Boss Energy (ASX:BOE): Its Honeymoon Uranium Project is back in production! But FY26 isn’t expected to go to (the previous) plan

Boss Energy’s (ASX:BOE) South Australian project may be called Honeymoon, but it has been anything but that for investors. And yesterday’s ‘upgrade’ to its opex and capex for the year ahead was evidently the last straw for many.

Boss Energy’s Honeymoon project

Lying in South Australia, it has 52.4Mt at 0.062% uranium for 71.6Mlbs. The Measured category has 3.1Mt for 7.6Mlbs uranium. Boss anticipates a 10 year mine life with 2.5Mlb annual production over that time. And that’s before you account for further exploration at the project – it reckons there’s a 100Mlb exploration target. In FY25 alone, it anticipates 850k lbs.

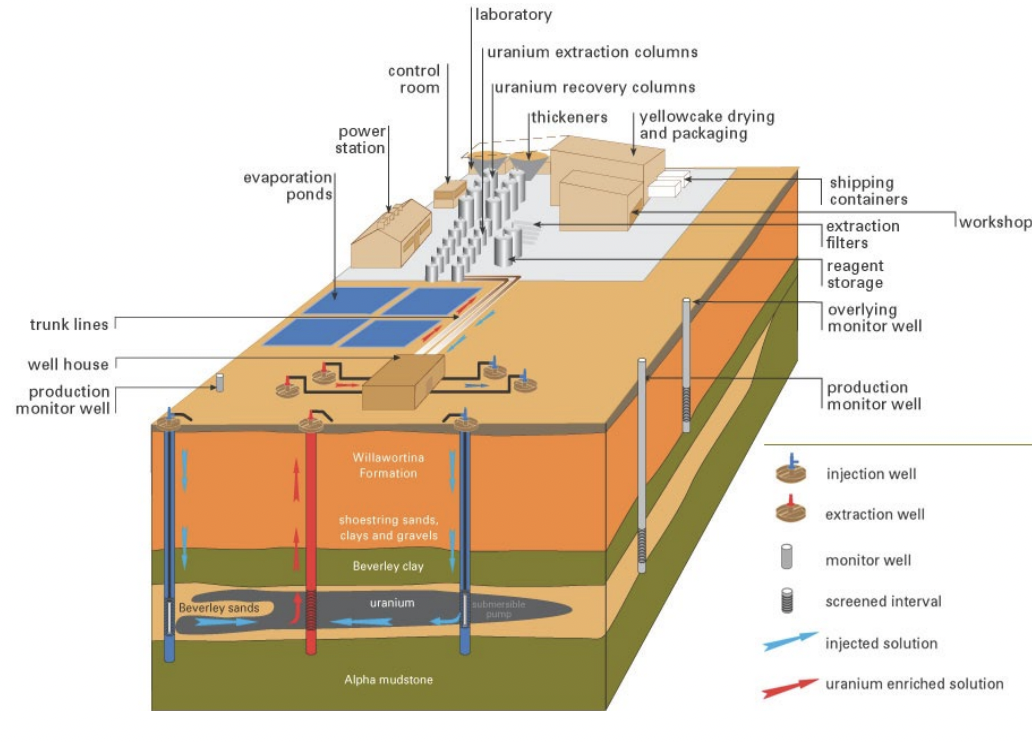

Boss prides itself on being a low-cost operation. This is because it uses In-Situ Recovery (ISR) Mining. This involves leach liquor being injected through the uranium hosted ore body to recover high grade pregnant liquor solution by production wells and is pumped to the surface. Uranium is extracted using ion exchange, precipitated out and dried to produce uranium. This is 2/3 the cost of conventional mining and the average capex is less than 15% of conventional mines.

Source: Company

The company still has a market cap of over A$700m, zero debt and $229m in cash and liquid assets. The company has entered into binding sales agreements to sell 3.5Mlbs to major American an European power utilities over the next 8 years.

And many investors may not know this, but it picked up 30% of a project in Texas – the Alta Mesa ISR Uranium Project. This has produced the third largest amount of uranium of all ISR assets in the US, producing 4.5Mlb between 2005 and 2013. It has a 20Mlb total high-grade resource of 1,200ppm and a 1.5Mlb plant capacity.

