Will the RBA Cut Interest Rates in 2024 and, if So, Which Stocks Should I Buy?

![]() Ujjwal Maheshwari, May 29, 2024

Ujjwal Maheshwari, May 29, 2024

The Reserve Bank of Australia (RBA) has been a focal point of economic discussions in 2024. With the cash rate at a 12-year high of 4.35%, Australians are eagerly anticipating potential relief. But will interest rates be cut this year, and if so, which stocks should investors consider buying?

The Likelihood of an RBA Rate Cut in 2024

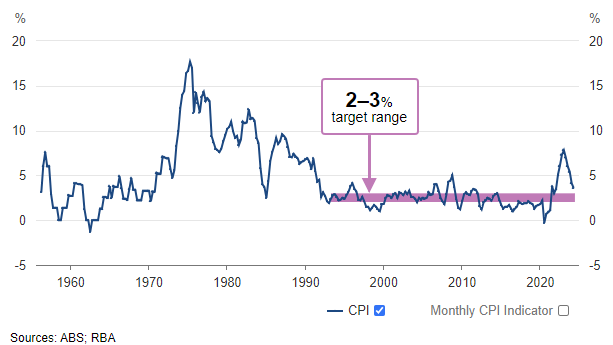

Australia is currently grappling with persistently high inflation, which has posed a significant challenge for the Reserve Bank of Australia (RBA). Although inflation eased to 3.5% in the year to March 2024, it remains above the RBA’s cash rate target range of 2-3%. In fact, in April inflation unexpectedly rose to 3.6% when the market was expecting a small decline to 3.4%!

Financial markets and analysts widely concur that a rate cut in the near term is unlikely. The RBA interest rate forecast has maintained an ambiguous stance, neither committing to nor dismissing the possibility of future rate hikes. This ambiguity has led to speculation among market participants regarding the timing and magnitude of potential rate cuts. Most economists anticipate that any rate reductions will occur in the latter part of 2024, with a modest cut expected in November.

Several key factors will influence the RBA’s decision-making process

First, this persistently high inflation is a primary concern for the RBA. The expectation is that inflation will not fall below the target range until 2025, which suggests the need to maintain higher interest rates for a longer period to control inflation effectively. This upward pressure on inflation means the RBA must consider the balance between domestic demand and inflation control.

Secondly, the overall economic data will significantly impact the RBA’s decisions. Australia’s economy has experienced a notable slowdown, with GDP growth at just 0.2% in the september quarter and an annual growth rate of 1.5%. Additionally, business confidence has dropped to an 11-year low, and consumer sentiment remains pessimistic due to rising borrowing costs and rising prices. These economic indicators signal that the economy is under pressure, which the RBA needs to consider.

Thirdly, the RBA closely monitors unemployment rates and broader labour market indicators. Recent data still shows relatively strong labor market conditions, which may slow the reduction in services inflation. Wage growth also impacts inflation and consumer spending, making it a vital factor in the RBA’s assessment. The sticky inflation in wages and services adds to the complexity of returning inflation to the target range.

However, both domestic and global influences are important. While the RBA focuses primarily on domestic issues, like household spending, financial stability and the effects of population growth on inflation, global factors such as the U.S. Federal Reserve’s monetary policy and its impact on the Australian dollar are also considered. However, domestic factors tend to have a more significant influence on the RBA’s decision making.

How Much Can Rates Be Cut?

The consensus among economists is that any rate cuts in 2024 will be modest. The RBA is expected to proceed cautiously to avoid undermining its progress in controlling inflation. Market expectations suggest that the cash rate could fall to around 4.10% by the end of the year, with further reductions possible in 2025, potentially bringing the rate to approximately 3.10% by the end of next year. This cautious approach is due to the current environment and the clear risk of rebounding inflation if rates are cut too aggressively.

Investment Opportunities

Interest rate cuts typically spur investment in growth-oriented sectors, particularly Technology and Life Sciences. Lower borrowing costs can fuel innovation and expansion, making these sectors attractive to investors in declining interest rate environments.

ASX Technology Stocks

Block Inc (ASX:SQ2)

This innovative company allows consumers to purchase items immediately and pay for them in instalments, which has revolutionised the retail experience. In a time where reduced borrowing costs can significantly enhance consumer spending, Block with its lower borrowing costs can reduce its interest expenses, improving profitability and freeing up cash for expanding its Cash App and Square services.

Increased consumer spending, driven by cheaper credit, can boost transaction volumes, enhancing gross payment volumes and profits. Additionally, lower rates can help Block invest more in technology and acquisitions, strengthening its market position. Improved market confidence can attract more investors, potentially raising the share price. Overall, these factors can positively impact Block’s financials, supporting its strong revenue and profit growth.

Xero Limited (ASX:XRO)

Xero’s products help businesses automate and streamline their accounting processes, reducing costs and improving efficiency. In a high-interest rate environment, where businesses face higher borrowing costs, the ability to save on operational expenses becomes even more valuable. Xero’s software can help businesses manage these financial pressures more effectively, potentially increasing demand for their solutions.

Xero operates on a subscription-based revenue model, which provides predictable and recurring revenue. This model is less susceptible to economic fluctuations compared to businesses that rely on one-time sales. Investors might find this stability attractive, especially in an uncertain economic climate influenced by high-interest rates.

Check out our recent article on Xero here

WiseTech Global (ASX:WTC)

WiseTech provides software solutions for the logistics industry, which is essential for global trade and supply chain management. Regardless of interest rate fluctuations, the logistics sector remains crucial as businesses continue to require efficient supply chain operations.

