Viva Leisure (ASX:VVA): When will investors realise the truth about Australia’s 2nd largest fitness network?

The pandemic is ancient history by now, but seemingly no one told investors looking at Viva Leisure (ASX:VVA). Because this company still has not recovered to levels seen pre-pandemic even though it is a bigger and better business than it was before.

Viva Leisure: Australia’s 2nd largest fitness network

To briefly recap the company, it listed in 2019 and has grown significantly since then. It is the Master Franchisor of Plus Fitness and the outright owner of several other fitness brands in multiple segments. For instance, it has clubs just for women, clubs just for cyclists, clubs just for boxers and several others. In September, it spent $2m for a 34% in Boutique Fitness Studios. Overall, the company is the 2nd largest operator in Australia, only behind Anytime Fitness. It is actually far larger than many better known brands including F45 which has 261 in Australia and Fitness First with 230.

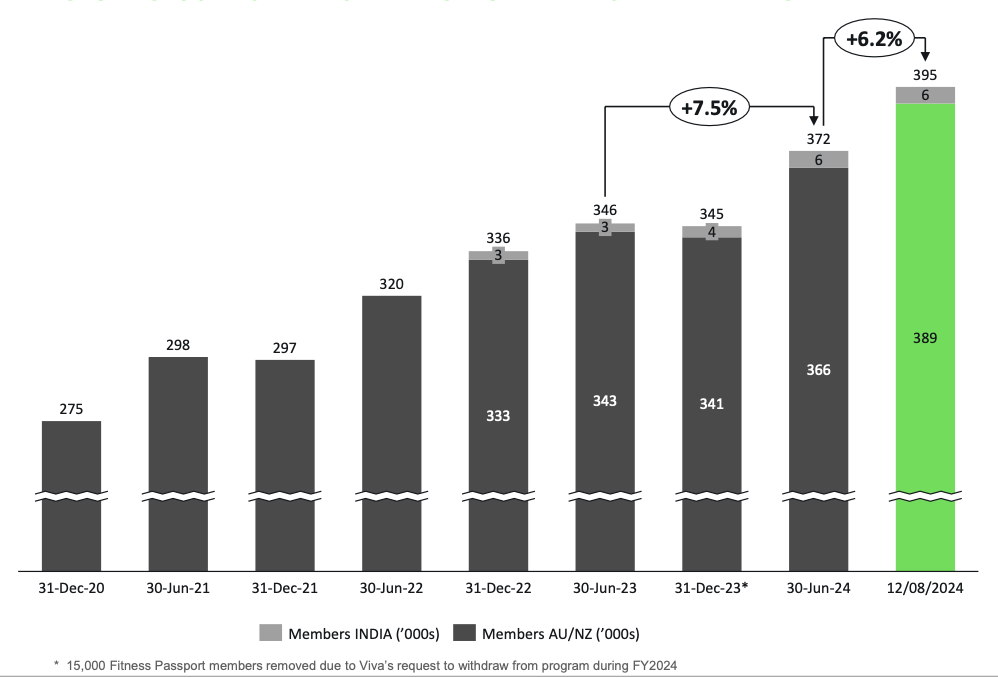

Viva has several competitive advantages, including market share, utilising data in its operations (to predict things such as when a member is at risk of cancelling) and offering members roaming between locations. When Viva kicked off its IPO marketing activities in late 2018, it had 30 clubs and just 42,500 members. Today, both numbers are <13x and <9x higher respectively with over 400 clubs and 395,000 members. And both figures continued to grow in FY24.

Source: Company

Why the skepticism?

Of course Viva Leisure was impacted by the pandemic and its locations were forced to close at various times. We don’t imagine that is why shares have not recovered. We see three reasons.

First is the fact that it is a rolled-up company. Many rolled-up companies like Healthia and DGL gained substantially in a low-interest rate and bull market environment, but have gone in the other direction as interest rates have grown as they have slowed down the M&A activity out of necessity and investors realised they either were not growing or weren’t growing as fast as investors have perceived.

Secondly, we think investors think Viva has competition with non-paying fitness activities like run clubs and solo activities like swimming. Viva’s membership numbers show that this may not be a case of run clubs stealing share from Viva, but the entire market growing. If you genuinely want to improve your health, you’ll need a trainer and a place with professional equipment to make it possible.