Boss Energy had a great 2022 and 2023…

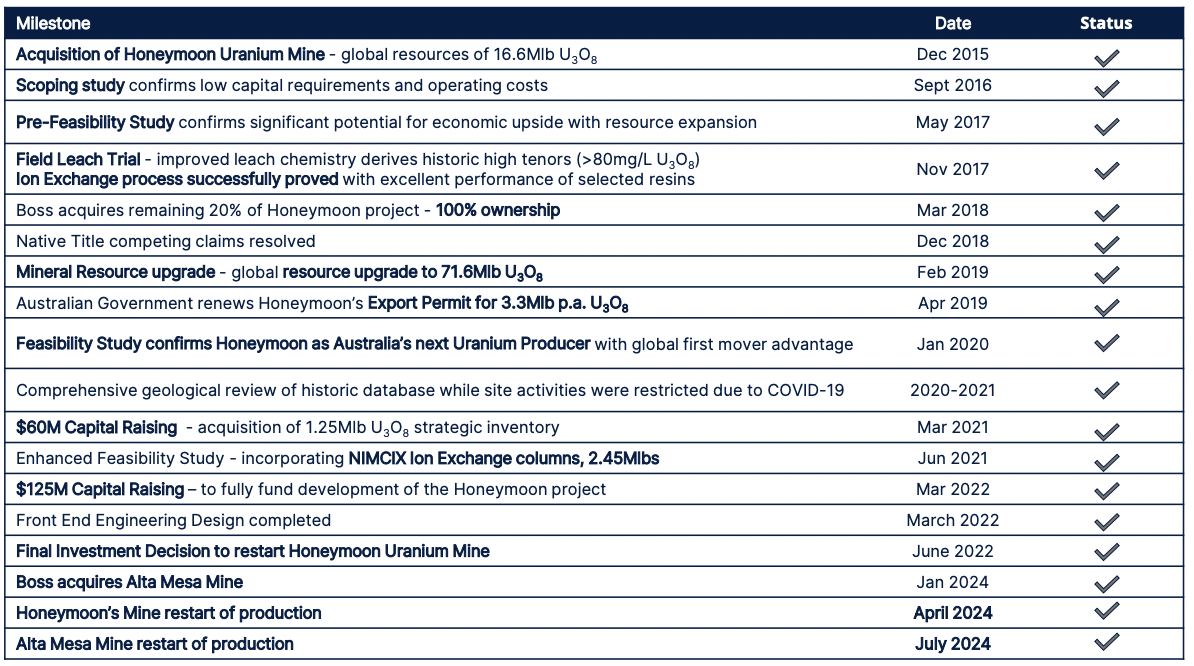

For Boss and the uranium sector, it had been a stellar couple of years in 2022 and 2023 as investors rode the uranium wave. After more than a decade in the doldrums post-GFC, yellowcake prices reached levels not seen since those days. Boss Energy had been planning to re-start Honeymoon since it took over the project in late 2015.

But as prices recovered, things were really getting serious as it raised $125m to fully fund development of the project and made a Final Investment Decision. This was off the back of a mid-2021 Feasibility Study that delivered a US$309m (up 35% in just 18 months), a 47% pre-tax IRR and 62% EBITDA margin. And this was only based off half of the 71.6Mlb resource.

Source: Company

But a bad 2024 and 2025

Boss Energy’s Honeymoon project was officially restarted in 2024, but it was not the best timing. After uranium prices peaked in January (at over US$100 per pound), they corrected and are now at US$76.40 a pound.

Even though there is interest in nuclear power the talk has not (yet) translated into uranium buying and procurement. The rejection of Peter Dutton’s plan to build nuclear power plants showed just how hard it can be. Moreover, as companies like Boss restart production, this is resulting in an over-supply.

Adding insult to injury, and this is why shares fell over 40% on Monday July 29, Boss has had production issues. Despite exceeding its first-year production and cost guidance and the company still promises to be cashflow positive in FY26, the guidance given was higher than expected. FY26 cost guidance was 23% higher, AISC is tipped to be 42% higher and capex 64% higher.

What’s more is that the company announced an independent review to the project due to ‘less continuity of mineralisation and leachability’ at Honeymoon. Sounds vague, doesn’t it? We agree and that probably adds to the problem. When a company gives a MRE, it can never be certain it’ll have the entire reosurce, it is just an estimate based off exploration and subsequent estimates.

Oh and we forgot to mention that CEO Duncan Craib announced he was departing a week earlier. And he’ll be walking off having sold $21m worth of shares at $5.63 in May 2024. So much for solidarity with shareholders.

Conclusion

Boss Energy deserves a hat tip because it took courage to hold onto an asset like Honeymoon for so long, in optimism such a time would come when production there could be profitable again. We think it right to be optimistic about the long-term outlook for uranium.

But it’ll take a while for investors to regain confidence. Stocks like Core Lithium and Bellevue Hill show they can bottom out, but even those two are yet to recover to highs previously seen prior to either cost upgrades or production downgrades. And for them to even show some signs of recovery, investors need concrete evidence. And it could take a while to see such evidence.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

The Metals Driving Australia’s Market in 2026

Australia will still be a metals market in 2026; that part is not up for debate. What is changing is…

Patagonia Lithium (ASX:PL3) Surges 53% on Ameerex Partnership: Is This Lithium Explorer a Buy?

Patagonia Lithium Secures Key Partnerships for Growth Patagonia Lithium (ASX: PL3) surged 53% to A$0.13 on Friday, hitting its highest…

Aristocrat Leisure (ASX:ALL) Extends $750m Buyback: Time to Buy Australia’s Gaming Giant?

Aristocrat Leisure: A Compelling Investment Opportunity Aristocrat Leisure (ASX: ALL) rose 1.01% to A$57.22 on Friday after announcing a A$750…