Recce’s Phase 2 ABSSSI Clinical Trial is on Track and Producing Outstanding Results

There are encouraging signs from Recce Pharmaceuticals‘ (ASX:RCE) Phase 2 ABSSSI Clinical Trial (Acute Bacterial Skin and Skin Structure Infections). The trial, is nearing completion, but the results to date have led to a Non-Data Safety Monitoring Board reviewing the trial unanimously recommending it continue.

Not only have there been no serious adverse events, but all patients completing treatment with Recce’s R327G (R327 in a gel formuation) have either achieved a complete cure or improvement.

Reintroduction to Recce and R327

For the sake of investors new to the story, Recce Pharmaceuticals is a biotech company dedicated to fighting a broad range of bacteria resistant to conventional antibiotics – with diabetic foot infections, urinary tract infections and sepsis being some examples. These kinds of bacteria cause significant healthcare costs and bodily damage. Consider the fact that there approximately 50% of all diabetic foot ulcers develop infection, which can lead to sepsis, gangrene, amputation, and death. Sepsis alone causes 11m deaths annually – more than deaths from prostate cancer, breast cancer and HIV/AIDs put together.

RECCE® 327 (R327) is the company’s most advanced asset. It has a unique Mechanism of Action (outlined below), working fast and continuing to work just as effectively with repeated use. Endurance is something existing antimicrobial solutions tend to stumble at, especially when bacteria mutates.

Recce’s Phase 2 ABSSSI Clinical Trial

Recce has several clinical trials underway, one of which is a Phase 2 trial of R327G in Acute Bacterial Skin and Skin Structure Infections (ABSSSI). The acronym ABSSI includes conditions such as diabetic foot infections (DFI), necrotising fasciitis, postoperative wound infections, and more.

Conducting a study in ABSSIs enables the company to bring together all the work it has done on these infections, under one key centralised regulatory category for a broad range of medical needs in the topical bacterial infection landscape. Looking globally, the ABSSSI treatment market size was US$7.8bn back in 2018 and is projected to reach US$26bn by 2032. representing a significant healthcare problem as well as an opportunity for Recce.

The trial has now dosed 20 out of a total 30 patients, all of whom either will or have received R327G once daily for 7 to 14 days for an ABSSI. Ethics approval for the trial was received in June 2024. Four months on, the study has dosed more than three quarters of the patients intended to be enrolled, and a clinical study review has been released from the independent non-Data Safety Monitoring Board. The board found no safety concerns, no serious adverse effects, and highly encouraging efficacy results as outlined below.

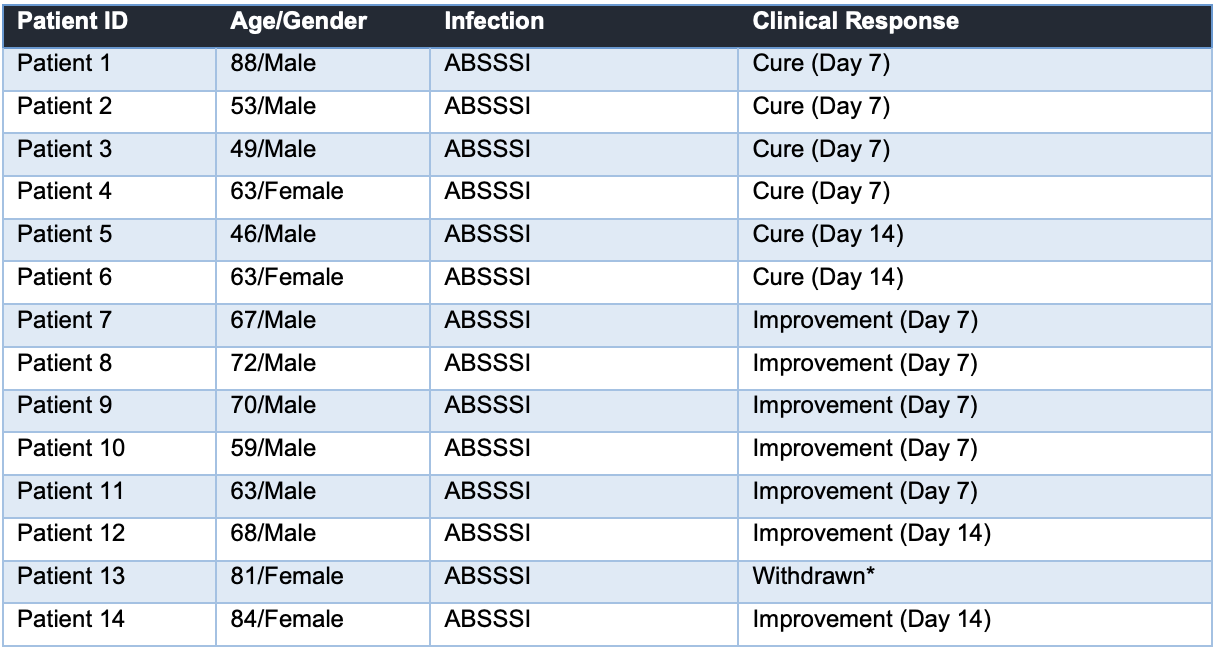

All patients completing treatments were positive on the primary endpoint, achieving either a complete cure or improvement – with some showing results in as little as 7 days. The patients had a variety of infections including diabetic food ulcers, eczema, scratch and puncture wound infections. The board recommended that the study should continue.

Source: Company; Note: The withdrawn patient was withdrawn due to pain at the wound site which was judged to be unlikely to be related to R327G

Recce is one of the most exciting ASX biotechs

Recce Pharmaceuticals is one of the few biotechs that has:

- multiple Phase II trials underway with interim efficacy data that is unanimously positive,

- An asset (in R327) with patents across multiple jurisdiction,

- Is working with the US Department of Defence following a US$2m grant,

- Such an extensive development pipeline,

- Awarded over $50m in grant funding from from AusIndustry for its Synthetic Antibiotic and Anti-Viral R&D expenditure, and

- a Qualified Infectious Disease Product (QIDP) designation for R327. This would enable the drug fast tracked product designation when going for clinical approval, plus 10 years of market exclusivity post approval.

These are just a handful of highlights of the company that investors who take a closer look at it will see.

This is a sponsored article.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…