WAAAX stocks in 2024: WAAAX on, WAAAX off!

![]() Nick Sundich, April 5, 2024

Nick Sundich, April 5, 2024

Remember the days when WAAAX stocks were outperforming FAANG stocks, so we were told by journalists and analysts?

The WAAAX stocks were a basket of 5 ASX tech stocks – WiseTech (ASX:WTC), Altium (ASX:ALT), Appen (ASX:APX), Afterpay (ASX:APT) and Xero (ASX:XRO). This basket is technically no more since Afterpay was swallowed up by Block (ASX:SQ2), even though the Jack Dorsey-led fintech has opted to list on the ASX in Afterpay’s place.

But we thought it would be interesting to revisit how the rest of these companies have been going and if they are still delivering the same returns. Spoiler Alert: Some are, but some aren’t.

The WAAAX stocks

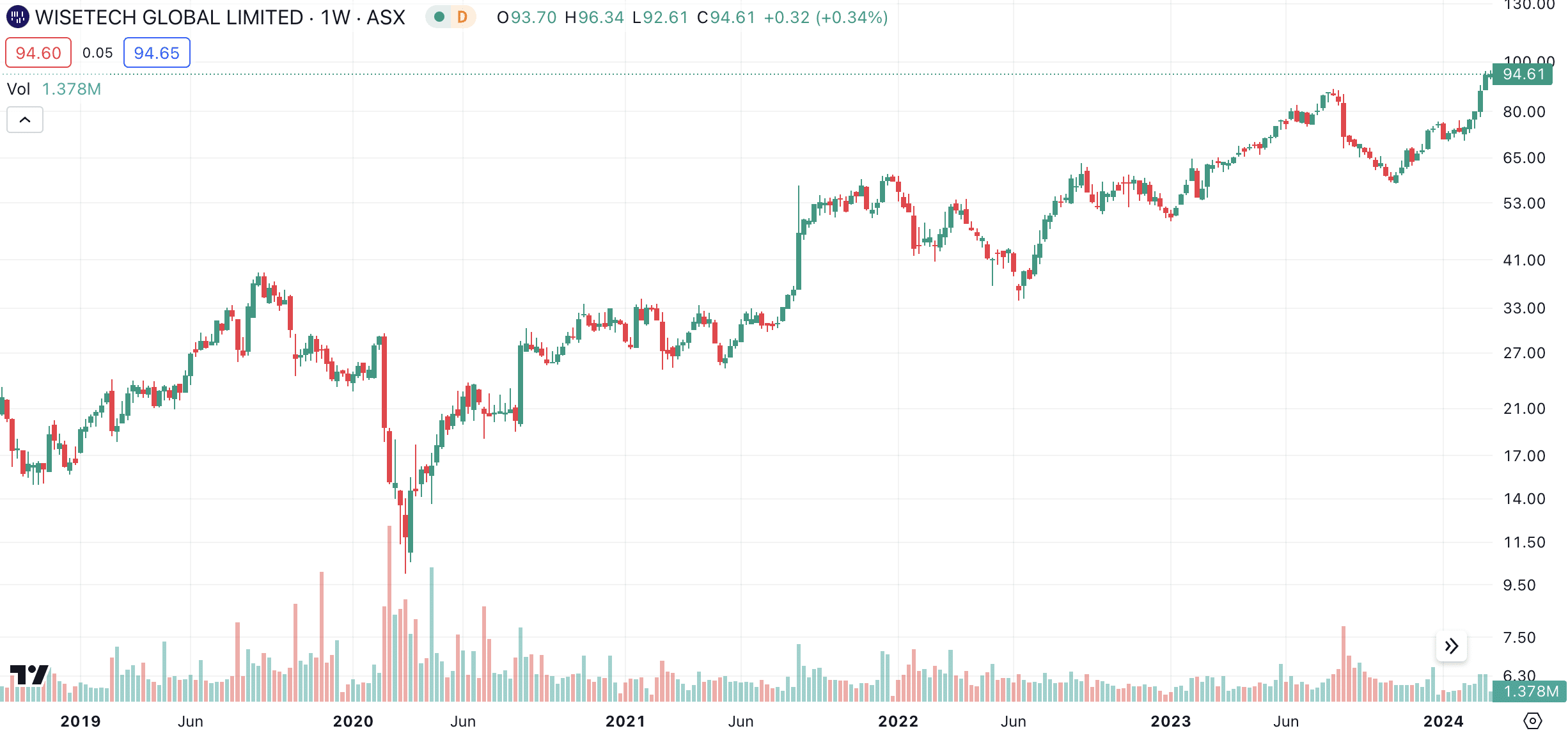

WiseTech (ASX:WTC)

You’ve heard the saying ‘saving the best till last’. We’re going to do the opposite here and start with the best performing WAAAX stock. This $27bn logistics software giant is up over 40% in the last year and over 300% in the last 5 years.

