflation and said it won’t lower the Cash Rate until sometime in 2025, we believe Australia’s Central Bank is once again behind the curve, like it was in 2022. We actually expect the RBA will start easing sooner than it has flagged so far, possibly already in December 2024.

In any case, Australia’s banks are not waiting for the RBA to see the error of its ways and have started to lower their interest rates for loans and mortgages as wholesale funding started to become cheaper earlier in 2024.

As interest rates start to come down and money essentially becomes cheaper, we expect valuations for all sorts of assets will start to go up, including valuations of Small Cap stocks. We have just seen the S&P/ASX Small Ordinaries Index test the recent breakout above the 3,091 level (chart above), which we also consider a good sign!

M&A activity in Small Caps is heating up

Another good indication that Small Caps stocks have become way too cheap, and that the Bear Market may be over, is take-over activity in this segment of the equity market.

A number of stocks that we have been watching because of low valuations relative to their financial prospects, have started to get take over offers. These stocks include BigTinCan (ASX:BTH), LiveHire (ASX:LVH), K2Fly (ASX:K2F), KeyPath Education (ASX:KED), Ansarada (ASX:AND), LiveTiles (ASX:LVT) Qantum Intellectual Property (ASX:QIP) to name a few. We believe this sort of M&A activity is a good indication of how low valuations for some high quality companies have become.

Small is beautiful … especially in Tech and Life Sciences

We believe we are finally at the end of the Great Small Cap Bear Market of 2022-2024. Interest rates are coming down, the smart money is shopping in Small Cap land and we’re seeing the leaders in their respective fields make substantial share price gains in recent weeks, especially in Tech and Life Sciences. We think this is only the start of more good things to come. So, get ready for a nice bull run in Small Caps!

What are the Best ASX Small & Mid Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…