AMP Limited: Breaking up is the best thing to do

Russell Katz, November 5, 2020

5 November 2020

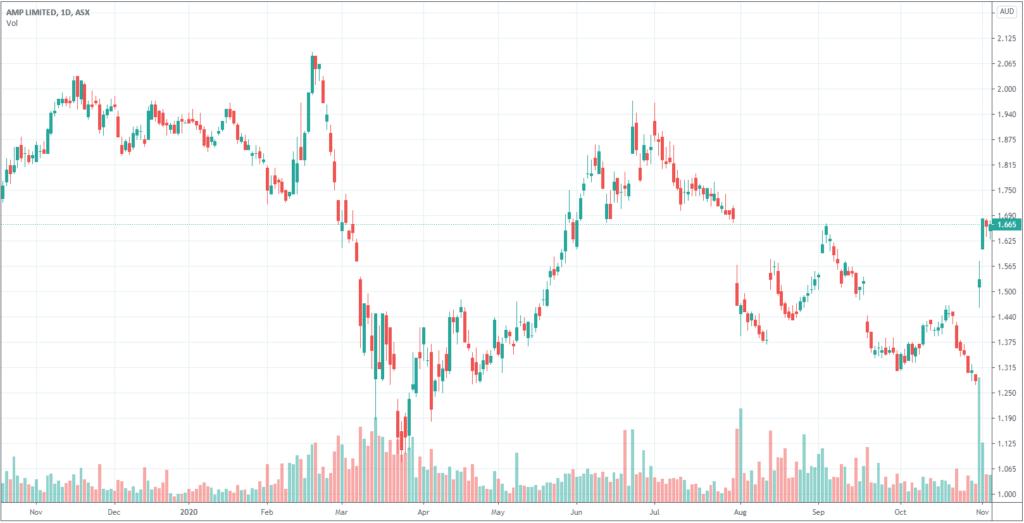

When we rated AMP four stars back on 4 September 2020, we placed a fairly significant requirement that the company was sold, either in pieces or in a single sale. We stand by our analysis today and sincerely believe that AMP management has so thoroughly destroyed its brand that if the company is not committed to breaking up, we would need an immediate two star rating on the company.

AMP announced on Monday, 2 November 2020, that they had received a non-binding offer from American buyout firm Ares Management at an indicative value of $1.85 per share. It is clear AMP management is holding out for an all-cash offer as the Ares offer is an unknown split of cash and script and there were rumours in the AFR that Ares is prepared to make an all cash offer as well.

So how would $1.85 turn out? Our initial four-star rating on 4 September 2020 was issued at $1.66 per share and our first update on 11 September 2020 reiterated our four-star rating at $1.57 per share. If our readers purchased during either of these ratings, a $1.85 buyout would provide a decent return. However, AMP management has made it clear there are many other companies interested in either part or all of the company. While $1.85 is definitely nothing to turn your head at, we still believe the final sale price will be higher as other companies come out of the woodwork and make their offers.

Want to become a better investor. Let us help you!

Get our 4 publications per week on ASX-listed

large, mid and small cap companies across all sectors

Model portfolios

Investor Webinars

Get access to all editions through a 30-day FREE TRIAL.

No credit card required!

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Evolution Mining (ASX:EVN) Delivers Record Cash Flow as Shares Hit All-Time High: Buy, Hold or Take Profits?

Evolution Mining (ASX:EVN) delivered another blockbuster quarter, with shares touching a fresh all-time high of A$13.30 after the company reported…

Paladin Energy (ASX:PDN) Higher Grades Drive a Strong Quarter

Why the Market Re-Rated This Uranium Update Despite broader market volatility, Paladin delivered a strong operational result, with the share…