Appen shares have plunged 90% from their peak! Is there any end to the bloodbath in sight?

There are few ASX shares that have seen such a fall from grace as Appen shares since 2020. In those days, Appen was such a good stock, it was part of a quintet of stocks deemed the WAAAX stocks and claimed to have outperformed the American FAANG stocks. Moreover, it was capitalised at over $3bn.

While some other stocks in the WAAAX cohort have continued onwards and upwards, it has not been so with Appen. And just when it appeared (for a few months last year) that things were looking up, it is back to Square One.

Recap of Appen

Appen sources and sells machine learning data to train AI algorithms. Historically, its client base was concentrated around a handful of big tech companies and predominantly for advertising purposes. Appen has been diversifying its customer base into new clients and markets although investors fear these cash flows won’t be as reliable and as strong as before. This has been showing in its results and in repeated failure to meet its own guidance, let alone consensus estimates.

In FY22, which is the calendar year, its revenue fell by 25% and its bottom line swung from a $28m profit to a $239m loss. In FY23, the stock surpassed $3 on a couple of occasions over hype that it can capitalise on the rise of ChatGPT and hope that things can be better because of new management and a cost reduction program. A key promise was that it would reach ‘underlying cash EBITDA profitability on an annualised, run-rate basis‘.

Losing Google was a key downward catalyst for Appen shares

2024 started bad for the company. Google informed Appen that it would be terminating its contract, effective in mid-March. In CY23, Appen received $82.8m from Google at a gross margin of 26%.

In the next 2 weeks, the company hired a new CEO, Ryan Kolln and implemented measures to mitigate the loss of the contract. It told investors it had implemented $60m in cost reduction measures.

In its CY23 results:

- Operating revenue declined 30% to $273m,

- Underlying EBITDA was in the red by $20.4m before forex losses, by $24.5m including forex losses,

- The underlying net loss was $52.8m.

It opted not to pay a dividend and closed with a cash balance of $32.1m. Adding insult to injury, a $154m takeover bid from New Jersey data engineering company Innodata fell through. Probably not as bad as when the $1.2bn takeover bid from Telus fell through a couple of years prior (a company that owns Appen’s main rival Lionbridge).

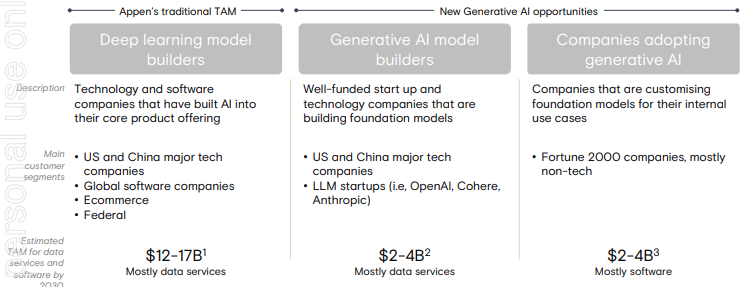

Appen has continued to sell the AI boom and that there is a chance for it to benefit. The estimates it has used (from Bloomberg Intelligence) suggest generative AI will be $1.3tn in 2032, up from $40bn in 2022 – that is 42% CAGR growth! Generative AI is also forecast to contribute $7tn to the global economy over the next 10 years. It also claimed that Generative AI has ‘expanded our TAM [Total Addressable Market] by $4-8bn’.

But the harsh reality is that the big tech giants have developed their own AI capabilities in house, for themselves and for other companies. And these markets are not as big as its traditional market.

Source: Company

Things were looking up…but

Appen shares went on a decent run in the first half of FY24. Although its operating revenue fell 18.4%, it was only down 1.5% excluding the impact of Google. Its gross margin improved 0.4 percentage points and its underlying EBITDA loss was just over $2m. Its underlying net loss was $11.8m and statutory loss was $17.8m, both $20m+ improvements. A $50m placement only briefly dented its share price. It purported to have returned to EBITDA profitability in the September quarter.

But to say the company’s FY24 results were poorly received was an understatement. The share price was $2.88 just prior to its release, then shares fell to $1.74 immediately and fell to $1 in the following weeks.

The drop led to the ASX sending the company a query. It all but said the market had it wrong, noting ‘it is possible that the market may have misinterpreted the…outlook provided in APX’s FY24 results’. It said that year to date project volumes were lower due to ‘annual planning by some major customers’, but the company remained confident in growth, noting adjusted revenue was 16% higher than a year ago excluding the impact of Google’s exit.

In Appen’s full FY24 results, revenue fell 14.2% mostly due to Google but (as noted above) its ‘adjusted’ revenue increased 16%. Its loss was $10.5m on an underlying basis and $20m on a statutory basis, figures that were $42.3m and $98.1m better than the year before respectively. The company gave no specific guidance but purported to have seen ‘positive signals on LLM related data growth’ and it was ‘highly focused on ongoing cash EBITDA positivity’.

Consensus estimates expect continued bottom line losses until FY27, although they expect 6% revenue growth in FY25, then 11% growth in FY26.

Shares crashed because when things are glum there’s worse to come

The Google news a year ago is still haunting the company, as investors fear there’s worse to come. The revealing of just how much revenue it was generating from Google showed the pivot away from Big Tech was going way too slow at best, or not happening at all at worst. We wouldn’t be surprised to see other big name clients publicly cancelling because big tech companies are gradually developing their own tools.

Now, we are not suggesting the company will go bust anytime soon, but it is in a new era that could lead to it having more customers, but making less money from each of them.

The bottom line here is that this is a company with an existential crisis that appears no closer to solving it than it was a year or two ago. The only reason you’d buy it is if you were desperate to reduce a Capital Gains Tax bill.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…