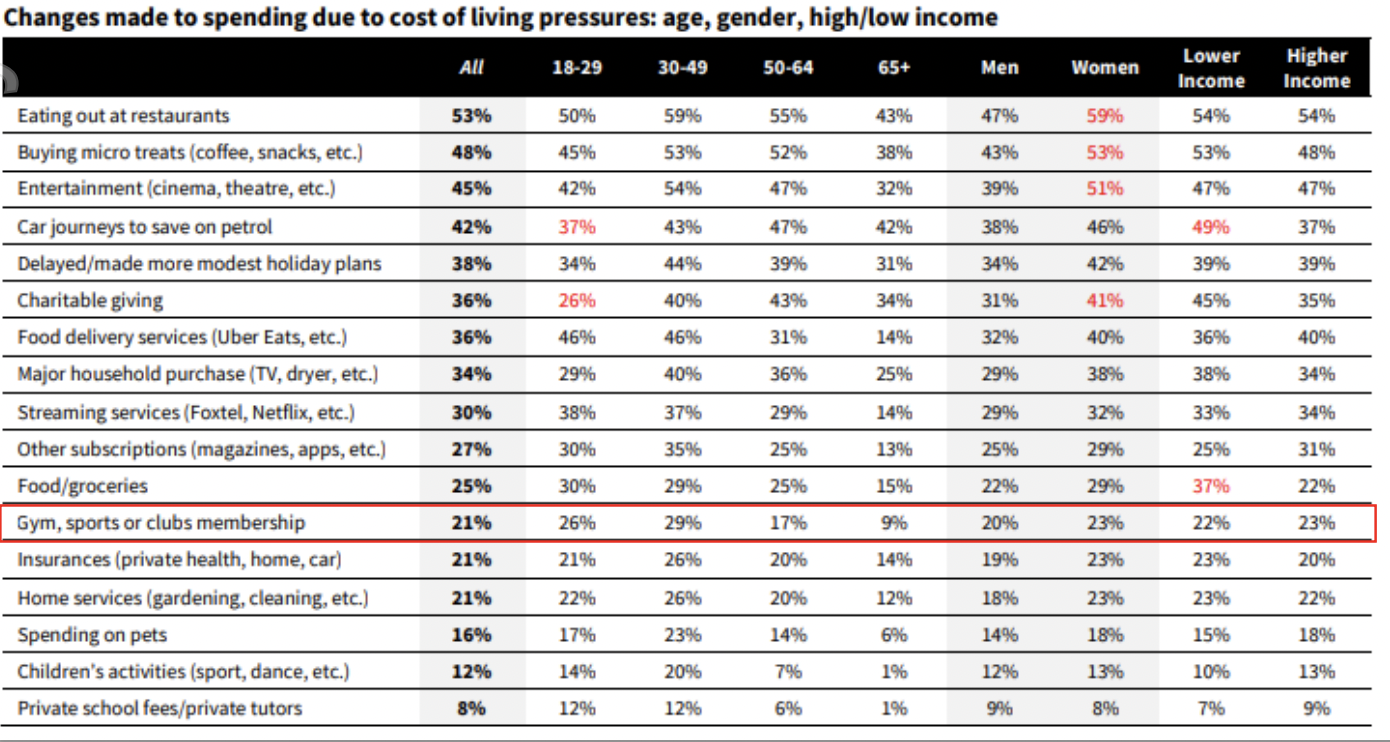

Moreover, it is actually the case that gym penetration rates are low, at just 16%. So if anything, Viva is a hunter for market share and not the hunted. Whilst we are on the ‘cost of living crisis’ angle, we note the average age of its members is 31 and the data says gyms are far down on the list of things people are giving up.

Source: NAB, Company

The opportunity

We also think investors are forgetting that the company is expanding into foreign markets. Only last week, the company announced it signed a partnership for its Plus Fitness brand to expand into a few countries in Asia – namely Singapore, Malaysia and the Philippines. We mentioned above that gym penetration is 16% in Australia, but it is below 6% in Singapore and below 2% in the other 2 countries. We see high potential for international expansion, not just because gym penetration generally may increase, but its franchise model provides flexibility for users to switch between locations and to use the gyms at their time and as they choose.

Conclusion

It is not often you can buy a company that is the 2nd largest player in a major market like Viva Leisure is. We think if the public market does not re-rate it…the private market will. Hint: Ask Healthia.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…