Similar to Xero, WiseTech operates on a subscription-based revenue model, which provides predictable and recurring revenue streams. This model offers financial stability and makes WiseTech less vulnerable to economic fluctuations compared to companies reliant on one-time sales.

ASX Healthcare Stocks

CSL Limited (ASX:CSL)

CSL’s portfolio includes treatments for rare and serious diseases, making it a critical player in the healthcare sector. CSL is well-positioned to benefit from increasing global healthcare spending and population growth. As populations age and the prevalence of chronic diseases rises, the demand for advanced medical treatments and vaccines is expected to grow. CSL’s extensive product portfolio, which spans immunoglobulins, specialty products and influenza vaccines, provides a diversified revenue stream. Additionally, the company’s global reach, with operations in over 60 countries, ensures broad market access and opportunities for expansion.

Cochlear Limited (ASX:COH)

Cochlear’s implants and sound processors are renowned for their reliability and effectiveness, making the company a leader in the hearing solutions market. The company’s strong focus on R&D and customer-centric approach has enabled it to maintain a competitive edge.

Cochlear’s growth potential is substantial, driven by an aging population and the increasing incidence of hearing loss. As the global population ages, the demand for advanced hearing solutions is expected to rise significantly. Moreover, the company’s efforts to improve patient outcomes through enhanced product features and services are likely to drive increased adoption of its solutions.

Cochlear generates a significant portion of its revenue from services and upgrades for its existing customer base. This recurring revenue model provides financial stability and predictability, which is particularly valuable during periods of economic uncertainty and high-interest rates

ResMed Inc. (ASX:RMD)

The company’s comprehensive product line includes devices and software solutions designed to improve the diagnosis, treatment and management of sleep disorders.

As more individuals seek diagnosis and treatment for sleep apnea, the demand for ResMed’s products is expected to rise. Additionally, the shift towards digital health and remote patient monitoring presents substantial opportunities for ResMed to expand its market reach. With a strong market position and a focus on innovation, ResMed is well-positioned to capitalise on the growing demand for respiratory care solutions.

Check out our recent article on ResMed here

The Case for Mid and Small Cap Stocks

While large-cap stocks, such as CSL and Block, often capture investor attention due to their established market presence and steady performance, mid and small-cap stocks present unique and substantial growth opportunities, especially in a low-interest-rate environment. These companies typically have greater room for expansion and can leverage lower borrowing and funding costs to fuel their growth initiatives. Unlike their larger counterparts, mid and small-cap stocks have significant catching up to do, which can lead to outsized returns for investors willing to take on a bit more risk.

Promising Mid and Small Cap Stocks

Mesoblast Limited (ASX:MSB)

Mesoblast Limited is at the forefront of regenerative medicine and stem cell therapies, focusing on developing innovative treatments that have the potential to transform healthcare. The company’s research and development efforts are concentrated on creating therapies for a range of conditions, including heart failure, chronic back pain and inflammatory diseases.

Mesoblast’s growth potential is considerable, driven by its advanced clinical trials and the possibility of regulatory approvals for its therapies. Success in these trials could lead to groundbreaking treatments reaching the market, significantly boosting the company’s valuation and market share. As regulatory bodies continue to recognize the efficacy and safety of stem cell therapies, Mesoblast stands to benefit immensely from first-mover advantages and a robust pipeline of innovative products.

Weebit Nano Ltd (ASX:WBT)

The RBA’s interest rate cuts can significantly benefit Weebit Nano. With lower borrowing costs, Weebit Nano can finance its cutting-edge research and development projects more affordably, pushing forward innovations in nanotechnology. This financial flexibility can also support the company’s plans for expanding its production facilities and entering new markets.

Additionally, reduced interest rates typically increase consumer spending. For Weebit Nano, this can lead to higher demand for its advanced nanotechnology products used in electronics and healthcare sectors. This boost in sales can drive overall growth.

Moreover, cheaper borrowing costs can facilitate strategic investments, such as upgrading equipment or acquiring smaller tech firms, enhancing Weebit Nano’s competitive edge. Improved market confidence resulting from economic stimulation can also attract more investors and foster beneficial partnerships with other tech innovators.

Imugene Limited (ASX:IMU)

Imugene focuses on harnessing the body’s immune system to target and eliminate cancer cells, a cutting-edge approach that has shown promise in clinical trials. Imugene’s pipeline includes several candidates designed to improve the efficacy of existing treatments and provide new therapeutic options for patients.

Breakthroughs in cancer treatment, supported by positive clinical trial results, could significantly enhance the company’s valuation and market penetration. The growing recognition of immunotherapy as a viable and effective cancer treatment modality positions Imugene at the forefront of this revolutionary field. As the company progresses towards regulatory approvals and commercialisation of its therapies, we believe investors could expect substantial appreciation in stock value, reflecting the transformative impact of its innovations in oncology.

Conclusion

While the RBA’s interest rate cuts in 2024 are not guaranteed, the possibility remains, especially if inflation moderates and economic conditions worsen. Investors should keep a close eye on economic indicators and central bank communications to stay ahead of potential market movements. Household budgets and discretionary spending will be key indicators to watch in the year ahead. Additionally, major banks and their interest rate forecasts will provide insights into potential downturn scenarios. As Australian households navigate the current economic cycle and sticky inflation, staying informed and making strategic investment decisions will be crucial.

But when interest rates finally start to come down, we believe Technology and Life Sciences stocks have the best chance of high returns for investors.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…