WiseTech listed in 2016 at $3.35 per share, so investors who’ve been in for the long term have been sitting on some pretty good gains.

WiseTech (ASX:WTC) share price chart, log scale (Source: TradingView)

It was arguably in no better position to be in during the pandemic with the growth in eCommerce. And even as brick and mortar stores have re-opened, supply chain issues ensure that there is still a need for this company’s products.

WiseTech delivered $816.8m in revenue in FY23, up 29% overall and 21% on an organic basis, $421.1m in EBITDA (excluding M&A costs) up 28%, and a net profit of $247.6m (up 30%). In 1HY24, it made $500.4m in revenue, putting it on track to surpass $1bn in revenue for the first time. EBITDA was up 16% and NPAT was up 8%. Indeed, the company had guided to over $1bn in revenue for FY24.

Take a bow, WiseTech. You are the best performing WAAAX stock. We aren’t retracting our previous comments that it is overvalued right now, but we cannot deny it has delivered in the past for investors, even if we doubt it can keep doing so without the same rate of growth.

Altium (ASX:ALT)

This WAAAX company just might be the most under-rated company of this quintet. Altium, which makes electronic design software, is up 67% in the last year and just over 100% in the last 5 years. Not the most spectacular returns by any means, but still outperforming many of its peers. And it is set to be bought be Japanese semiconductor fab Renesas Electronics for A$9.1bn, or A$68.50 per share.

In 1HY24, it grew revenues by 16% to US$138.6m and net profit jumped by 11% to US$33m, successfully passing price increases onto customers. Although this company never was the sexiest WAAAX stock on ASX, it was almost always delivering returns – something that cannot be said of all tech stocks.

