Orthocell (ASX:OCC): All systems go for a US market roll out of its flagship Remplir nerve repair product

Orthocell (ASX:OCC) is the latest ASX biotech to obtain FDA approval. Its nerve repair product Remplir was already approved in Australia, New Zealand and Singapore, plus approval is pending in Canada and Thailand. But the US was the biggest piece of the US$3.5bn pie that is the company’s global addressable market, and now it is good to go.

As a side note, this company’s approval is comes only days after Artrya (ASX:AYA) received its green light, and EBR Systems (ASX:EBR) could be a matter of days. So, notwithstanding the failure of Opthea, 2025 could be the best year for ASX Biotechs since at least 2021…but enough on other companies because Orthocell deserves its moment in spotlight.

Orthocell’s FDA approval is several years in the making

Orthocell listed on the ASX in 2014 and its work dates back to 2000 when its founders worked on regenerative therapies at the University of WA. It has a biological collage membrane ‘platform’ device known as Celgro which is the basis of Remplir and other products.

At the time of its listing, Orthocell’s flagship products were two cell-based, regenerative products (Ortho-ACI and Ortho-ATI) which repair injuries by using a patient’s own cells. These have been slower to roll out. Then there is the Striate resorbable collage membrane that can be used for dental bone and regeneration procedures and is FDA approved.

But the approval of Remplir is a company-defining moment. Although Orthocell said it before we did, we would not disagree because it is the company’s flagship product and provides the largest opportunity.

Why Remplir is a big deal

Remplir helps repair peripheral nerve injuries by wrapping the area with collagen nerve. It provides compression-free protection to the nerve, generating an ideal microenvironment to aid healing. The nerve is returned to its pre-injured state. It can serve a number of purposes.

Source: Company

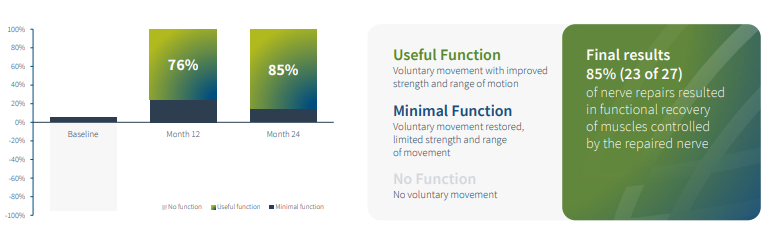

Clinical trial results have been outstanding. Well, of course they had to be for the company to get FDA approval, but it isn’t worth snuffing at the results. 85% of nerve repairs using Remplir resulted in functional recovery of muscles within 24 months, and 76% in 12 months. Granted, this does include both those who only had some voluntary movement restored although those that had only a modest degree of improved strength and a range of motion were in the minority.

Source: Company

Right now, the gold standard technique for peripheral nerve repair is by suturing – in other words, stitches (a needle and thread is used to close wounds). The trouble is that it is difficult to achieve alignment, and it may induce foreign body reaction which can lead to chronic inflammation, fibrosis and scarring. Success rates are 50-70%.

But now, Remplir offers an alternative treatment. We noted above that the market is US$3.5bn, but the US is worth US$1.6bn of that. Even though there are some market incumbents, even they have a low penetration rate. The problem is that materials are too rigid, challenging to deploy and make it difficult to manage size differences between nerve ends, leading to compression injuries or neuroma formation.

Remplir is ready to be shipped out from Day 1. There is a manufacturing facility in WA with an annual capacity of 100,000 units, and a US-based central warehousing, order fulfillment and customer service centre. Inventories have a 3-year shelf life and can be made by back-up suppliers if needed.

The company is set to go with sales distributors, key opinion leaders and influential hospital reference sites at the ready. It plans for 12 distributors within 6-12 months. It has $32m in cash at bank and recently welcomed to the board Avita inventor Fiona Wood. Also sitting on the board is former US ambassador Kim Beazley as well as former professor of medicine at Harvard Dr Rravi Thadhani.

Conclusion

It is all systems go for Orthocell now. It has taken many years of hard work, but the company is all set to launch its flagship technology in the US market.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…