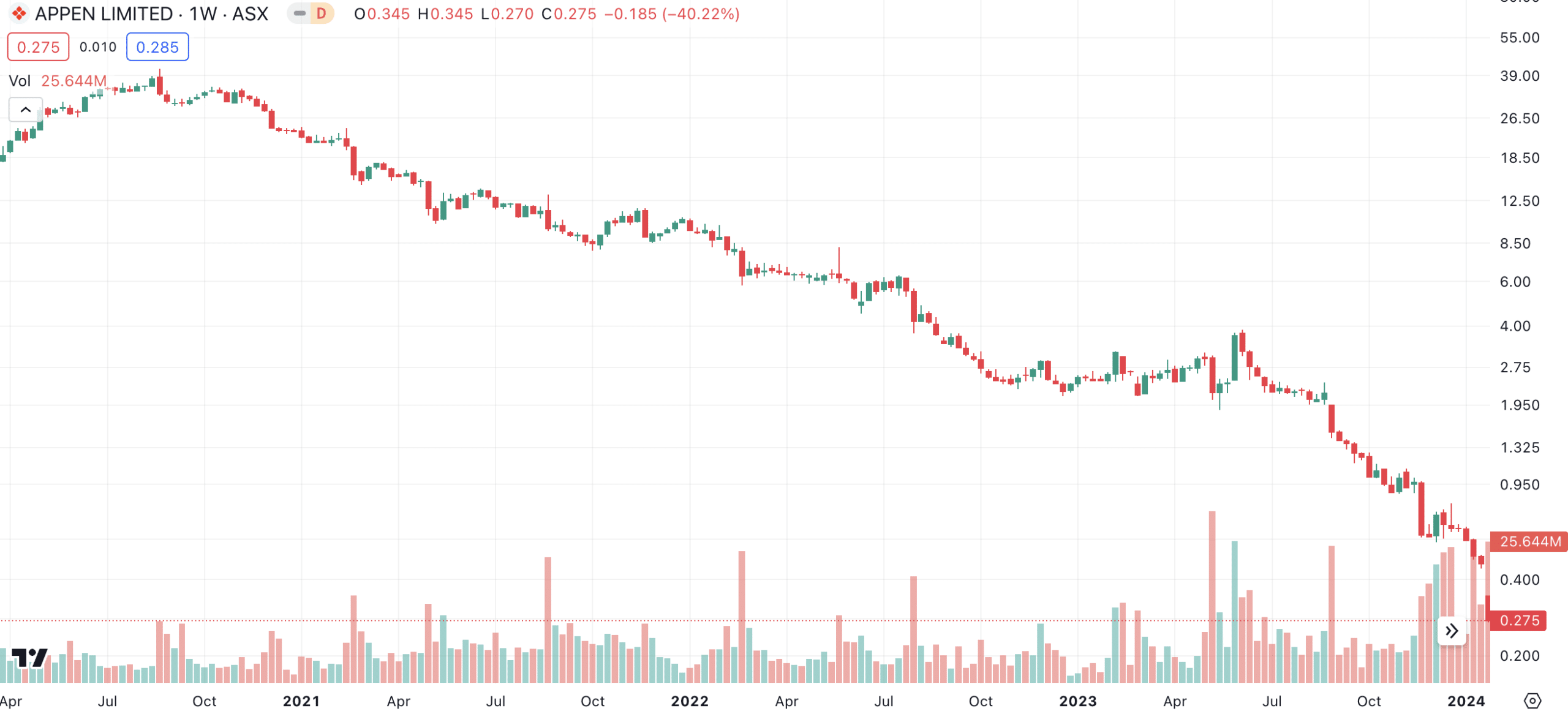

Appen (ASX:APX)

With a 60% decline in 12 months and 80% decline in 5 years, this company is in the worst position of any of the WAAAX stocks. Since mid-2020, this stock has fallen from over $40 per share to less than $3 per share.

Appen shares (ASX:APX) chart, log scale (Source: TradingView)

Appen sources and sells machine learning data to train AI algorithms. Historically, its client base was concentrated around a handful of big tech companies and predominantly for advertising purposes. Appen has been diversifying its customer base into new clients and markets although investors fear these cash flows won’t be as reliable and as strong as before. This has been showing in its results and in repeated failure to meet its own guidance, let alone consensus estimates.

In 2023, the stock surpassed $3 on a couple of occasions over hype that it can capitalise on the rise of ChatGPT and hope that things can be better because of new management and a cost reduction program. A couple of takeover offers helped, although both ended with the bidders walking away.

What a difference a customer makes

Ultimately, any hype or hope is not being shown in the bottom line. Its revenue for CY24 was $273m, down 30% from the year before, as Google, one of Appen’s main customers said goodbye. Its underlying net loss was $52.8m, compared to $22.8m the year before. This doesn’t even include a $69.2m goodwill impairment.

We’ve said this before and we’ll say it again: you would only buy this WAAAX stock if you were extremely desperate to reduce a capital gains tax bill.

Afterpay/Block (ASX:SQ2)

Since the takeover we no longer receive results from the Afterpay segment like we used to. And we need to find a new acronym rather than WAAAX for this group of stocks. Block timed its run poorly, listing on the ASX as the Ukraine war broke out. After some months of stagnation, shares are up over 20% in the last 12 months.

Being a US company, Block provides quarterly results even though it is profitable. During CY23, it delivered US$21.9bn in revenue and a $1.1bn profit, both up over 40% in a year..

Xero (ASX:XRO)

Xero is up 46% in 12 months and 167% in 5 years, making it the second best performer among WAAAX stocks after WiseTech.

Xero is all about helping small & medium sized businesses do business. The company, which has over 3 million subscribers, primarily sells accounting software that helps businesses keep books, pay bills and send invoices. But it has gradually developed features useful beyond book-keeping, such as storing files, converting currencies, keeping track of inventories and creating professional quotes.

Nice bounce back as off late

Xero is one of those companies that actually was hit by the Tech Wreck but rebounded ever since FY23 results, released in May 2023. The headline figures were good enough, it recorded 28% growth in revenues and 61% growth in operating income. But other critical figures painted an even better picture.

It has customer churn of less than 1%, it is making more average revenue per user from outside Australia and New Zealand than from within and its operating margin rose by 1% even accounting for one-off restructuring costs. The net cash position increased by $46.2m to $97.4m and it has total liquid resources of $1.1bn.

We expect an even better result in FY24, which will be revealed by the end of May 2024.

The Bottom Line: It’s complicated

As always with investing, there are winners and there are losers. And who is who can depend and when you ask…wax on, wax off.

The WAAAX stocks have had very mixed fates in recent years. WiseTech (ASX:WTC) and Xero (ASX:XRO) have performed the best with Altium (ASX:ALU) not far behind. Appen (ASX:APX) has proven to be a dud investment, while the jury is still out on Block’s growth potential on the ASX.

What are the Best ASX Technology Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…